- Malaysia

- /

- Industrials

- /

- KLSE:TEXCHEM

Texchem Resources Bhd Just Missed EPS By 18%: Here's What Analysts Think Will Happen Next

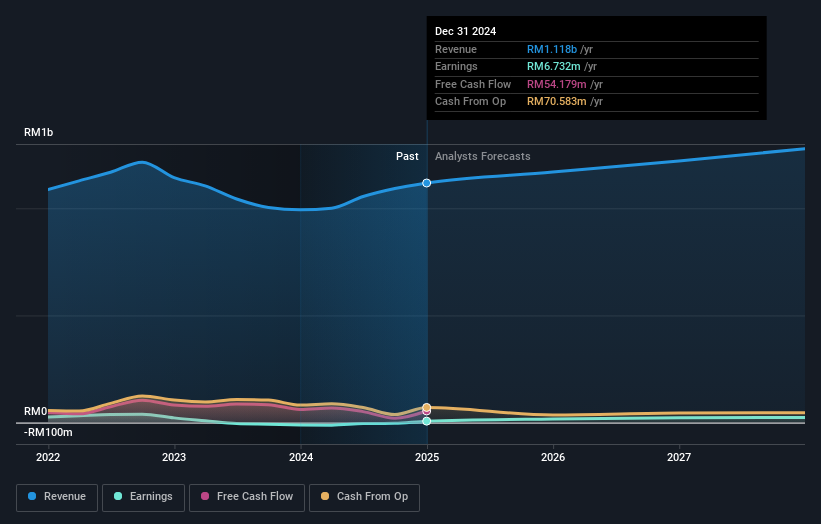

Shareholders of Texchem Resources Bhd (KLSE:TEXCHEM) will be pleased this week, given that the stock price is up 13% to RM0.79 following its latest yearly results. Revenues were in line with forecasts, at RM1.1b, although statutory earnings per share came in 18% below what the analyst expected, at RM0.058 per share. Earnings are an important time for investors, as they can track a company's performance, look at what the analyst is forecasting for next year, and see if there's been a change in sentiment towards the company. We've gathered the most recent statutory forecasts to see whether the analyst has changed their earnings models, following these results.

Check out our latest analysis for Texchem Resources Bhd

Following the latest results, Texchem Resources Bhd's single analyst are now forecasting revenues of RM1.17b in 2025. This would be a satisfactory 4.6% improvement in revenue compared to the last 12 months. Per-share earnings are expected to surge 144% to RM0.14. Before this earnings report, the analyst had been forecasting revenues of RM1.19b and earnings per share (EPS) of RM0.16 in 2025. The analyst seem to have become more bearish following the latest results. While there were no changes to revenue forecasts, there was a substantial drop in EPS estimates.

Despite cutting their earnings forecasts,the analyst has lifted their price target 9.7% to RM1.58, suggesting that these impacts are not expected to weigh on the stock's value in the long term.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. One thing stands out from these estimates, which is that Texchem Resources Bhd is forecast to grow faster in the future than it has in the past, with revenues expected to display 4.6% annualised growth until the end of 2025. If achieved, this would be a much better result than the 0.2% annual decline over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 5.5% annually for the foreseeable future. So although Texchem Resources Bhd's revenue growth is expected to improve, it is still expected to grow slower than the industry.

The Bottom Line

The most important thing to take away is that the analyst downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Fortunately, the analyst also reconfirmed their revenue estimates, suggesting that it's tracking in line with expectations. Although our data does suggest that Texchem Resources Bhd's revenue is expected to perform worse than the wider industry. We note an upgrade to the price target, suggesting that the analyst believes the intrinsic value of the business is likely to improve over time.

With that in mind, we wouldn't be too quick to come to a conclusion on Texchem Resources Bhd. Long-term earnings power is much more important than next year's profits. At least one analyst has provided forecasts out to 2027, which can be seen for free on our platform here.

You should always think about risks though. Case in point, we've spotted 2 warning signs for Texchem Resources Bhd you should be aware of, and 1 of them can't be ignored.

Valuation is complex, but we're here to simplify it.

Discover if Texchem Resources Bhd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:TEXCHEM

Texchem Resources Bhd

An investment holding company, engages in industrial, polymer engineering, food, restaurant, and venture businesses.

Undervalued with moderate growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026