- Malaysia

- /

- Construction

- /

- KLSE:SENDAI

Eversendai Corporation Berhad's (KLSE:SENDAI) Stock Price Has Reduced 68% In The Past Three Years

While it may not be enough for some shareholders, we think it is good to see the Eversendai Corporation Berhad (KLSE:SENDAI) share price up 18% in a single quarter. Meanwhile over the last three years the stock has dropped hard. Tragically, the share price declined 68% in that time. So the improvement may be a real relief to some. After all, could be that the fall was overdone.

View our latest analysis for Eversendai Corporation Berhad

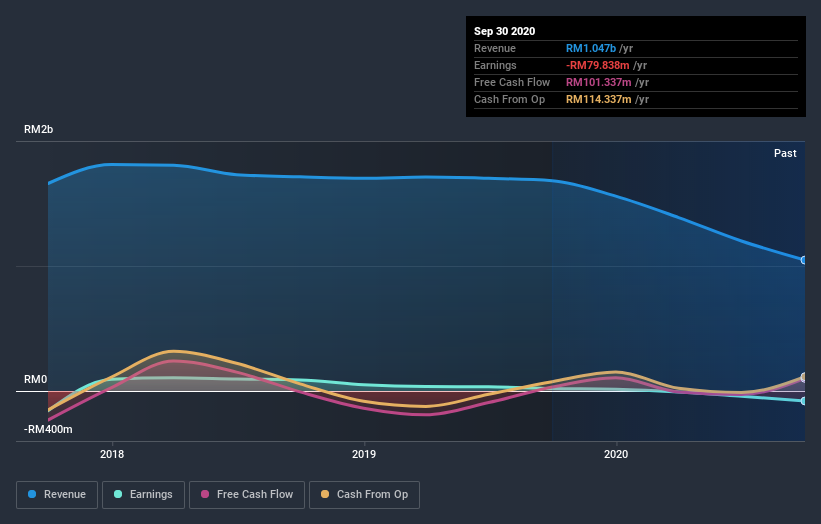

Because Eversendai Corporation Berhad made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, Eversendai Corporation Berhad's revenue dropped 12% per year. That is not a good result. The share price decline of 19% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Having said that, if growth is coming in the future, now may be the low ebb for the company. We'd be pretty wary of this one until it makes a profit, because we don't specialize in finding turnaround situations.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Eversendai Corporation Berhad's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Eversendai Corporation Berhad had a tough year, with a total loss of 32%, against a market gain of about 9.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Eversendai Corporation Berhad better, we need to consider many other factors. Take risks, for example - Eversendai Corporation Berhad has 2 warning signs we think you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you decide to trade Eversendai Corporation Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Eversendai Corporation Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:SENDAI

Eversendai Corporation Berhad

Provides construction services in the Middle East, India, Southeast Asia, and internationally.

Good value with acceptable track record.

Market Insights

Community Narratives