- Malaysia

- /

- Electrical

- /

- KLSE:PWRWELL

With EPS Growth And More, Powerwell Holdings Berhad (KLSE:PWRWELL) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Powerwell Holdings Berhad (KLSE:PWRWELL). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Powerwell Holdings Berhad

How Fast Is Powerwell Holdings Berhad Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It is awe-striking that Powerwell Holdings Berhad's EPS went from RM0.0077 to RM0.028 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement. Could this be a sign that the business has reached an inflection point?

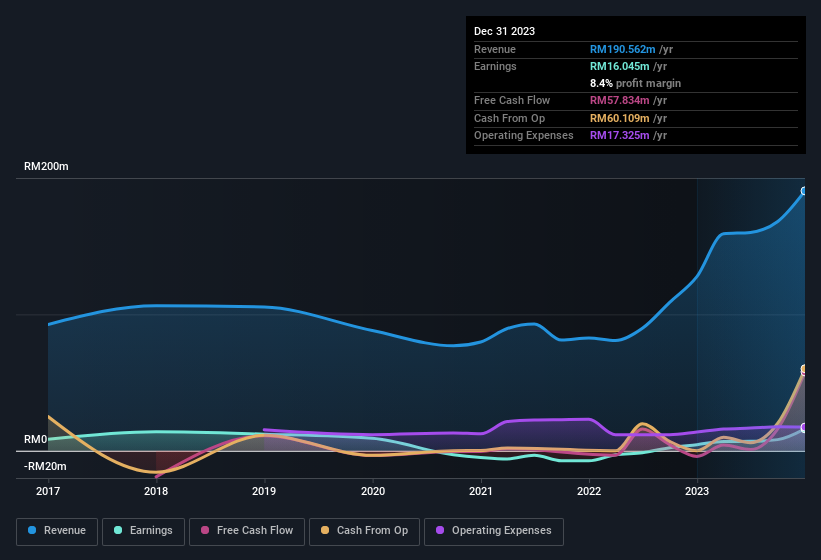

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of Powerwell Holdings Berhad shareholders is that EBIT margins have grown from 5.4% to 11% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Powerwell Holdings Berhad is no giant, with a market capitalisation of RM273m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Powerwell Holdings Berhad Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Shareholders will be pleased by the fact that insiders own Powerwell Holdings Berhad shares worth a considerable sum. To be specific, they have RM72m worth of shares. This considerable investment should help drive long-term value in the business. That amounts to 26% of the company, demonstrating a degree of high-level alignment with shareholders.

Does Powerwell Holdings Berhad Deserve A Spot On Your Watchlist?

Powerwell Holdings Berhad's earnings per share have been soaring, with growth rates sky high. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So based on this quick analysis, we do think it's worth considering Powerwell Holdings Berhad for a spot on your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Powerwell Holdings Berhad , and understanding these should be part of your investment process.

Although Powerwell Holdings Berhad certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Malaysian companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:PWRWELL

Powerwell Holdings Berhad

An investment holding company, engages in the design, manufacture, and trading of electricity distribution products in Malaysia, Bangladesh, Indonesia, Singapore, Pakistan, Thailand, Vietnam, Bangladesh, and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives