- Malaysia

- /

- Construction

- /

- KLSE:MRCB

We Think Malaysian Resources Corporation Berhad's (KLSE:MRCB) CEO Compensation Package Needs To Be Put Under A Microscope

Shareholders will probably not be too impressed with the underwhelming results at Malaysian Resources Corporation Berhad (KLSE:MRCB) recently. At the upcoming AGM on 08 June 2021, shareholders can hear from the board including their plans for turning around performance. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. We present the case why we think CEO compensation is out of sync with company performance.

View our latest analysis for Malaysian Resources Corporation Berhad

How Does Total Compensation For Mohamad Bin Mohamad Salim Compare With Other Companies In The Industry?

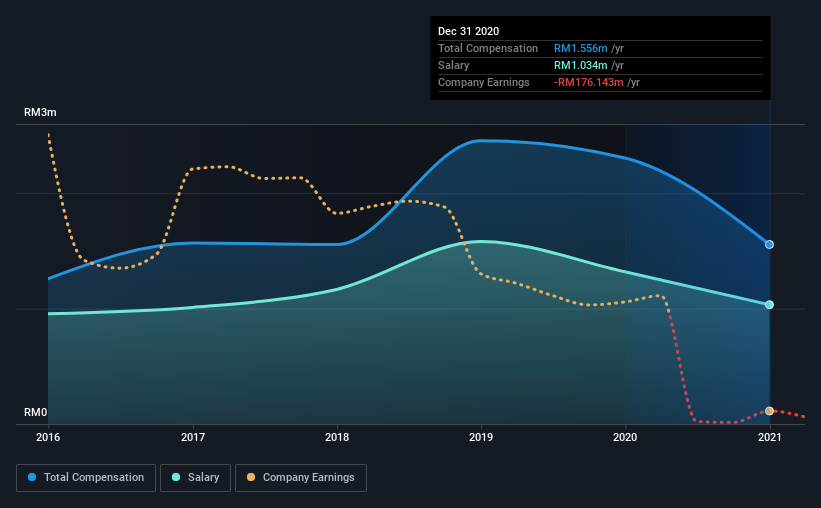

According to our data, Malaysian Resources Corporation Berhad has a market capitalization of RM1.9b, and paid its CEO total annual compensation worth RM1.6m over the year to December 2020. Notably, that's a decrease of 33% over the year before. Notably, the salary which is RM1.03m, represents most of the total compensation being paid.

For comparison, other companies in the same industry with market capitalizations ranging between RM825m and RM3.3b had a median total CEO compensation of RM1.6m. This suggests that Malaysian Resources Corporation Berhad remunerates its CEO largely in line with the industry average.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | RM1.0m | RM1.3m | 66% |

| Other | RM522k | RM985k | 34% |

| Total Compensation | RM1.6m | RM2.3m | 100% |

On an industry level, around 78% of total compensation represents salary and 22% is other remuneration. In Malaysian Resources Corporation Berhad's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Malaysian Resources Corporation Berhad's Growth Numbers

Over the last three years, Malaysian Resources Corporation Berhad has shrunk its earnings per share by 122% per year. Its revenue is down 34% over the previous year.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Malaysian Resources Corporation Berhad Been A Good Investment?

Since shareholders would have lost about 25% over three years, some Malaysian Resources Corporation Berhad investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO pay is simply one of the many factors that need to be considered while examining business performance. In our study, we found 2 warning signs for Malaysian Resources Corporation Berhad you should be aware of, and 1 of them is a bit unpleasant.

Important note: Malaysian Resources Corporation Berhad is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:MRCB

Malaysian Resources Corporation Berhad

An investment holding company, operates as a property and construction company in Malaysia, Australia, Thailand, Singapore, Hong Kong, and New Zealand.

High growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026