- Malaysia

- /

- Industrials

- /

- KLSE:BJCORP

Some Shareholders May find It Hard To Increase Berjaya Corporation Berhad's (KLSE:BJCORP) CEO Compensation This Year

Key Insights

- Berjaya Corporation Berhad's Annual General Meeting to take place on 12th of December

- Total pay for CEO Vivienne Cheng includes RM429.2k salary

- Total compensation is similar to the industry average

- Over the past three years, Berjaya Corporation Berhad's EPS fell by 42% and over the past three years, the total shareholder return was 0.0004%

Share price growth at Berjaya Corporation Berhad (KLSE:BJCORP) has remained rather flat over the last few years and it may be because earnings has struggled to grow at all. The upcoming AGM on 12th of December may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

See our latest analysis for Berjaya Corporation Berhad

How Does Total Compensation For Vivienne Cheng Compare With Other Companies In The Industry?

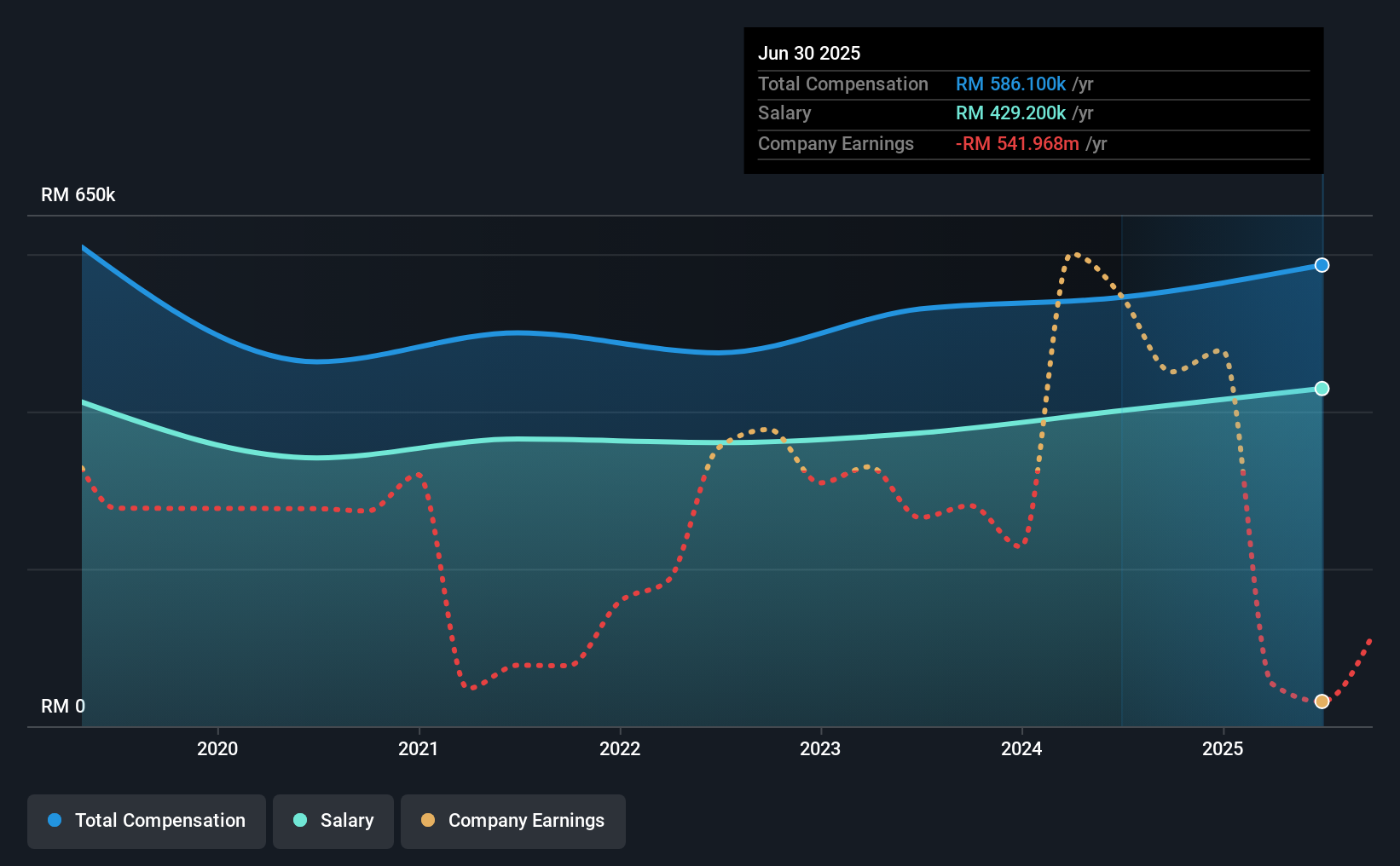

At the time of writing, our data shows that Berjaya Corporation Berhad has a market capitalization of RM1.6b, and reported total annual CEO compensation of RM586k for the year to June 2025. That's a fairly small increase of 7.5% over the previous year. In particular, the salary of RM429.2k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar companies from the Malaysia Industrials industry with market caps ranging from RM823m to RM3.3b, we found that the median CEO total compensation was RM587k. From this we gather that Vivienne Cheng is paid around the median for CEOs in the industry.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | RM429k | RM401k | 73% |

| Other | RM157k | RM144k | 27% |

| Total Compensation | RM586k | RM545k | 100% |

On an industry level, roughly 64% of total compensation represents salary and 36% is other remuneration. Berjaya Corporation Berhad is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Berjaya Corporation Berhad's Growth

Over the last three years, Berjaya Corporation Berhad has shrunk its earnings per share by 42% per year. It saw its revenue drop 3.0% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Berjaya Corporation Berhad Been A Good Investment?

Berjaya Corporation Berhad has not done too badly by shareholders, with a total return of 0.0004%, over three years. It would be nice to see that metric improve in the future. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

In Summary...

The flat share price growth combined with the the fact that earnings have failed to grow makes us wonder whether the share price will have any further strong momentum. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Berjaya Corporation Berhad.

Switching gears from Berjaya Corporation Berhad, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're here to simplify it.

Discover if Berjaya Corporation Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:BJCORP

Berjaya Corporation Berhad

Provides consumer marketing, direct selling, and retailing services.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026