- Germany

- /

- Aerospace & Defense

- /

- XTRA:HAG

February 2025's Noteworthy Stocks Possibly Priced Below Estimated Fair Value

Reviewed by Simply Wall St

As global markets navigate a landscape marked by accelerating U.S. inflation and stock indexes nearing record highs, investors are keenly observing the interplay between economic indicators and market performance. With growth stocks outpacing value shares and small-cap stocks lagging behind their larger counterparts, the current environment presents unique opportunities for identifying undervalued stocks that may be priced below their estimated fair value. In this context, a good stock often exhibits strong fundamentals or potential for growth that is not yet fully recognized by the market, making it an appealing option for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.65 | US$36.93 | 49.5% |

| Tibet Rhodiola Pharmaceutical Holding (SHSE:600211) | CN¥36.50 | CN¥72.75 | 49.8% |

| Nuvoton Technology (TWSE:4919) | NT$96.00 | NT$191.23 | 49.8% |

| People & Technology (KOSDAQ:A137400) | ₩41600.00 | ₩81998.88 | 49.3% |

| Saigon Thuong Tin Commercial Bank (HOSE:STB) | ₫38250.00 | ₫76325.14 | 49.9% |

| Kraft Bank (OB:KRAB) | NOK9.10 | NOK18.03 | 49.5% |

| Solum (KOSE:A248070) | ₩17660.00 | ₩34915.02 | 49.4% |

| Hensoldt (XTRA:HAG) | €40.78 | €81.50 | 50% |

| Array Technologies (NasdaqGM:ARRY) | US$6.79 | US$13.53 | 49.8% |

| Likewise Group (AIM:LIKE) | £0.185 | £0.37 | 49.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

América Móvil. de (BMV:AMX B)

Overview: América Móvil, S.A.B. de C.V. offers telecommunications services across Latin America and internationally, with a market cap of MX$948.34 billion.

Operations: The company generates revenue from its Cellular Services segment, which amounts to MX$869.22 billion.

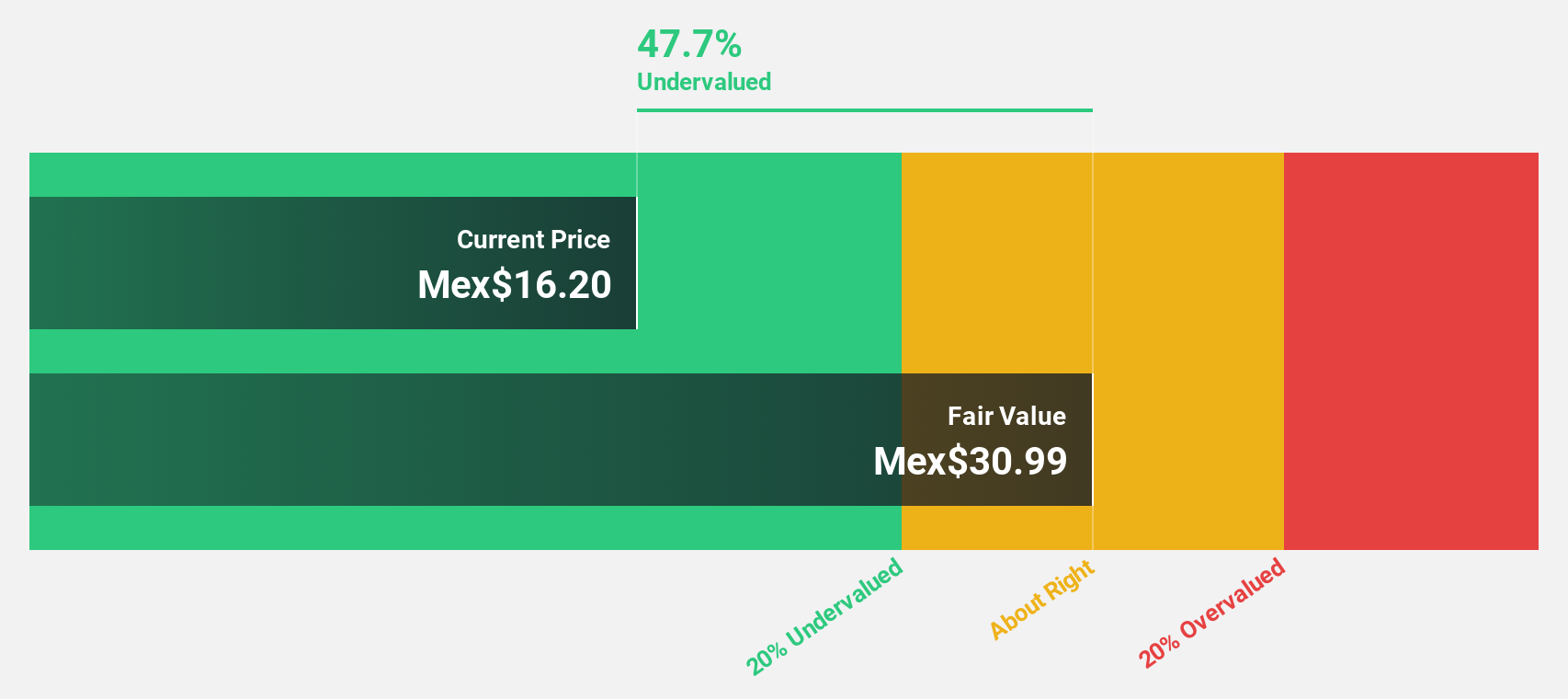

Estimated Discount To Fair Value: 46.6%

América Móvil's recent earnings report shows a decline in net income despite revenue growth, with annual net income dropping to MX$28.31 billion from MX$76.11 billion the previous year. The stock trades at 46.6% below its estimated fair value and is undervalued by over 20% based on discounted cash flow analysis. Although it has a high debt level and unstable dividends, forecasted earnings growth of 25.5% annually outpaces the Mexican market average of 11.2%.

