- Malaysia

- /

- Construction

- /

- KLSE:GBGAQRS

Analysts Just Made A Major Revision To Their Gabungan AQRS Berhad (KLSE:GBGAQRS) Revenue Forecasts

The analysts covering Gabungan AQRS Berhad (KLSE:GBGAQRS) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

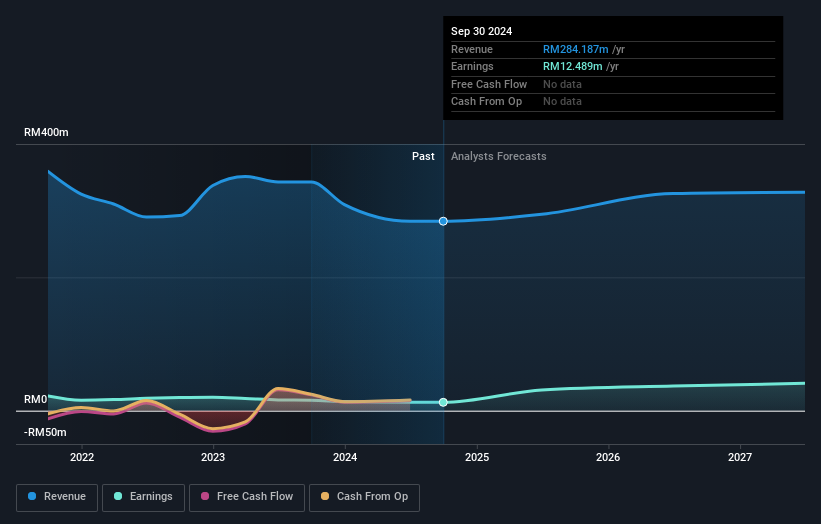

After this downgrade, Gabungan AQRS Berhad's three analysts are now forecasting revenues of RM295m in 2025. This would be a modest 3.6% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to surge 161% to RM0.06. Prior to this update, the analysts had been forecasting revenues of RM414m and earnings per share (EPS) of RM0.062 in 2025. It looks like analyst sentiment has fallen somewhat in this update, with a sizeable cut to revenue estimates and a small dip in earnings per share numbers as well.

Check out our latest analysis for Gabungan AQRS Berhad

It'll come as no surprise then, to learn that the analysts have cut their price target 20% to RM0.39.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. One thing stands out from these estimates, which is that Gabungan AQRS Berhad is forecast to grow faster in the future than it has in the past, with revenues expected to display 3.6% annualised growth until the end of 2025. If achieved, this would be a much better result than the 1.7% annual decline over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 13% annually for the foreseeable future. Although Gabungan AQRS Berhad's revenues are expected to improve, it seems that the analysts are still bearish on the business, forecasting it to grow slower than the broader industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that Gabungan AQRS Berhad's revenues are expected to grow slower than the wider market. Furthermore, there was a cut to the price target, suggesting that the latest news has led to more pessimism about the intrinsic value of the business. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Gabungan AQRS Berhad after today.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Gabungan AQRS Berhad going out to 2027, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:GBGAQRS

Gabungan AQRS Berhad

An investment holding company, engages in development and construction of property in Malaysia.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives