- Malaysia

- /

- Construction

- /

- KLSE:CITAGLB

Here's Why Citaglobal Berhad (KLSE:CITAGLB) Can Manage Its Debt Responsibly

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Citaglobal Berhad (KLSE:CITAGLB) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Citaglobal Berhad

What Is Citaglobal Berhad's Net Debt?

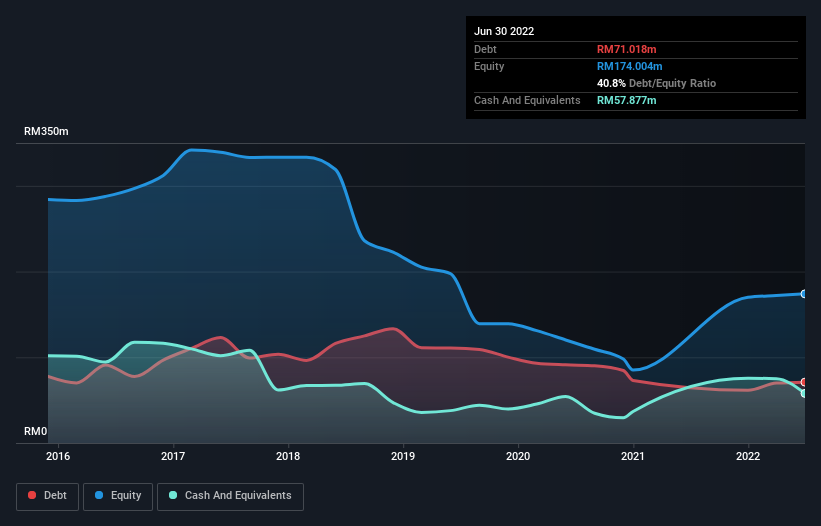

As you can see below, Citaglobal Berhad had RM71.0m of debt, at June 2022, which is about the same as the year before. You can click the chart for greater detail. On the flip side, it has RM57.9m in cash leading to net debt of about RM13.1m.

How Strong Is Citaglobal Berhad's Balance Sheet?

According to the last reported balance sheet, Citaglobal Berhad had liabilities of RM138.6m due within 12 months, and liabilities of RM20.4m due beyond 12 months. Offsetting these obligations, it had cash of RM57.9m as well as receivables valued at RM149.7m due within 12 months. So it actually has RM48.5m more liquid assets than total liabilities.

This excess liquidity suggests that Citaglobal Berhad is taking a careful approach to debt. Due to its strong net asset position, it is not likely to face issues with its lenders.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Looking at its net debt to EBITDA of 0.69 and interest cover of 3.8 times, it seems to us that Citaglobal Berhad is probably using debt in a pretty reasonable way. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. Notably, Citaglobal Berhad made a loss at the EBIT level, last year, but improved that to positive EBIT of RM16m in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But it is Citaglobal Berhad's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Over the last year, Citaglobal Berhad saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Citaglobal Berhad's conversion of EBIT to free cash flow was a real negative on this analysis, although the other factors we considered were considerably better. In particular, we are dazzled with its net debt to EBITDA. Looking at all this data makes us feel a little cautious about Citaglobal Berhad's debt levels. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Citaglobal Berhad is showing 3 warning signs in our investment analysis , and 1 of those can't be ignored...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CITAGLB

Citaglobal Berhad

An investment holding company, engages in civil engineering, construction, and related works in Malaysia.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives