- Malaysia

- /

- Construction

- /

- KLSE:ROHAS

What Did Rohas Tecnic Berhad's (KLSE:ROHAS) CEO Take Home Last Year?

Wai Leong has been the CEO of Rohas Tecnic Berhad (KLSE:ROHAS) since 2017, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Rohas Tecnic Berhad

How Does Total Compensation For Wai Leong Compare With Other Companies In The Industry?

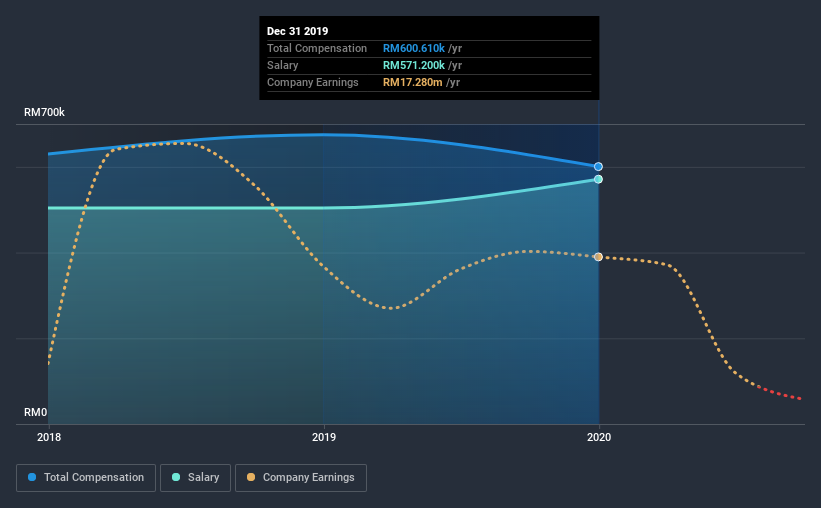

Our data indicates that Rohas Tecnic Berhad has a market capitalization of RM156m, and total annual CEO compensation was reported as RM601k for the year to December 2019. That's a notable decrease of 11% on last year. We note that the salary portion, which stands at RM571.2k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below RM818m, reported a median total CEO compensation of RM935k. Accordingly, Rohas Tecnic Berhad pays its CEO under the industry median. What's more, Wai Leong holds RM1.1m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | RM571k | RM504k | 95% |

| Other | RM29k | RM171k | 5% |

| Total Compensation | RM601k | RM675k | 100% |

On an industry level, around 79% of total compensation represents salary and 21% is other remuneration. Rohas Tecnic Berhad is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Rohas Tecnic Berhad's Growth

Rohas Tecnic Berhad has reduced its earnings per share by 55% a year over the last three years. It saw its revenue drop 27% over the last year.

Few shareholders would be pleased to read that EPS have declined. This is compounded by the fact revenue is actually down on last year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Rohas Tecnic Berhad Been A Good Investment?

Since shareholders would have lost about 74% over three years, some Rohas Tecnic Berhad investors would surely be feeling negative emotions. So shareholders would probably want the company to be lessto generous with CEO compensation.

In Summary...

Wai receives almost all of their compensation through a salary. As previously discussed, Wai is compensated less than what is normal for CEOs of companies of similar size, and which belong to the same industry. Over the last three years, shareholder returns have been downright disappointing, and EPSgrowth has been equally disappointing. Although we wouldn’t say CEO compensation is high, it’s tough to foresee shareholders warming up to thoughts of a bump anytime soon.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 2 warning signs for Rohas Tecnic Berhad that you should be aware of before investing.

Important note: Rohas Tecnic Berhad is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade Rohas Tecnic Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Rohas Tecnic Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:ROHAS

Rohas Tecnic Berhad

An investment holding company, manufactures steel lattice towers and monopoles for power transmission and telecommunications in Malaysia, Bangladesh, Cambodia, and Nepal.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives