- Mexico

- /

- Transportation

- /

- BMV:GMXT *

January 2025's Top Stocks Estimated To Be Trading Below Their Fair Value

Reviewed by Simply Wall St

As global markets navigate the complexities of fluctuating consumer confidence and mixed economic signals, major indices have experienced moderate gains, with technology stocks leading the charge. Amid these conditions, identifying undervalued stocks becomes crucial for investors looking to capitalize on potential market inefficiencies, especially when consumer sentiment and economic growth are in flux.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Lundin Gold (TSX:LUG) | CA$31.92 | CA$63.81 | 50% |

| Tourmaline Oil (TSX:TOU) | CA$67.37 | CA$134.34 | 49.9% |

| Bank BTPN Syariah (IDX:BTPS) | IDR935.00 | IDR1869.73 | 50% |

| Strike CompanyLimited (TSE:6196) | ¥3655.00 | ¥7284.35 | 49.8% |

| Camden National (NasdaqGS:CAC) | US$42.25 | US$84.44 | 50% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.76 | €5.50 | 49.8% |

| Elekta (OM:EKTA B) | SEK61.80 | SEK123.12 | 49.8% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| Vogo (ENXTPA:ALVGO) | €2.95 | €5.87 | 49.8% |

Here we highlight a subset of our preferred stocks from the screener.

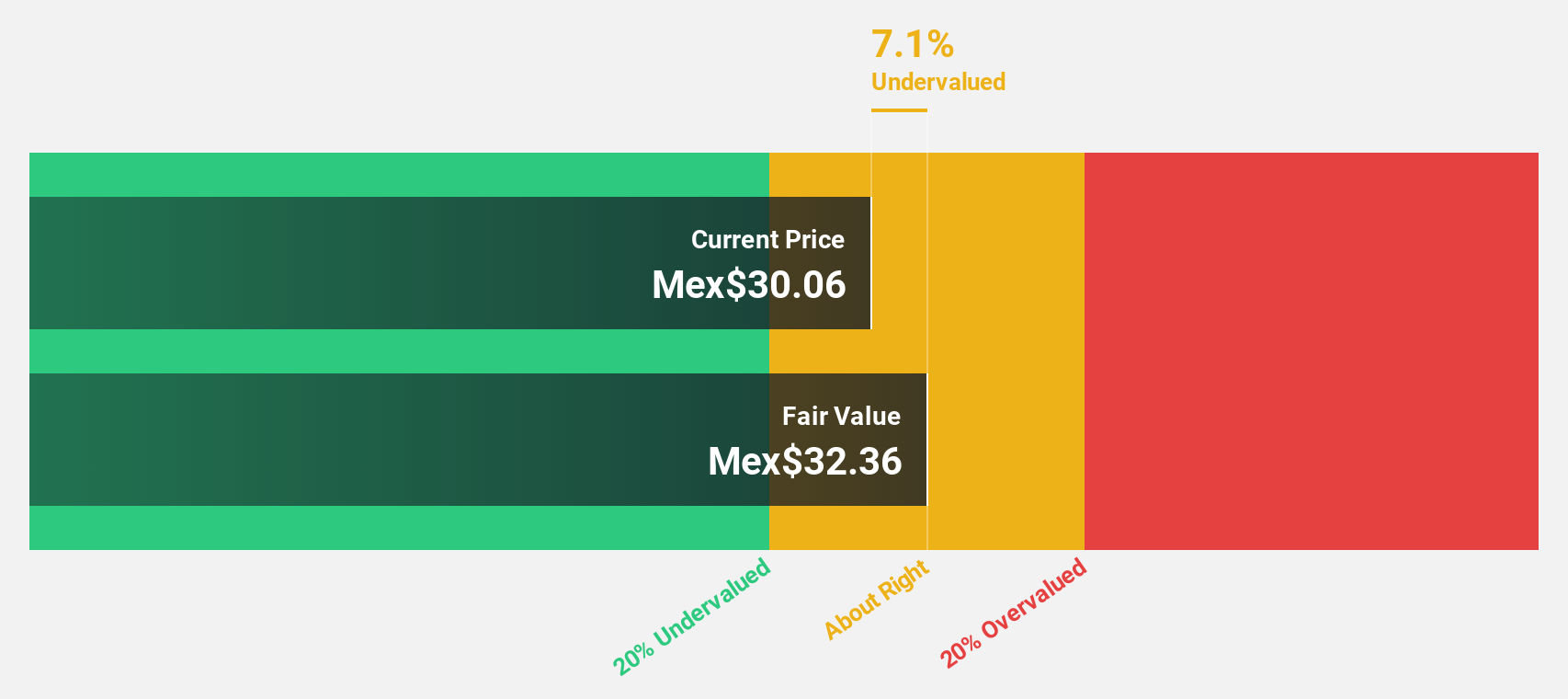

GMéxico Transportes. de (BMV:GMXT *)

Overview: GMéxico Transportes, S.A.B. de C.V. offers logistics and ground transportation solutions in Mexico with a market cap of MX$142.29 billion.

Operations: The company generates revenue through its logistics and ground transportation services in Mexico.

Estimated Discount To Fair Value: 36.8%

GMéxico Transportes is trading at MX$32.02, which is 36.8% below its estimated fair value of MX$50.68, suggesting it may be undervalued based on cash flows. Despite a dividend yield of 6.25% not being well covered by earnings, the company's earnings are forecast to grow significantly at 21.64% annually over the next three years, outpacing both its revenue growth and the broader Mexican market's expected profit growth rate.

- In light of our recent growth report, it seems possible that GMéxico Transportes. de's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of GMéxico Transportes. de stock in this financial health report.

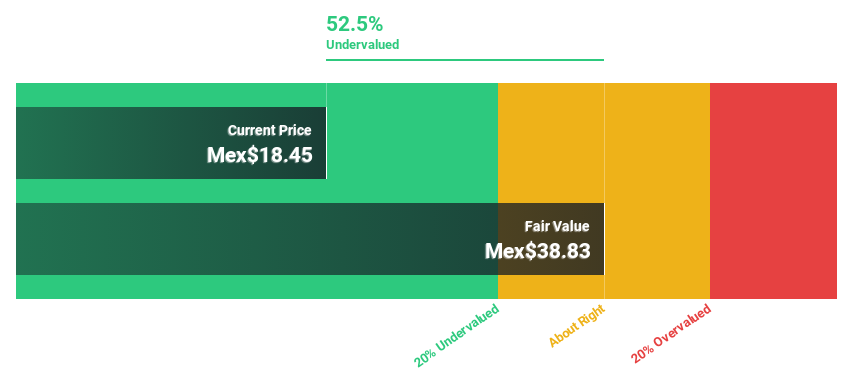

Grupo Traxión. de (BMV:TRAXION A)

Overview: Grupo Traxión, S.A.B. de C.V. is a mobility and logistics company operating in Mexico with a market cap of MX$10.57 billion.

Operations: The company's revenue is derived from three main segments: Cargo Transportation (MX$8.12 billion), Mobility of Personnel (MX$10.17 billion), and Logistics and Technology (MX$9.94 billion).

Estimated Discount To Fair Value: 40.3%

Grupo Traxión is trading at MX$18.64, significantly below its estimated fair value of MX$31.24, highlighting potential undervaluation based on cash flows. Despite recent volatility and shareholder dilution, earnings are expected to grow substantially at 21.4% annually, surpassing the Mexican market's growth rate. However, interest payments are not well covered by earnings. Recent reports show increased sales but a decline in quarterly net income compared to the previous year.

- Insights from our recent growth report point to a promising forecast for Grupo Traxión. de's business outlook.

- Click to explore a detailed breakdown of our findings in Grupo Traxión. de's balance sheet health report.

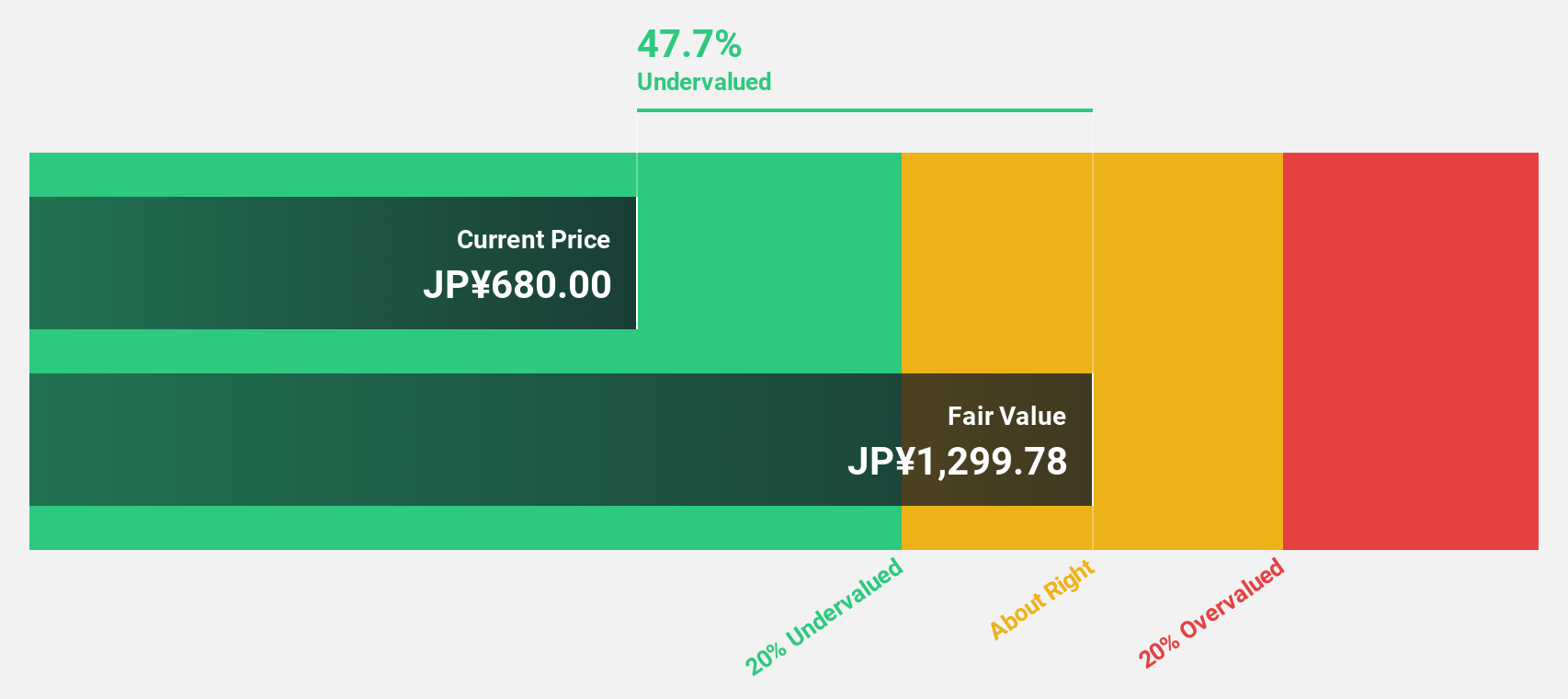

CURVES HOLDINGS (TSE:7085)

Overview: CURVES HOLDINGS Co., Ltd. operates and manages women's fitness clubs under the Curves brand in Japan, with a market cap of ¥71.53 billion.

Operations: Unfortunately, the revenue segment details for CURVES HOLDINGS Co., Ltd. are not provided in the text you shared. Please provide the specific revenue segment information if available, and I can help summarize it for you.

Estimated Discount To Fair Value: 32.5%

CURVES HOLDINGS is trading at ¥777, significantly below its estimated fair value of ¥1150.45, indicating potential undervaluation based on cash flows. Earnings grew by 39.8% over the past year and are forecast to grow at 9.6% annually, outpacing the Japanese market's growth rate of 7.8%. Revenue is also expected to increase faster than the market average at 6.7% per year. The company recently raised its dividend guidance for fiscal 2025, enhancing shareholder returns.

- The analysis detailed in our CURVES HOLDINGS growth report hints at robust future financial performance.

- Navigate through the intricacies of CURVES HOLDINGS with our comprehensive financial health report here.

Make It Happen

- Delve into our full catalog of 897 Undervalued Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:GMXT *

GMéxico Transportes. de

Provides logistics and ground transportation solutions in Mexico.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives