- Malaysia

- /

- Industrials

- /

- KLSE:INCKEN

Is Inch Kenneth Kajang Rubber (KLSE:INCKEN) In A Good Position To Deliver On Growth Plans?

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So, the natural question for Inch Kenneth Kajang Rubber (KLSE:INCKEN) shareholders is whether they should be concerned by its rate of cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

View our latest analysis for Inch Kenneth Kajang Rubber

How Long Is Inch Kenneth Kajang Rubber's Cash Runway?

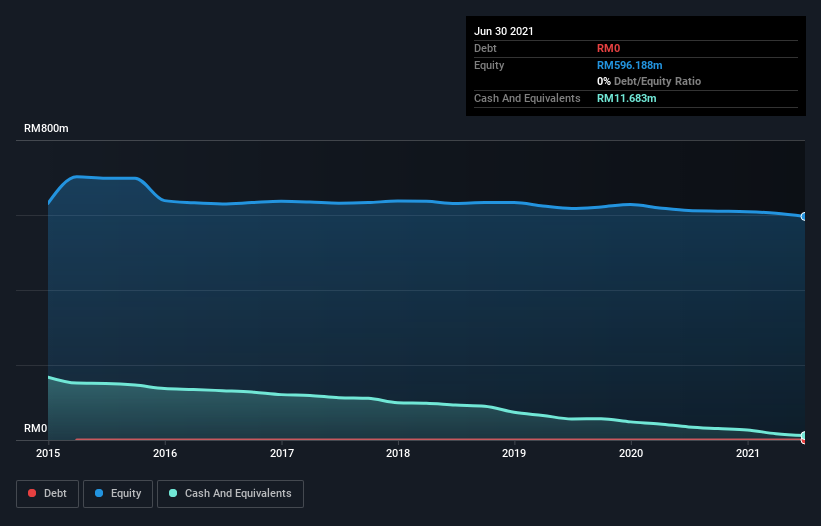

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at June 2021, Inch Kenneth Kajang Rubber had cash of RM12m and no debt. In the last year, its cash burn was RM21m. Therefore, from June 2021 it had roughly 7 months of cash runway. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. The image below shows how its cash balance has been changing over the last few years.

How Well Is Inch Kenneth Kajang Rubber Growing?

Some investors might find it troubling that Inch Kenneth Kajang Rubber is actually increasing its cash burn, which is up 41% in the last year. But looking on the bright side, its revenue gained by 51%, lending some credence to the growth narrative. Of course, with spend going up shareholders will want to see fast growth continue. On balance, we'd say the company is improving over time. Of course, we've only taken a quick look at the stock's growth metrics, here. This graph of historic revenue growth shows how Inch Kenneth Kajang Rubber is building its business over time.

How Hard Would It Be For Inch Kenneth Kajang Rubber To Raise More Cash For Growth?

Since Inch Kenneth Kajang Rubber has been boosting its cash burn, the market will likely be considering how it can raise more cash if need be. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Inch Kenneth Kajang Rubber's cash burn of RM21m is about 12% of its RM170m market capitalisation. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

Is Inch Kenneth Kajang Rubber's Cash Burn A Worry?

Even though its cash runway makes us a little nervous, we are compelled to mention that we thought Inch Kenneth Kajang Rubber's revenue growth was relatively promising. We don't think its cash burn is particularly problematic, but after considering the range of factors in this article, we do think shareholders should be monitoring how it changes over time. Taking a deeper dive, we've spotted 4 warning signs for Inch Kenneth Kajang Rubber you should be aware of, and 2 of them are a bit unpleasant.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:INCKEN

Inch Kenneth Kajang Rubber

An investment holding company, engages in the oil palm plantation, tourism resort, rubber, and property development businesses in Malaysia and Thailand.

Excellent balance sheet very low.

Market Insights

Community Narratives