If You Had Bought Malaysia Building Society Berhad (KLSE:MBSB) Stock Five Years Ago, You'd Be Sitting On A 65% Loss, Today

Statistically speaking, long term investing is a profitable endeavour. But no-one is immune from buying too high. For example, after five long years the Malaysia Building Society Berhad (KLSE:MBSB) share price is a whole 65% lower. That's not a lot of fun for true believers.

Check out our latest analysis for Malaysia Building Society Berhad

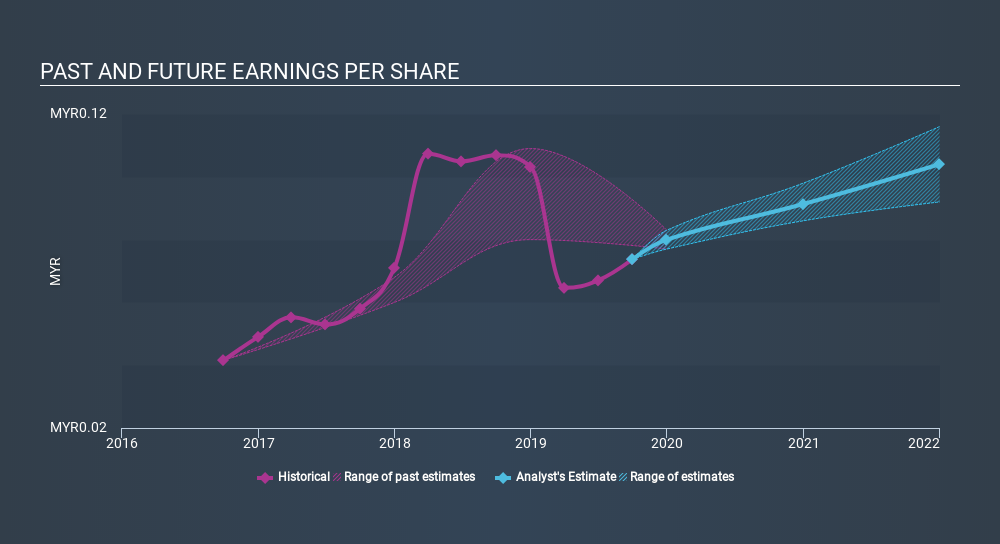

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years over which the share price declined, Malaysia Building Society Berhad's earnings per share (EPS) dropped by 25% each year. This fall in the EPS is worse than the 19% compound annual share price fall. So the market may previously have expected a drop, or else it expects the situation will improve.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Fundamentally, investors are buying a company's future earnings, but the stability of the business can influence the price they're willing to pay. For example, we've discovered 2 warning signs for Malaysia Building Society Berhad which any shareholder or potential investor should be aware of.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Malaysia Building Society Berhad's TSR for the last 5 years was -56%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market gained around 4.1% in the last year, Malaysia Building Society Berhad shareholders lost 6.7% (even including dividends) . However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 15% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. Before forming an opinion on Malaysia Building Society Berhad you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About KLSE:MBSB

MBSB Berhad

An investment holding company, provides banking services in Malaysia.

Proven track record with adequate balance sheet.