What Can We Learn About Hong Leong Bank Berhad's (KLSE:HLBANK) CEO Compensation?

Domenic Fuda became the CEO of Hong Leong Bank Berhad (KLSE:HLBANK) in 2016, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for Hong Leong Bank Berhad

How Does Total Compensation For Domenic Fuda Compare With Other Companies In The Industry?

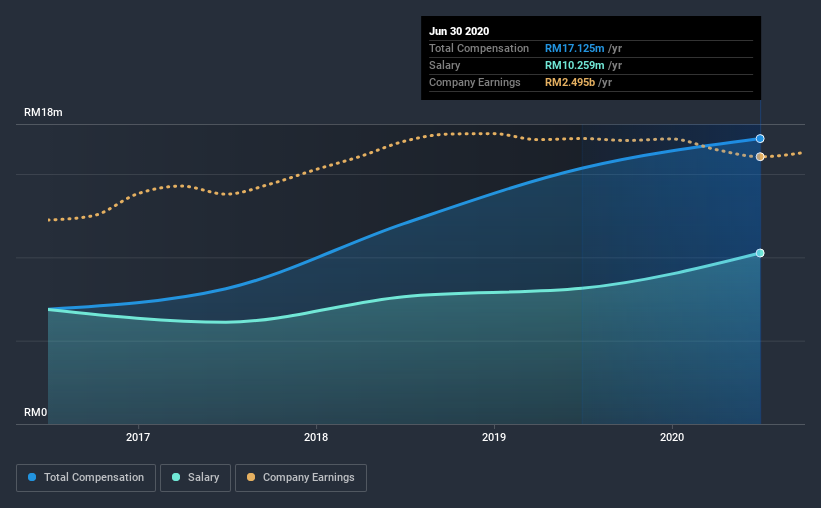

Our data indicates that Hong Leong Bank Berhad has a market capitalization of RM38b, and total annual CEO compensation was reported as RM17m for the year to June 2020. That's a notable increase of 12% on last year. We note that the salary portion, which stands at RM10.3m constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the industry with market capitalizations between RM16b and RM48b, we discovered that the median CEO total compensation of that group was RM870k. Accordingly, our analysis reveals that Hong Leong Bank Berhad pays Domenic Fuda north of the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | RM10m | RM8.1m | 60% |

| Other | RM6.9m | RM7.2m | 40% |

| Total Compensation | RM17m | RM15m | 100% |

Speaking on an industry level, nearly 60% of total compensation represents salary, while the remainder of 40% is other remuneration. Hong Leong Bank Berhad is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Hong Leong Bank Berhad's Growth Numbers

Over the past three years, Hong Leong Bank Berhad has seen its earnings per share (EPS) grow by 4.2% per year. In the last year, its revenue is down 5.1%.

We generally like to see a little revenue growth, but it is good to see a modest EPS growth at least. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Hong Leong Bank Berhad Been A Good Investment?

With a total shareholder return of 9.0% over three years, Hong Leong Bank Berhad has done okay by shareholders. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

In Summary...

As previously discussed, Domenic is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. But the business isn't growing EPS, and the returns to shareholders haven't been wonderful. Overall, although the company has delivered steady performance, we would like to see an improvement in key metrics before we can say the high CEO compensation is justified.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Hong Leong Bank Berhad that you should be aware of before investing.

Switching gears from Hong Leong Bank Berhad, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Hong Leong Bank Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Hong Leong Bank Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hong Leong Bank Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:HLBANK

Hong Leong Bank Berhad

Operates as a financial services company in Malaysia, Singapore, Hong Kong, China, Vietnam, and Cambodia.

Flawless balance sheet average dividend payer.