- Malaysia

- /

- Industrials

- /

- KLSE:TEXCHEM

Is Now The Time To Put Texchem Resources Bhd (KLSE:TEXCHEM) On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Texchem Resources Bhd (KLSE:TEXCHEM). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Texchem Resources Bhd

Texchem Resources Bhd's Improving Profits

Over the last three years, Texchem Resources Bhd has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like a firecracker arcing through the night sky, Texchem Resources Bhd's EPS shot from RM0.093 to RM0.27, over the last year. Year on year growth of 193% is certainly a sight to behold.

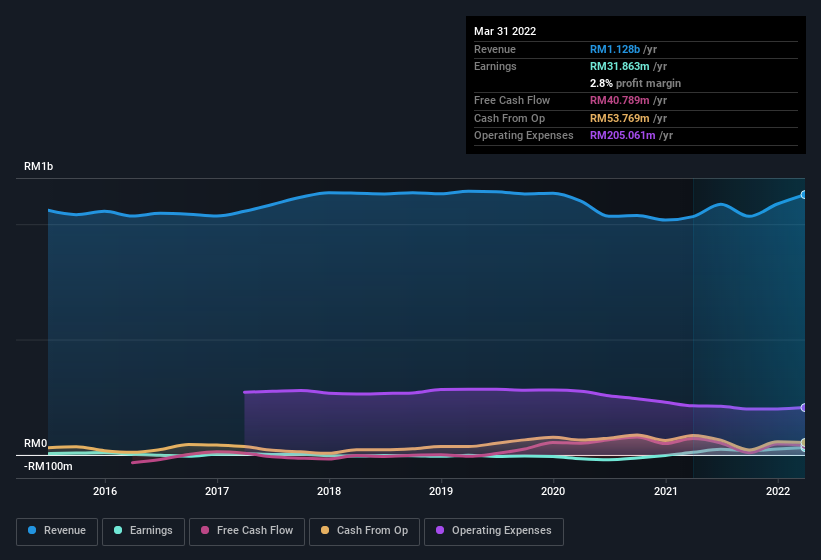

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Texchem Resources Bhd's EBIT margins were flat over the last year, revenue grew by a solid 9.2% to RM1.1b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Texchem Resources Bhd is no giant, with a market capitalization of RM347m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Texchem Resources Bhd Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that Texchem Resources Bhd insiders have a significant amount of capital invested in the stock. Indeed, they hold RM64m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 18% of the company; visible skin in the game.

Should You Add Texchem Resources Bhd To Your Watchlist?

Texchem Resources Bhd's earnings per share have taken off like a rocket aimed right at the moon. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. At times fast EPS growth is a sign the business has reached an inflection point; and I do like those. So yes, on this short analysis I do think it's worth considering Texchem Resources Bhd for a spot on your watchlist. You should always think about risks though. Case in point, we've spotted 4 warning signs for Texchem Resources Bhd you should be aware of.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Texchem Resources Bhd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:TEXCHEM

Texchem Resources Bhd

An investment holding company, engages in industrial, polymer engineering, food, restaurant, and venture businesses.

Undervalued with moderate growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026