Here's Why Poly Glass Fibre (M) Bhd (KLSE:POLY) Can Manage Its Debt Responsibly

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Poly Glass Fibre (M) Bhd. (KLSE:POLY) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Poly Glass Fibre (M) Bhd

What Is Poly Glass Fibre (M) Bhd's Debt?

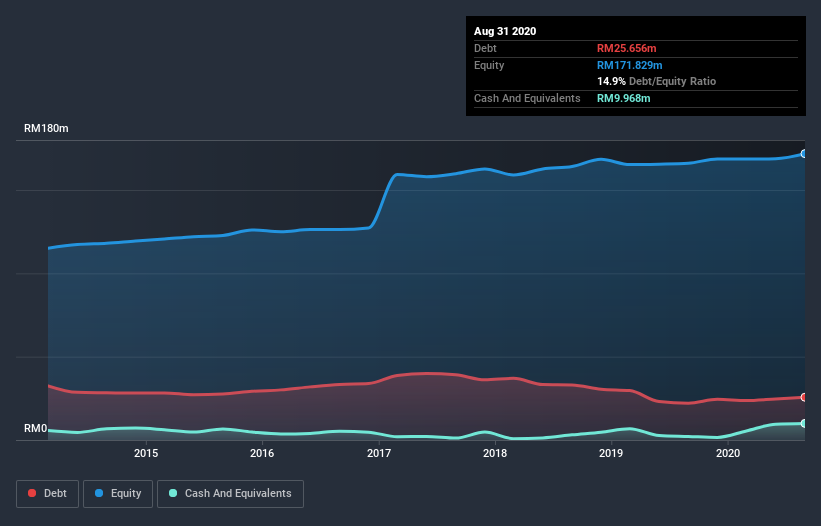

You can click the graphic below for the historical numbers, but it shows that as of August 2020 Poly Glass Fibre (M) Bhd had RM25.7m of debt, an increase on RM22.1m, over one year. However, because it has a cash reserve of RM9.97m, its net debt is less, at about RM15.7m.

A Look At Poly Glass Fibre (M) Bhd's Liabilities

Zooming in on the latest balance sheet data, we can see that Poly Glass Fibre (M) Bhd had liabilities of RM16.7m due within 12 months and liabilities of RM46.7m due beyond that. Offsetting this, it had RM9.97m in cash and RM17.9m in receivables that were due within 12 months. So its liabilities total RM35.6m more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since Poly Glass Fibre (M) Bhd has a market capitalization of RM87.2m, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Poly Glass Fibre (M) Bhd has net debt of just 1.1 times EBITDA, indicating that it is certainly not a reckless borrower. And it boasts interest cover of 9.4 times, which is more than adequate. Another good sign is that Poly Glass Fibre (M) Bhd has been able to increase its EBIT by 26% in twelve months, making it easier to pay down debt. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Poly Glass Fibre (M) Bhd will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Happily for any shareholders, Poly Glass Fibre (M) Bhd actually produced more free cash flow than EBIT over the last three years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

Happily, Poly Glass Fibre (M) Bhd's impressive conversion of EBIT to free cash flow implies it has the upper hand on its debt. And the good news does not stop there, as its EBIT growth rate also supports that impression! Looking at the bigger picture, we think Poly Glass Fibre (M) Bhd's use of debt seems quite reasonable and we're not concerned about it. After all, sensible leverage can boost returns on equity. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Poly Glass Fibre (M) Bhd (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade Poly Glass Fibre (M) Bhd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:PGF

PGF Capital Berhad

Engages in the manufacture and trading of fiber glasswool and related products primarily in Malaysia, Oceania, and internationally.

Flawless balance sheet with questionable track record.