- Mexico

- /

- Telecom Services and Carriers

- /

- BMV:SITES1 A-1

Solid Earnings Reflect Operadora de Sites Mexicanos. de's (BMV:SITES1A-1) Strength As A Business

Even though Operadora de Sites Mexicanos, S.A.B. de C.V.'s (BMV:SITES1A-1) recent earnings release was robust, the market didn't seem to notice. We think that investors have missed some encouraging factors underlying the profit figures.

View our latest analysis for Operadora de Sites Mexicanos. de

Zooming In On Operadora de Sites Mexicanos. de's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. The ratio shows us how much a company's profit exceeds its FCF.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

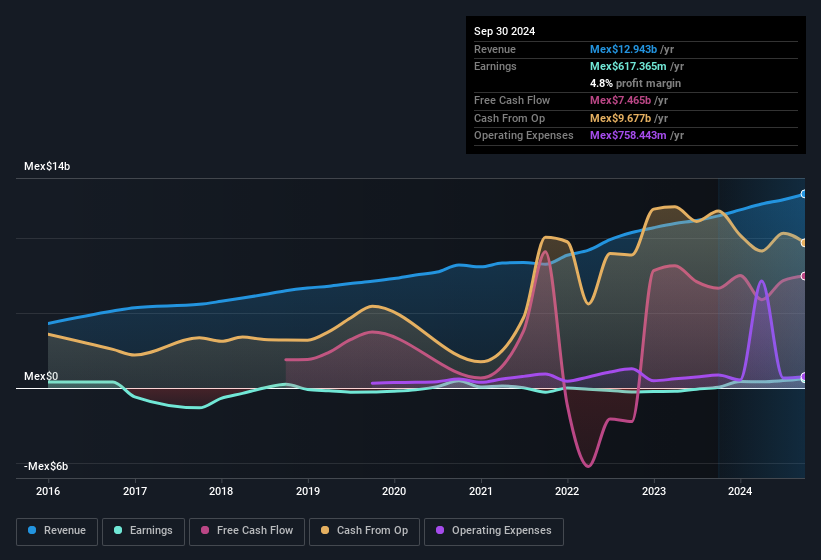

For the year to September 2024, Operadora de Sites Mexicanos. de had an accrual ratio of -0.11. That indicates that its free cash flow was a fair bit more than its statutory profit. To wit, it produced free cash flow of Mex$7.5b during the period, dwarfing its reported profit of Mex$617.4m. Operadora de Sites Mexicanos. de's free cash flow improved over the last year, which is generally good to see.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Operadora de Sites Mexicanos. de's Profit Performance

As we discussed above, Operadora de Sites Mexicanos. de has perfectly satisfactory free cash flow relative to profit. Because of this, we think Operadora de Sites Mexicanos. de's earnings potential is at least as good as it seems, and maybe even better! And on top of that, its earnings per share have grown at an extremely impressive rate over the last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you'd like to know more about Operadora de Sites Mexicanos. de as a business, it's important to be aware of any risks it's facing. In terms of investment risks, we've identified 1 warning sign with Operadora de Sites Mexicanos. de, and understanding it should be part of your investment process.

This note has only looked at a single factor that sheds light on the nature of Operadora de Sites Mexicanos. de's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:SITES1 A-1

Operadora de Sites Mexicanos. de

Operadora de Sites Mexicanos, S.A.B. de C.V.

Proven track record with moderate growth potential.

Market Insights

Community Narratives