- Malaysia

- /

- Construction

- /

- KLSE:WIDAD

Risks Still Elevated At These Prices As Widad Group Berhad (KLSE:WIDAD) Shares Dive 60%

The Widad Group Berhad (KLSE:WIDAD) share price has fared very poorly over the last month, falling by a substantial 60%. For any long-term shareholders, the last month ends a year to forget by locking in a 55% share price decline.

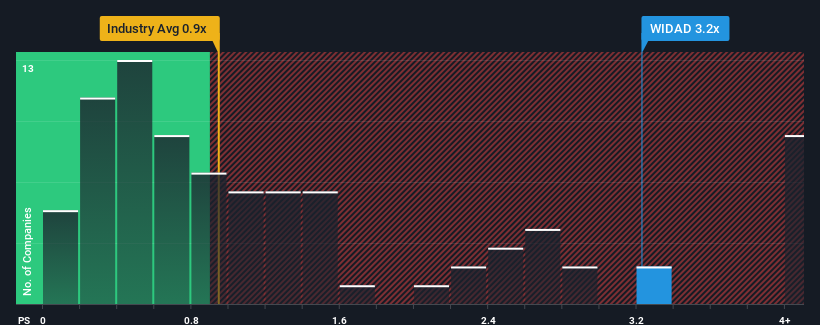

In spite of the heavy fall in price, you could still be forgiven for thinking Widad Group Berhad is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.2x, considering almost half the companies in Malaysia's Construction industry have P/S ratios below 0.9x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Widad Group Berhad

How Has Widad Group Berhad Performed Recently?

Recent times have been quite advantageous for Widad Group Berhad as its revenue has been rising very briskly. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Widad Group Berhad, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Widad Group Berhad's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 36% last year. The strong recent performance means it was also able to grow revenue by 39% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 18% shows it's noticeably less attractive.

In light of this, it's alarming that Widad Group Berhad's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Final Word

Even after such a strong price drop, Widad Group Berhad's P/S still exceeds the industry median significantly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

The fact that Widad Group Berhad currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Widad Group Berhad (at least 3 which are a bit concerning), and understanding them should be part of your investment process.

If you're unsure about the strength of Widad Group Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Widad Group Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:WIDAD

Widad Group Berhad

An investment holding company, engages in the construction and integrated facilities management activities primarily in Malaysia.

Slight and fair value.