Shareholders May Be More Conservative With UWC Berhad's (KLSE:UWC) CEO Compensation For Now

Under the guidance of CEO Chai Ng, UWC Berhad (KLSE:UWC) has performed reasonably well recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 09 January 2023. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

Check out our latest analysis for UWC Berhad

Comparing UWC Berhad's CEO Compensation With The Industry

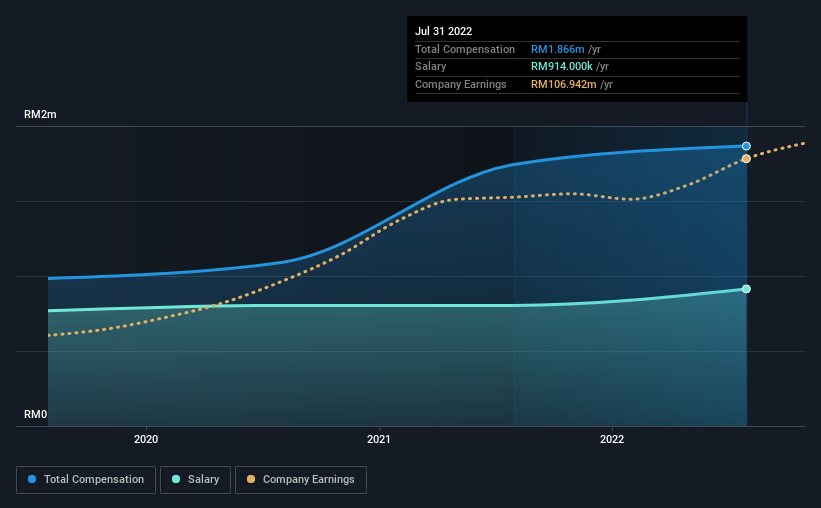

According to our data, UWC Berhad has a market capitalization of RM4.4b, and paid its CEO total annual compensation worth RM1.9m over the year to July 2022. That's a fairly small increase of 7.1% over the previous year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at RM914k.

On examining similar-sized companies in the Malaysian Machinery industry with market capitalizations between RM1.8b and RM7.0b, we discovered that the median CEO total compensation of that group was RM511k. Hence, we can conclude that Chai Ng is remunerated higher than the industry median. What's more, Chai Ng holds RM334m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | RM914k | RM804k | 49% |

| Other | RM952k | RM939k | 51% |

| Total Compensation | RM1.9m | RM1.7m | 100% |

Speaking on an industry level, nearly 78% of total compensation represents salary, while the remainder of 22% is other remuneration. UWC Berhad pays a modest slice of remuneration through salary, as compared to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

UWC Berhad's Growth

UWC Berhad's earnings per share (EPS) grew 36% per year over the last three years. It achieved revenue growth of 27% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has UWC Berhad Been A Good Investment?

Boasting a total shareholder return of 296% over three years, UWC Berhad has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

Shareholders may want to check for free if UWC Berhad insiders are buying or selling shares.

Switching gears from UWC Berhad, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:UWC

UWC Berhad

An investment holding company, engages in the provision of precision sheet metal fabrication, precision machined components, and value-added assembly services.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion