- Malaysia

- /

- Construction

- /

- KLSE:MELATI

If You Like EPS Growth Then Check Out Melati Ehsan Holdings Berhad (KLSE:MELATI) Before It's Too Late

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Melati Ehsan Holdings Berhad (KLSE:MELATI). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Melati Ehsan Holdings Berhad

How Fast Is Melati Ehsan Holdings Berhad Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Who among us would not applaud Melati Ehsan Holdings Berhad's stratospheric annual EPS growth of 48%, compound, over the last three years? That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Unfortunately, Melati Ehsan Holdings Berhad's revenue dropped 38% last year, but the silver lining is that EBIT margins improved from 1.5% to 6.6%. That's not ideal.

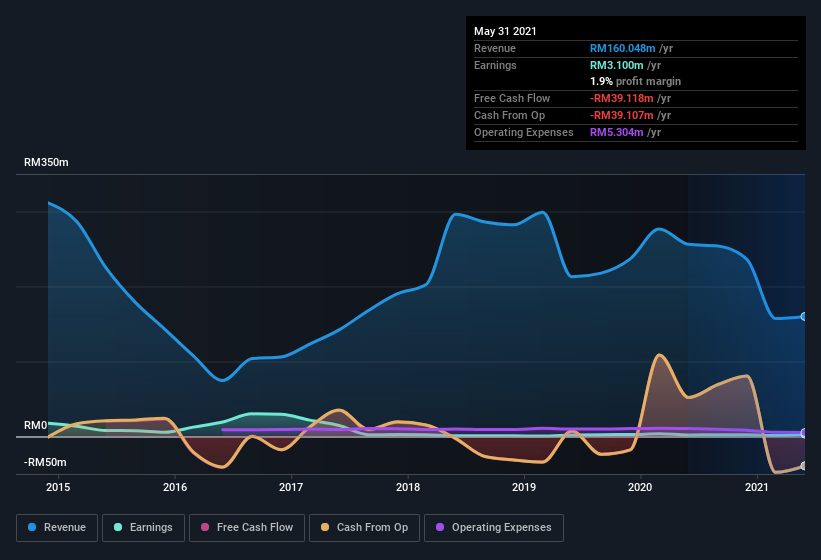

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Melati Ehsan Holdings Berhad isn't a huge company, given its market capitalization of RM73m. That makes it extra important to check on its balance sheet strength.

Are Melati Ehsan Holdings Berhad Insiders Aligned With All Shareholders?

I always like to check up on CEO compensation, because I think that reasonable pay levels, around or below the median, can be a sign that shareholder interests are well considered. I discovered that the median total compensation for the CEOs of companies like Melati Ehsan Holdings Berhad with market caps under RM831m is about RM514k.

The Melati Ehsan Holdings Berhad CEO received total compensation of only RM20k in the year to . This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Melati Ehsan Holdings Berhad To Your Watchlist?

Melati Ehsan Holdings Berhad's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. Such fast EPS growth makes me wonder if the business has hit an inflection point (and I mean the good kind.) At the same time the reasonable CEO compensation reflects well on the board of directors. While I couldn't be sure without a deeper dive, it does seem that Melati Ehsan Holdings Berhad has the hallmarks of a quality business; and that would make it well worth watching. Even so, be aware that Melati Ehsan Holdings Berhad is showing 4 warning signs in our investment analysis , and 2 of those shouldn't be ignored...

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:MELATI

Melati Ehsan Holdings Berhad

An investment holding company, operates as a turnkey contractor specializing in construction management in Malaysia.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion