- Malaysia

- /

- Construction

- /

- KLSE:FBG

Risks To Shareholder Returns Are Elevated At These Prices For Fajarbaru Builder Group Bhd. (KLSE:FAJAR)

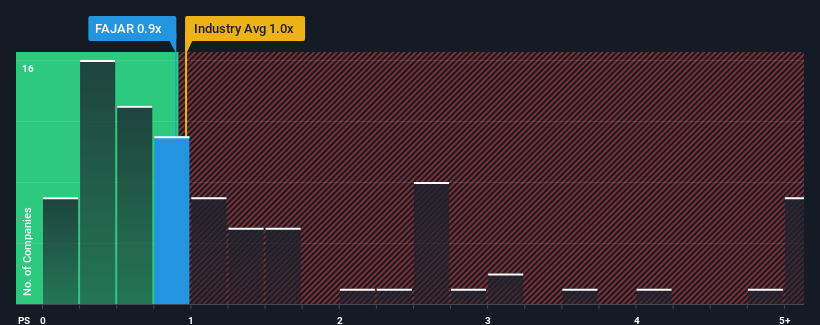

There wouldn't be many who think Fajarbaru Builder Group Bhd.'s (KLSE:FAJAR) price-to-sales (or "P/S") ratio of 0.9x is worth a mention when the median P/S for the Construction industry in Malaysia is similar at about 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Fajarbaru Builder Group Bhd

How Fajarbaru Builder Group Bhd Has Been Performing

The revenue growth achieved at Fajarbaru Builder Group Bhd over the last year would be more than acceptable for most companies. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Fajarbaru Builder Group Bhd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Fajarbaru Builder Group Bhd's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

Fajarbaru Builder Group Bhd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 29% last year. As a result, it also grew revenue by 12% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 18% shows it's noticeably less attractive.

With this information, we find it interesting that Fajarbaru Builder Group Bhd is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does Fajarbaru Builder Group Bhd's P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Fajarbaru Builder Group Bhd revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Before you settle on your opinion, we've discovered 2 warning signs for Fajarbaru Builder Group Bhd (1 is a bit concerning!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:FBG

FBG Holdings Berhad

An investment holding company, engages in the civil, infrastructure, and building construction works in Malaysia.

Established dividend payer with moderate risk.

Market Insights

Community Narratives