- Malaysia

- /

- Construction

- /

- KLSE:WCT

Here's Why We Think WCT Holdings Berhad (KLSE:WCT) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like WCT Holdings Berhad (KLSE:WCT). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for WCT Holdings Berhad

How Fast Is WCT Holdings Berhad Growing Its Earnings Per Share?

In the last three years WCT Holdings Berhad's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. WCT Holdings Berhad's EPS shot up from RM0.044 to RM0.064; a result that's bound to keep shareholders happy. That's a impressive gain of 44%.

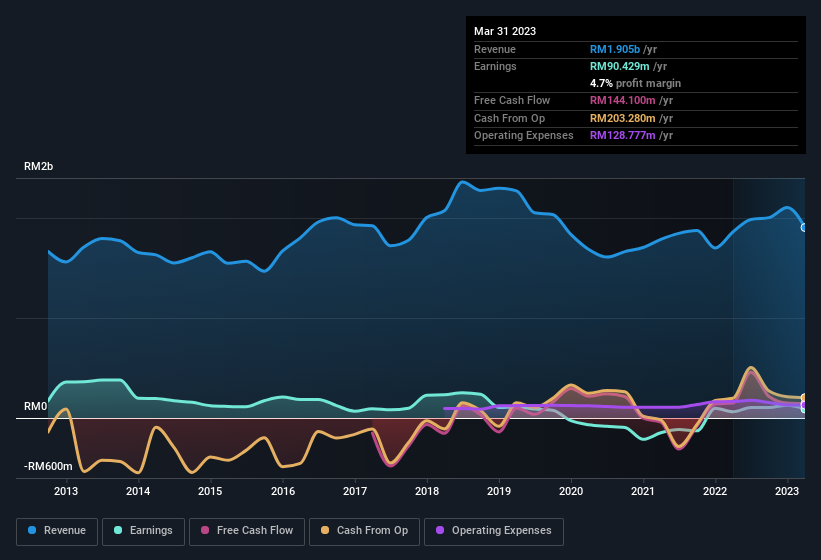

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that WCT Holdings Berhad is growing revenues, and EBIT margins improved by 10.6 percentage points to 3.9%, over the last year. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for WCT Holdings Berhad's future profits.

Are WCT Holdings Berhad Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. WCT Holdings Berhad followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. As a matter of fact, their holding is valued at RM148m. That's a lot of money, and no small incentive to work hard. As a percentage, this totals to 20% of the shares on issue for the business, an appreciable amount considering the market cap.

Should You Add WCT Holdings Berhad To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into WCT Holdings Berhad's strong EPS growth. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. We should say that we've discovered 2 warning signs for WCT Holdings Berhad (1 is a bit concerning!) that you should be aware of before investing here.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if WCT Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:WCT

WCT Holdings Berhad

An investment holding company, engages in the engineering and construction, property development, and property investment and management activities in Malaysia, the Middle East, India, and internationally.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives