Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Ho Wah Genting Berhad (KLSE:HWGB) does use debt in its business. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Ho Wah Genting Berhad

How Much Debt Does Ho Wah Genting Berhad Carry?

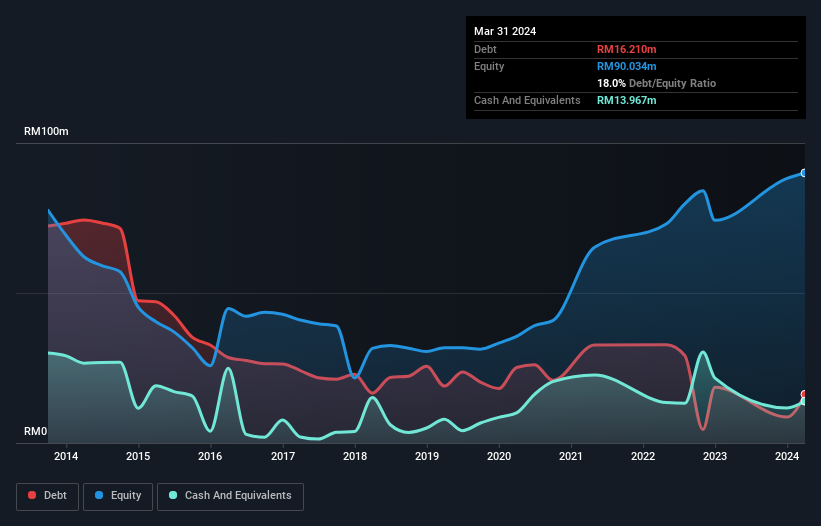

As you can see below, Ho Wah Genting Berhad had RM16.2m of debt at March 2024, down from RM18.6m a year prior. On the flip side, it has RM14.0m in cash leading to net debt of about RM2.24m.

How Strong Is Ho Wah Genting Berhad's Balance Sheet?

According to the last reported balance sheet, Ho Wah Genting Berhad had liabilities of RM35.9m due within 12 months, and liabilities of RM12.7m due beyond 12 months. Offsetting this, it had RM14.0m in cash and RM23.5m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM11.1m.

Since publicly traded Ho Wah Genting Berhad shares are worth a total of RM56.5m, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Ho Wah Genting Berhad's low debt to EBITDA ratio of 0.22 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 4.2 times last year does give us pause. So we'd recommend keeping a close eye on the impact financing costs are having on the business. Importantly, Ho Wah Genting Berhad grew its EBIT by 36% over the last twelve months, and that growth will make it easier to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Ho Wah Genting Berhad will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last two years, Ho Wah Genting Berhad actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

Happily, Ho Wah Genting Berhad's impressive conversion of EBIT to free cash flow implies it has the upper hand on its debt. But truth be told we feel its interest cover does undermine this impression a bit. Looking at the bigger picture, we think Ho Wah Genting Berhad's use of debt seems quite reasonable and we're not concerned about it. After all, sensible leverage can boost returns on equity. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. We've identified 2 warning signs with Ho Wah Genting Berhad , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you're looking to trade Ho Wah Genting Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Ho Wah Genting Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:HWGB

Ho Wah Genting Berhad

An investment holding company, manufactures and sells wires and cables, moulded power supply cord sets, and cable assemblies for electrical and electronic devices and equipment in Malaysia, rest of Asia, and North America.

Flawless balance sheet and slightly overvalued.