These 4 Measures Indicate That SAM Engineering & Equipment (M) Berhad (KLSE:SAM) Is Using Debt Reasonably Well

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that SAM Engineering & Equipment (M) Berhad (KLSE:SAM) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for SAM Engineering & Equipment (M) Berhad

How Much Debt Does SAM Engineering & Equipment (M) Berhad Carry?

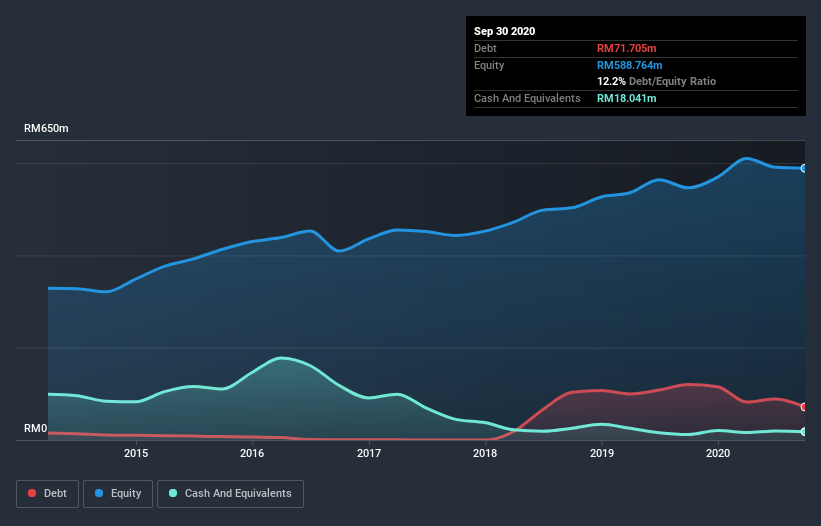

The image below, which you can click on for greater detail, shows that SAM Engineering & Equipment (M) Berhad had debt of RM71.7m at the end of September 2020, a reduction from RM120.3m over a year. On the flip side, it has RM18.0m in cash leading to net debt of about RM53.7m.

How Strong Is SAM Engineering & Equipment (M) Berhad's Balance Sheet?

The latest balance sheet data shows that SAM Engineering & Equipment (M) Berhad had liabilities of RM226.9m due within a year, and liabilities of RM58.3m falling due after that. On the other hand, it had cash of RM18.0m and RM318.2m worth of receivables due within a year. So it can boast RM51.1m more liquid assets than total liabilities.

This short term liquidity is a sign that SAM Engineering & Equipment (M) Berhad could probably pay off its debt with ease, as its balance sheet is far from stretched.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

SAM Engineering & Equipment (M) Berhad has a low net debt to EBITDA ratio of only 0.37. And its EBIT covers its interest expense a whopping 26.8 times over. So we're pretty relaxed about its super-conservative use of debt. The good news is that SAM Engineering & Equipment (M) Berhad has increased its EBIT by 6.3% over twelve months, which should ease any concerns about debt repayment. There's no doubt that we learn most about debt from the balance sheet. But it is SAM Engineering & Equipment (M) Berhad's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Considering the last three years, SAM Engineering & Equipment (M) Berhad actually recorded a cash outflow, overall. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

Happily, SAM Engineering & Equipment (M) Berhad's impressive interest cover implies it has the upper hand on its debt. But the stark truth is that we are concerned by its conversion of EBIT to free cash flow. Looking at all the aforementioned factors together, it strikes us that SAM Engineering & Equipment (M) Berhad can handle its debt fairly comfortably. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 2 warning signs we've spotted with SAM Engineering & Equipment (M) Berhad .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade SAM Engineering & Equipment (M) Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:SAM

SAM Engineering & Equipment (M) Berhad

An investment holding company, engages in the aerospace and equipment manufacturing businesses in Malaysia, rest of Asia, North and Latin America, and Europe.

Flawless balance sheet with reasonable growth potential.