- Mexico

- /

- Telecom Services and Carriers

- /

- BMV:AXTEL CPO

Axtel, S.A.B. de C.V. (BMV:AXTELCPO) Shares Fly 37% But Investors Aren't Buying For Growth

Axtel, S.A.B. de C.V. (BMV:AXTELCPO) shares have continued their recent momentum with a 37% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 14% over that time.

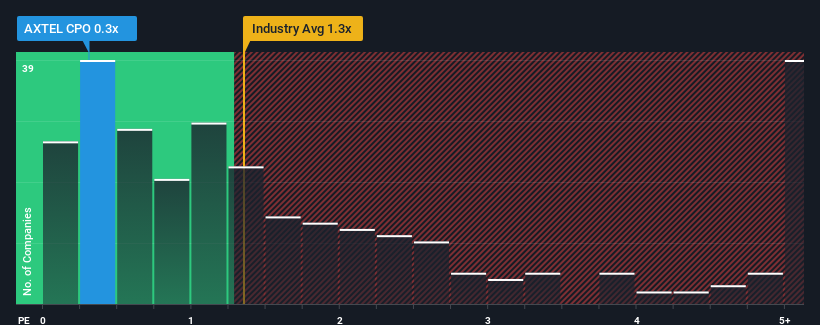

Even after such a large jump in price, it would still be understandable if you think Axtel. de is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.3x, considering almost half the companies in Mexico's Telecom industry have P/S ratios above 1.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Axtel. de

What Does Axtel. de's Recent Performance Look Like?

There hasn't been much to differentiate Axtel. de's and the industry's revenue growth lately. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Keen to find out how analysts think Axtel. de's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Axtel. de would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 4.5% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 11% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 1.7% each year as estimated by the two analysts watching the company. With the industry predicted to deliver 6.2% growth each year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Axtel. de's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Axtel. de's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Axtel. de's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 3 warning signs for Axtel. de (2 don't sit too well with us!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Axtel. de, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:AXTEL CPO

Axtel. de

An information and communications technology (ICT) company, provides ICT solutions to companies, corporations, financial institutions, and government entities in Mexico.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives