Kobay Technology Bhd.'s (KLSE:KOBAY) 39% Jump Shows Its Popularity With Investors

Kobay Technology Bhd. (KLSE:KOBAY) shares have continued their recent momentum with a 39% gain in the last month alone. Unfortunately, despite the strong performance over the last month, the full year gain of 9.6% isn't as attractive.

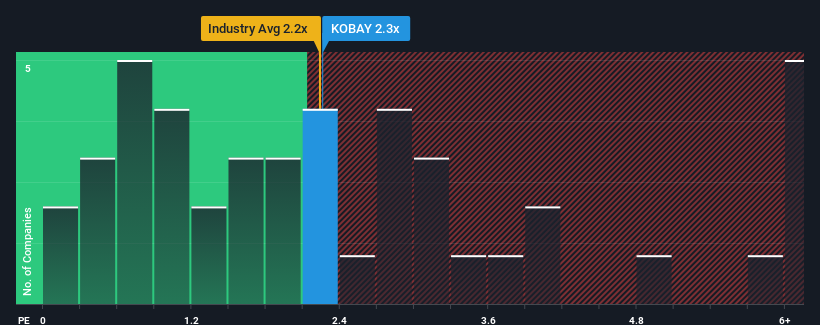

Even after such a large jump in price, it's still not a stretch to say that Kobay Technology Bhd's price-to-sales (or "P/S") ratio of 2.3x right now seems quite "middle-of-the-road" compared to the Machinery industry in Malaysia, where the median P/S ratio is around 2.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Kobay Technology Bhd

How Kobay Technology Bhd Has Been Performing

For example, consider that Kobay Technology Bhd's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Kobay Technology Bhd will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Kobay Technology Bhd would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 10% decrease to the company's top line. Still, the latest three year period has seen an excellent 93% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

It's interesting to note that the rest of the industry is similarly expected to grow by 27% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this in consideration, it's clear to see why Kobay Technology Bhd's P/S matches up closely to its industry peers. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Final Word

Its shares have lifted substantially and now Kobay Technology Bhd's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we've seen, Kobay Technology Bhd's three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

Having said that, be aware Kobay Technology Bhd is showing 2 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Kobay Technology Bhd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KOBAY

Kobay Technology Bhd

An investment holding company, engages in the manufacturing, property development, pharmaceutical and healthcare, and asset management businesses in Malaysia, Singapore, the United States, and internationally.

Excellent balance sheet with acceptable track record.