Shareholders Will Probably Hold Off On Increasing Seremban Engineering Berhad's (KLSE:SEB) CEO Compensation For The Time Being

Key Insights

- Seremban Engineering Berhad will host its Annual General Meeting on 14th of December

- Salary of RM289.1k is part of CEO Wai Wong's total remuneration

- Total compensation is 152% above industry average

- Over the past three years, Seremban Engineering Berhad's EPS grew by 2.8% and over the past three years, the total shareholder return was 5.0%

Performance at Seremban Engineering Berhad (KLSE:SEB) has been reasonably good and CEO Wai Wong has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 14th of December, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still want to keep CEO compensation within reason.

Check out our latest analysis for Seremban Engineering Berhad

How Does Total Compensation For Wai Wong Compare With Other Companies In The Industry?

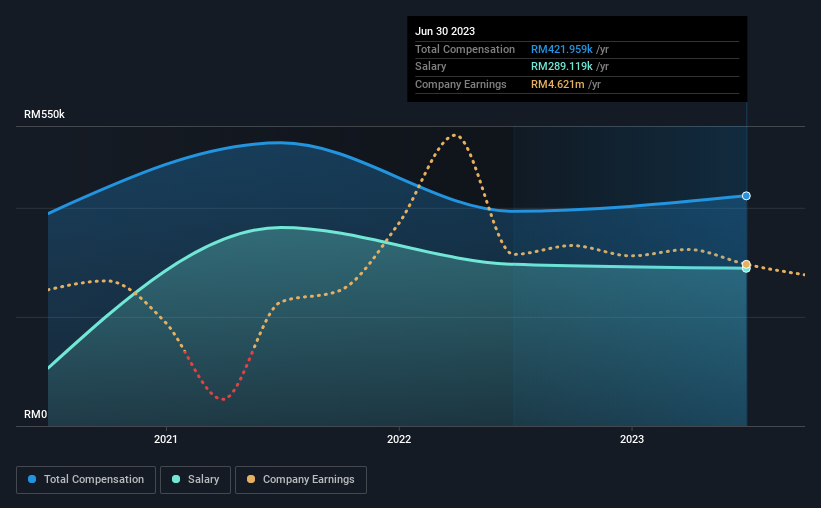

Our data indicates that Seremban Engineering Berhad has a market capitalization of RM59m, and total annual CEO compensation was reported as RM422k for the year to June 2023. That's just a smallish increase of 7.2% on last year. Notably, the salary which is RM289.1k, represents most of the total compensation being paid.

In comparison with other companies in the Malaysian Machinery industry with market capitalizations under RM935m, the reported median total CEO compensation was RM167k. This suggests that Wai Wong is paid more than the median for the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | RM289k | RM296k | 69% |

| Other | RM133k | RM97k | 31% |

| Total Compensation | RM422k | RM394k | 100% |

On an industry level, roughly 81% of total compensation represents salary and 19% is other remuneration. Seremban Engineering Berhad sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Seremban Engineering Berhad's Growth Numbers

Seremban Engineering Berhad's earnings per share (EPS) grew 2.8% per year over the last three years. Its revenue is up 17% over the last year.

We think the revenue growth is good. And, while modest, the EPS growth is noticeable. So while we'd stop just short of calling this a top performer, but we think it is well worth watching. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Seremban Engineering Berhad Been A Good Investment?

With a total shareholder return of 5.0% over three years, Seremban Engineering Berhad has done okay by shareholders, but there's always room for improvement. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 3 warning signs (and 1 which doesn't sit too well with us) in Seremban Engineering Berhad we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SEB

Seremban Engineering Berhad

Engages in the manufacture, sales, and fabrication of process equipment and steel structures in Europe, Malaysia, Singapore, and the rest of Asia.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives