- Malaysia

- /

- Electrical

- /

- KLSE:SCOMNET

Is Supercomnet Technologies Berhad's (KLSE:SCOMNET) Latest Stock Performance A Reflection Of Its Financial Health?

Most readers would already be aware that Supercomnet Technologies Berhad's (KLSE:SCOMNET) stock increased significantly by 18% over the past three months. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. In this article, we decided to focus on Supercomnet Technologies Berhad's ROE.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for Supercomnet Technologies Berhad

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Supercomnet Technologies Berhad is:

9.2% = RM19m ÷ RM205m (Based on the trailing twelve months to December 2019).

The 'return' is the yearly profit. That means that for every MYR1 worth of shareholders' equity, the company generated MYR0.09 in profit.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learnt that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Supercomnet Technologies Berhad's Earnings Growth And 9.2% ROE

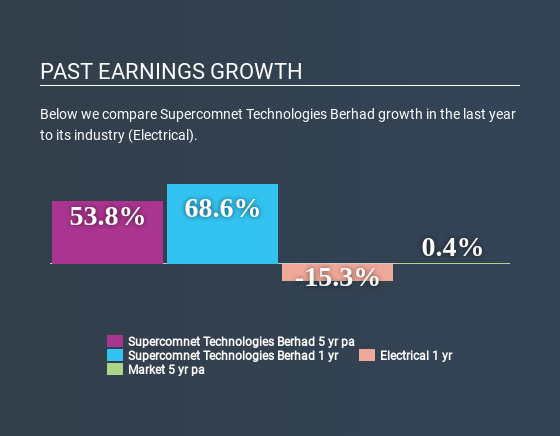

On the face of it, Supercomnet Technologies Berhad's ROE is not much to talk about. However, the fact that the company's ROE is higher than the average industry ROE of 5.7%, is definitely interesting. Even more so after seeing Supercomnet Technologies Berhad's exceptional 54% net income growth over the past five years. Bear in mind, the company does have a moderately low ROE. It is just that the industry ROE is lower. Therefore, the growth in earnings could also be the result of other factors. Such as- high earnings retention or the company belonging to a high growth industry.

When you consider the fact that the industry earnings have shrunk at a rate of 10% in the same period, the company's net income growth is pretty remarkable.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. Is Supercomnet Technologies Berhad fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Supercomnet Technologies Berhad Making Efficient Use Of Its Profits?

Supercomnet Technologies Berhad has a three-year median payout ratio of 35% (where it is retaining 65% of its income) which is not too low or not too high. By the looks of it, the dividend is well covered and Supercomnet Technologies Berhad is reinvesting its profits efficiently as evidenced by its exceptional growth which we discussed above.

Additionally, Supercomnet Technologies Berhad has paid dividends over a period of eight years which means that the company is pretty serious about sharing its profits with shareholders.

Conclusion

On the whole, we feel that Supercomnet Technologies Berhad's performance has been quite good. Specifically, we like that it has been reinvesting a high portion of its profits at a moderate rate of return, resulting in earnings expansion. If the company continues to grow its earnings the way it has, that could have a positive impact on its share price given how earnings per share influence long-term share prices. Remember, the price of a stock is also dependent on the perceived risk. Therefore investors must keep themselves informed about the risks involved before investing in any company. You can see the 1 risk we have identified for Supercomnet Technologies Berhad by visiting our risks dashboard for free on our platform here.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About KLSE:SCOMNET

Supercomnet Technologies Berhad

Engages in the manufacture and sale of PVC compounds, and cables and wires for electronic devices and data control switches in Malaysia, the Dominican Republic, the United States, Denmark, Singapore, Taiwan, and Hong Kong.

Flawless balance sheet with high growth potential.