- Malaysia

- /

- Construction

- /

- KLSE:WIDAD

Widad Group Berhad (KLSE:WIDAD shareholders incur further losses as stock declines 12% this week, taking one-year losses to 72%

Even the best investor on earth makes unsuccessful investments. But it should be a priority to avoid stomach churning catastrophes, wherever possible. So spare a thought for the long term shareholders of Widad Group Berhad (KLSE:WIDAD); the share price is down a whopping 72% in the last twelve months. That'd be a striking reminder about the importance of diversification. We note that it has not been easy for shareholders over three years, either; the share price is down 71% in that time. The share price has dropped 75% in three months.

With the stock having lost 12% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for Widad Group Berhad

Widad Group Berhad wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last twelve months, Widad Group Berhad increased its revenue by 36%. We think that is pretty nice growth. Unfortunately, the market wanted something better, given it sent the share price 72% lower during the year. It could be that the losses are too much for investors to handle without losing their nerve. It seems that the market has concerns about the future, because that share price action does not seem to reflect the revenue growth at all.

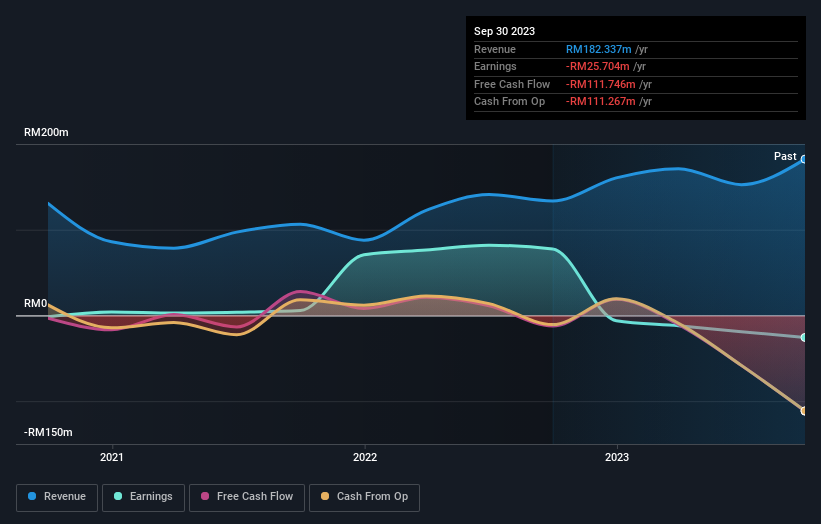

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Widad Group Berhad shareholders are down 72% for the year, but the market itself is up 13%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 5 warning signs for Widad Group Berhad (3 can't be ignored) that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Widad Group Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:WIDAD

Widad Group Berhad

An investment holding company, engages in the construction and integrated facilities management activities primarily in Malaysia.

Slight and fair value.

Similar Companies

Market Insights

Community Narratives