- Malaysia

- /

- Trade Distributors

- /

- KLSE:CHUAN

We Think Chuan Huat Resources Berhad (KLSE:CHUAN) Is Taking Some Risk With Its Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Chuan Huat Resources Berhad (KLSE:CHUAN) does carry debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Chuan Huat Resources Berhad

How Much Debt Does Chuan Huat Resources Berhad Carry?

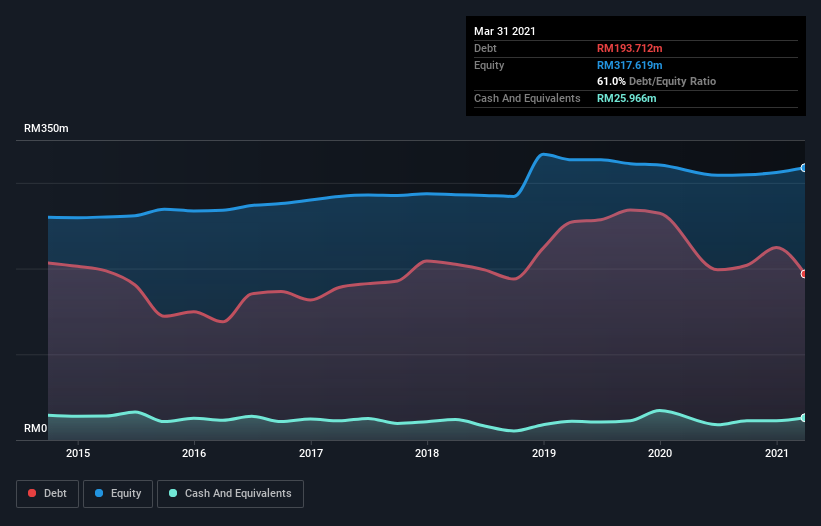

The image below, which you can click on for greater detail, shows that Chuan Huat Resources Berhad had debt of RM193.7m at the end of March 2021, a reduction from RM264.6m over a year. However, it does have RM26.0m in cash offsetting this, leading to net debt of about RM167.7m.

How Healthy Is Chuan Huat Resources Berhad's Balance Sheet?

According to the last reported balance sheet, Chuan Huat Resources Berhad had liabilities of RM220.0m due within 12 months, and liabilities of RM41.6m due beyond 12 months. Offsetting this, it had RM26.0m in cash and RM178.3m in receivables that were due within 12 months. So it has liabilities totalling RM57.4m more than its cash and near-term receivables, combined.

Chuan Huat Resources Berhad has a market capitalization of RM105.4m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Chuan Huat Resources Berhad shareholders face the double whammy of a high net debt to EBITDA ratio (14.6), and fairly weak interest coverage, since EBIT is just 1.1 times the interest expense. The debt burden here is substantial. However, it should be some comfort for shareholders to recall that Chuan Huat Resources Berhad actually grew its EBIT by a hefty 402%, over the last 12 months. If it can keep walking that path it will be in a position to shed its debt with relative ease. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Chuan Huat Resources Berhad will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Chuan Huat Resources Berhad saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Chuan Huat Resources Berhad's interest cover and its track record of converting EBIT to free cash flow make us rather uncomfortable with its debt levels. But on the bright side, its EBIT growth rate is a good sign, and makes us more optimistic. Once we consider all the factors above, together, it seems to us that Chuan Huat Resources Berhad's debt is making it a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that Chuan Huat Resources Berhad is showing 3 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:CHUAN

Chuan Huat Resources Berhad

An investment holding company, engages in hardware and building materials, technology-related products, and property businesses in Malaysia.

Slight and slightly overvalued.

Similar Companies

Market Insights

Community Narratives