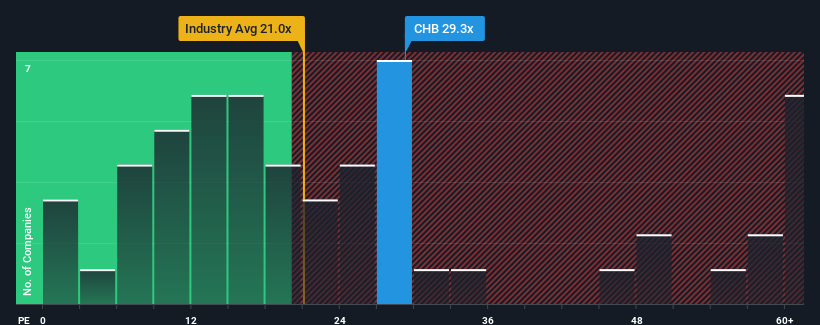

Critical Holdings Berhad's (KLSE:CHB) price-to-earnings (or "P/E") ratio of 29.3x might make it look like a strong sell right now compared to the market in Malaysia, where around half of the companies have P/E ratios below 15x and even P/E's below 9x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times have been advantageous for Critical Holdings Berhad as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Critical Holdings Berhad

Is There Enough Growth For Critical Holdings Berhad?

The only time you'd be truly comfortable seeing a P/E as steep as Critical Holdings Berhad's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 21% last year. The strong recent performance means it was also able to grow EPS by 263% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 22% as estimated by the two analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 17%, which is noticeably less attractive.

In light of this, it's understandable that Critical Holdings Berhad's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Critical Holdings Berhad maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Critical Holdings Berhad (1 is potentially serious!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Critical Holdings Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CHB

Critical Holdings Berhad

An investment holding company, provides MEP design and engineering solutions for data centers, cleanrooms, and plantrooms in Malaysia and Singapore.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives