Chung Mui is the CEO of P.I.E. Industrial Berhad (KLSE:PIE), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for P.I.E. Industrial Berhad

How Does Total Compensation For Chung Mui Compare With Other Companies In The Industry?

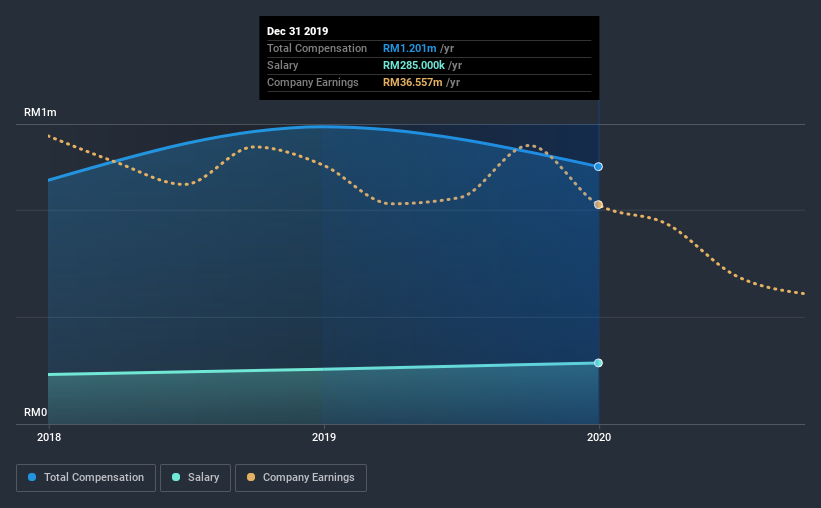

At the time of writing, our data shows that P.I.E. Industrial Berhad has a market capitalization of RM772m, and reported total annual CEO compensation of RM1.2m for the year to December 2019. Notably, that's a decrease of 13% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at RM285k.

On examining similar-sized companies in the industry with market capitalizations between RM407m and RM1.6b, we discovered that the median CEO total compensation of that group was RM861k. Accordingly, our analysis reveals that P.I.E. Industrial Berhad pays Chung Mui north of the industry median. What's more, Chung Mui holds RM5.0m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | RM285k | RM256k | 24% |

| Other | RM916k | RM1.1m | 76% |

| Total Compensation | RM1.2m | RM1.4m | 100% |

On an industry level, roughly 76% of total compensation represents salary and 24% is other remuneration. P.I.E. Industrial Berhad pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at P.I.E. Industrial Berhad's Growth Numbers

P.I.E. Industrial Berhad has reduced its earnings per share by 23% a year over the last three years. Its revenue is down 14% over the previous year.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has P.I.E. Industrial Berhad Been A Good Investment?

P.I.E. Industrial Berhad has served shareholders reasonably well, with a total return of 14% over three years. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

As we touched on above, P.I.E. Industrial Berhad is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Meanwhile, EPS has not been growing sufficiently to impress us, over the last three years. While shareholder returns are acceptable, they don't delight. So we think more research is needed, but we don't think the CEO is underpaid.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 3 warning signs for P.I.E. Industrial Berhad that investors should think about before committing capital to this stock.

Important note: P.I.E. Industrial Berhad is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade P.I.E. Industrial Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:PIE

P.I.E. Industrial Berhad

An investment holding company, manufactures and sells industrial products in Malaysia, the United States, rest of the Asia Pacific countries, and Europe.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives