David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Chin Hin Group Berhad (KLSE:CHINHIN) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Chin Hin Group Berhad

What Is Chin Hin Group Berhad's Net Debt?

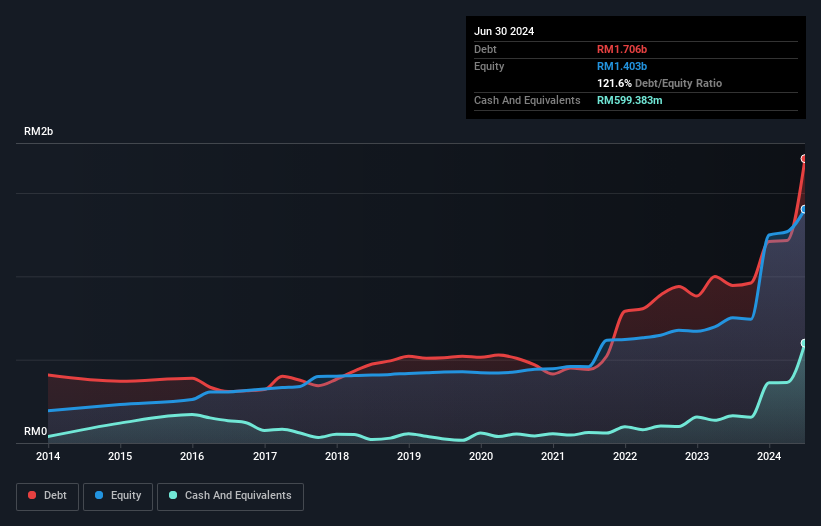

The image below, which you can click on for greater detail, shows that at June 2024 Chin Hin Group Berhad had debt of RM1.71b, up from RM945.2m in one year. However, it does have RM599.4m in cash offsetting this, leading to net debt of about RM1.11b.

How Healthy Is Chin Hin Group Berhad's Balance Sheet?

The latest balance sheet data shows that Chin Hin Group Berhad had liabilities of RM1.86b due within a year, and liabilities of RM989.6m falling due after that. Offsetting this, it had RM599.4m in cash and RM1.25b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM1.01b.

Since publicly traded Chin Hin Group Berhad shares are worth a total of RM8.63b, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Chin Hin Group Berhad shareholders face the double whammy of a high net debt to EBITDA ratio (7.2), and fairly weak interest coverage, since EBIT is just 2.4 times the interest expense. This means we'd consider it to have a heavy debt load. The silver lining is that Chin Hin Group Berhad grew its EBIT by 123% last year, which nourishing like the idealism of youth. If it can keep walking that path it will be in a position to shed its debt with relative ease. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Chin Hin Group Berhad will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Chin Hin Group Berhad saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Chin Hin Group Berhad's conversion of EBIT to free cash flow and net debt to EBITDA definitely weigh on it, in our esteem. But its EBIT growth rate tells a very different story, and suggests some resilience. Looking at all the angles mentioned above, it does seem to us that Chin Hin Group Berhad is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example Chin Hin Group Berhad has 2 warning signs (and 1 which is potentially serious) we think you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CHINHIN

Chin Hin Group Berhad

Provides building materials and services in Malaysia, Singapore, Thailand, the Philippines, Indonesia, Brunei, Bangladesh, Cambodia, India, Maldives, Myanmar, Sri Lanka, Vietnam, New Zealand, and Hong Kong.

Proven track record with mediocre balance sheet.