- Malaysia

- /

- Construction

- /

- KLSE:MUDAJYA

Mudajaya Group Berhad (KLSE:MUDAJYA) Is Finding It Tricky To Allocate Its Capital

What underlying fundamental trends can indicate that a company might be in decline? A business that's potentially in decline often shows two trends, a return on capital employed (ROCE) that's declining, and a base of capital employed that's also declining. Trends like this ultimately mean the business is reducing its investments and also earning less on what it has invested. In light of that, from a first glance at Mudajaya Group Berhad (KLSE:MUDAJYA), we've spotted some signs that it could be struggling, so let's investigate.

What is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on Mudajaya Group Berhad is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.002 = RM1.3m ÷ (RM1.2b - RM580m) (Based on the trailing twelve months to December 2020).

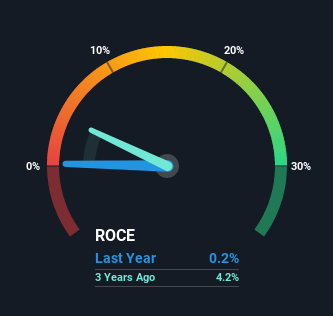

Therefore, Mudajaya Group Berhad has an ROCE of 0.2%. In absolute terms, that's a low return and it also under-performs the Construction industry average of 4.8%.

View our latest analysis for Mudajaya Group Berhad

Historical performance is a great place to start when researching a stock so above you can see the gauge for Mudajaya Group Berhad's ROCE against it's prior returns. If you'd like to look at how Mudajaya Group Berhad has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

What The Trend Of ROCE Can Tell Us

We aren't inspired by the trend, given ROCE has reduced by 90% over the last five years and Mudajaya Group Berhad is applying -56% less capital in the business, even after the capital raising they conducted (prior to their latest reported figures).

On a side note, Mudajaya Group Berhad's current liabilities have increased over the last five years to 47% of total assets, effectively distorting the ROCE to some degree. If current liabilities hadn't increased as much as they did, the ROCE could actually be even lower. What this means is that in reality, a rather large portion of the business is being funded by the likes of the company's suppliers or short-term creditors, which can bring some risks of its own.

What We Can Learn From Mudajaya Group Berhad's ROCE

In summary, it's unfortunate that Mudajaya Group Berhad is shrinking its capital base and also generating lower returns. This could explain why the stock has sunk a total of 81% in the last five years. Unless there is a shift to a more positive trajectory in these metrics, we would look elsewhere.

If you want to continue researching Mudajaya Group Berhad, you might be interested to know about the 3 warning signs that our analysis has discovered.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:MUDAJYA

Mudajaya Group Berhad

An investment holding company, engages in civil engineering and building construction activities in Malaysia and China.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A buy recommendation

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026