Broker Revenue Forecasts For CB Industrial Product Holding Berhad (KLSE:CBIP) Are Surging Higher

Celebrations may be in order for CB Industrial Product Holding Berhad (KLSE:CBIP) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The analysts have sharply increased their revenue numbers, with a view that CB Industrial Product Holding Berhad will make substantially more sales than they'd previously expected. CB Industrial Product Holding Berhad has also found favour with investors, with the stock up a noteworthy 12% to RM1.14 over the past week. It will be interesting to see if today's upgrade is enough to propel the stock even higher.

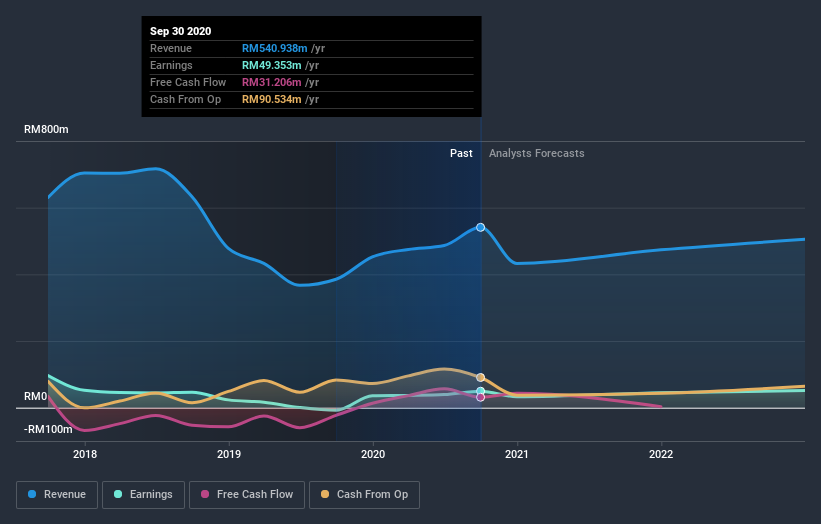

Following the latest upgrade, the current consensus, from the four analysts covering CB Industrial Product Holding Berhad, is for revenues of RM433m in 2020, which would reflect an uncomfortable 20% reduction in CB Industrial Product Holding Berhad's sales over the past 12 months. Statutory earnings per share are supposed to plunge 25% to RM0.071 in the same period. Prior to this update, the analysts had been forecasting revenues of RM389m and earnings per share (EPS) of RM0.067 in 2020. The most recent forecasts are noticeably more optimistic, with a nice gain to revenue estimates and a lift to earnings per share as well.

View our latest analysis for CB Industrial Product Holding Berhad

Although the analysts have upgraded their earnings estimates, there was no change to the consensus price target of RM0.92, suggesting that the forecast performance does not have a long term impact on the company's valuation. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic CB Industrial Product Holding Berhad analyst has a price target of RM1.05 per share, while the most pessimistic values it at RM0.87. Even so, with a relatively close grouping of estimates, it looks like the analysts are quite confident in their valuations, suggesting CB Industrial Product Holding Berhad is an easy business to forecast or the underlying assumptions are obvious.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the CB Industrial Product Holding Berhad's past performance and to peers in the same industry. Over the past five years, revenues have declined around 4.9% annually. Worse, forecasts are essentially predicting the decline to accelerate, with the estimate for a 20% decline in revenue next year. Compare this against analyst estimates for companies in the wider industry, which suggest that revenues (in aggregate) are expected to grow 21% next year. So it's pretty clear that, while it does have declining revenues, the analysts also expect CB Industrial Product Holding Berhad to suffer worse than the wider industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for this year, expecting improving business conditions. Pleasantly, analysts also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow slower than the wider market. Seeing the dramatic upgrade to this year's forecasts, it might be time to take another look at CB Industrial Product Holding Berhad.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for CB Industrial Product Holding Berhad going out to 2022, and you can see them free on our platform here..

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

When trading CB Industrial Product Holding Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade CB Industrial Product Holding Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:CBIP

CB Industrial Product Holding Berhad

An investment holding company, manufactures and sells palm oil mill equipment and related spare parts in Indonesia, Malaysia, Papua New Guinea, Thailand, Central America, Africa, Singapore, Liberia, and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives