- Malaysia

- /

- Trade Distributors

- /

- KLSE:WMG

Investors Still Waiting For A Pull Back In WMG Holdings Bhd. (KLSE:WMG)

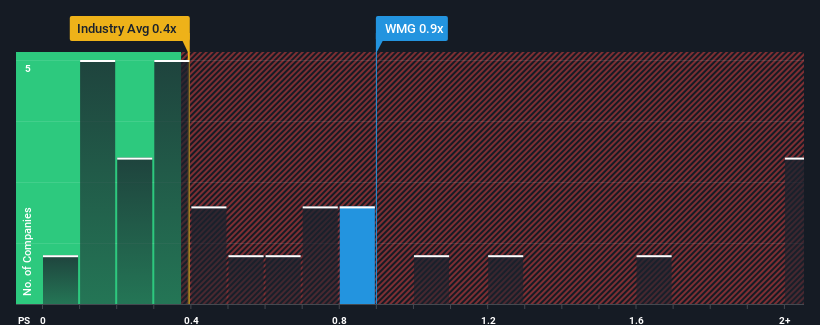

When close to half the companies in the Trade Distributors industry in Malaysia have price-to-sales ratios (or "P/S") below 0.4x, you may consider WMG Holdings Bhd. (KLSE:WMG) as a stock to potentially avoid with its 0.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for WMG Holdings Bhd

What Does WMG Holdings Bhd's Recent Performance Look Like?

Recent times have been quite advantageous for WMG Holdings Bhd as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Although there are no analyst estimates available for WMG Holdings Bhd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is WMG Holdings Bhd's Revenue Growth Trending?

In order to justify its P/S ratio, WMG Holdings Bhd would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered an exceptional 64% gain to the company's top line. The latest three year period has also seen an excellent 55% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 3.6% shows it's noticeably more attractive.

In light of this, it's understandable that WMG Holdings Bhd's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's no surprise that WMG Holdings Bhd can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 2 warning signs for WMG Holdings Bhd (1 shouldn't be ignored!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on WMG Holdings Bhd, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade WMG Holdings Bhd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if WMG Holdings Bhd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:WMG

WMG Holdings Bhd

An investment holding company, primarily engages in the property development activities in Malaysia.

Excellent balance sheet with acceptable track record.