- Malaysia

- /

- Construction

- /

- KLSE:ANEKA

Here's Why Aneka Jaringan Holdings Berhad (KLSE:ANEKA) Can Afford Some Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Aneka Jaringan Holdings Berhad (KLSE:ANEKA) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Aneka Jaringan Holdings Berhad

What Is Aneka Jaringan Holdings Berhad's Net Debt?

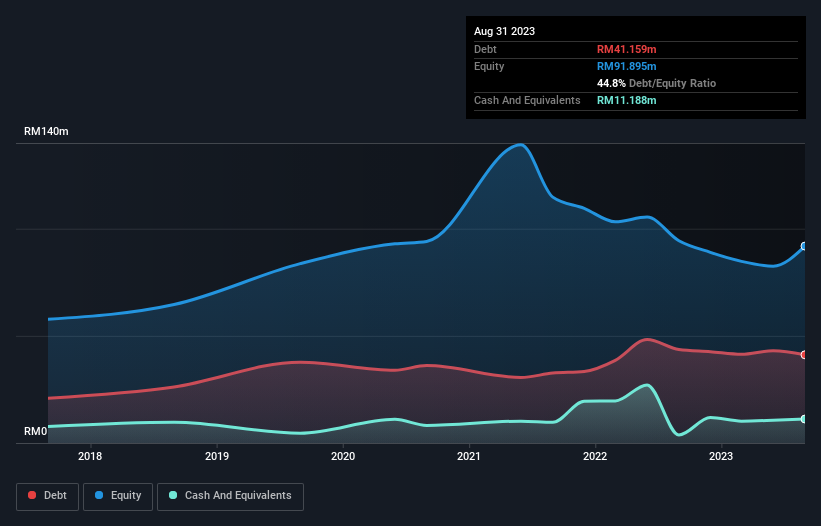

As you can see below, Aneka Jaringan Holdings Berhad had RM41.2m of debt at August 2023, down from RM43.6m a year prior. However, it does have RM11.2m in cash offsetting this, leading to net debt of about RM30.0m.

How Strong Is Aneka Jaringan Holdings Berhad's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Aneka Jaringan Holdings Berhad had liabilities of RM132.4m due within 12 months and liabilities of RM14.1m due beyond that. On the other hand, it had cash of RM11.2m and RM149.2m worth of receivables due within a year. So it actually has RM13.8m more liquid assets than total liabilities.

This surplus suggests that Aneka Jaringan Holdings Berhad has a conservative balance sheet, and could probably eliminate its debt without much difficulty. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Aneka Jaringan Holdings Berhad will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Aneka Jaringan Holdings Berhad wasn't profitable at an EBIT level, but managed to grow its revenue by 12%, to RM190m. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Importantly, Aneka Jaringan Holdings Berhad had an earnings before interest and tax (EBIT) loss over the last year. To be specific the EBIT loss came in at RM6.6m. On a more positive note, the company does have liquid assets, so it has a bit of time to improve its operations before the debt becomes an acute problem. But we'd be more likely to spend time trying to understand the stock if the company made a profit. This one is a bit too risky for our liking. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 3 warning signs we've spotted with Aneka Jaringan Holdings Berhad (including 1 which makes us a bit uncomfortable) .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:ANEKA

Aneka Jaringan Holdings Berhad

An investment holding company, engages in the foundation and basement construction businesses primarily in Malaysia and Indonesia.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026