- Our comprehensive growth report raises the possibility that América Móvil. de is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of América Móvil. de.

Wistron (TWSE:3231)

Overview: Wistron Corporation, along with its subsidiaries, designs, manufactures, and sells information technology products in Taiwan, Asia, and internationally with a market cap of NT$322.03 billion.

Operations: The company's revenue primarily comes from its Research and Development and Manufacturing Services Operations, totaling NT$944.49 billion.

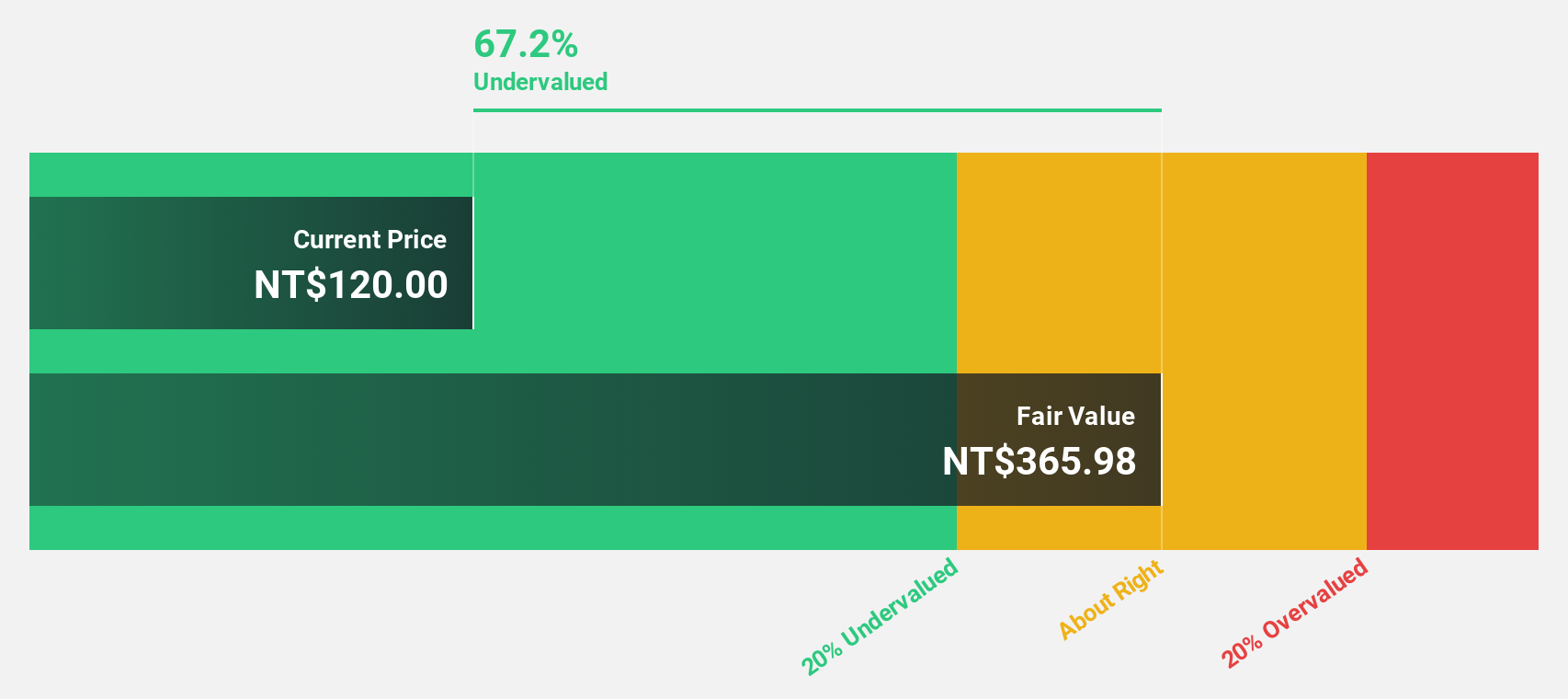

Estimated Discount To Fair Value: 41.4%

Wistron is trading at NT$111.5, significantly below its estimated fair value of NT$190.14, indicating it may be undervalued based on cash flows. The company's earnings are expected to grow significantly over the next three years, outpacing the Taiwan market's average growth rate. Despite a forecasted low return on equity and modest dividend yield of 2.33%, Wistron's revenue growth is projected to exceed 20% annually, suggesting strong future cash flow potential.

- Our growth report here indicates Wistron may be poised for an improving outlook.

- Take a closer look at Wistron's balance sheet health here in our report.

Hensoldt (XTRA:HAG)

Overview: HENSOLDT AG, along with its subsidiaries, offers defense and security electronic sensor solutions globally and has a market cap of €4.71 billion.

Operations: The company generates revenue through its Sensors segment, contributing €1.80 billion, and its Optronics segment, adding €303 million.

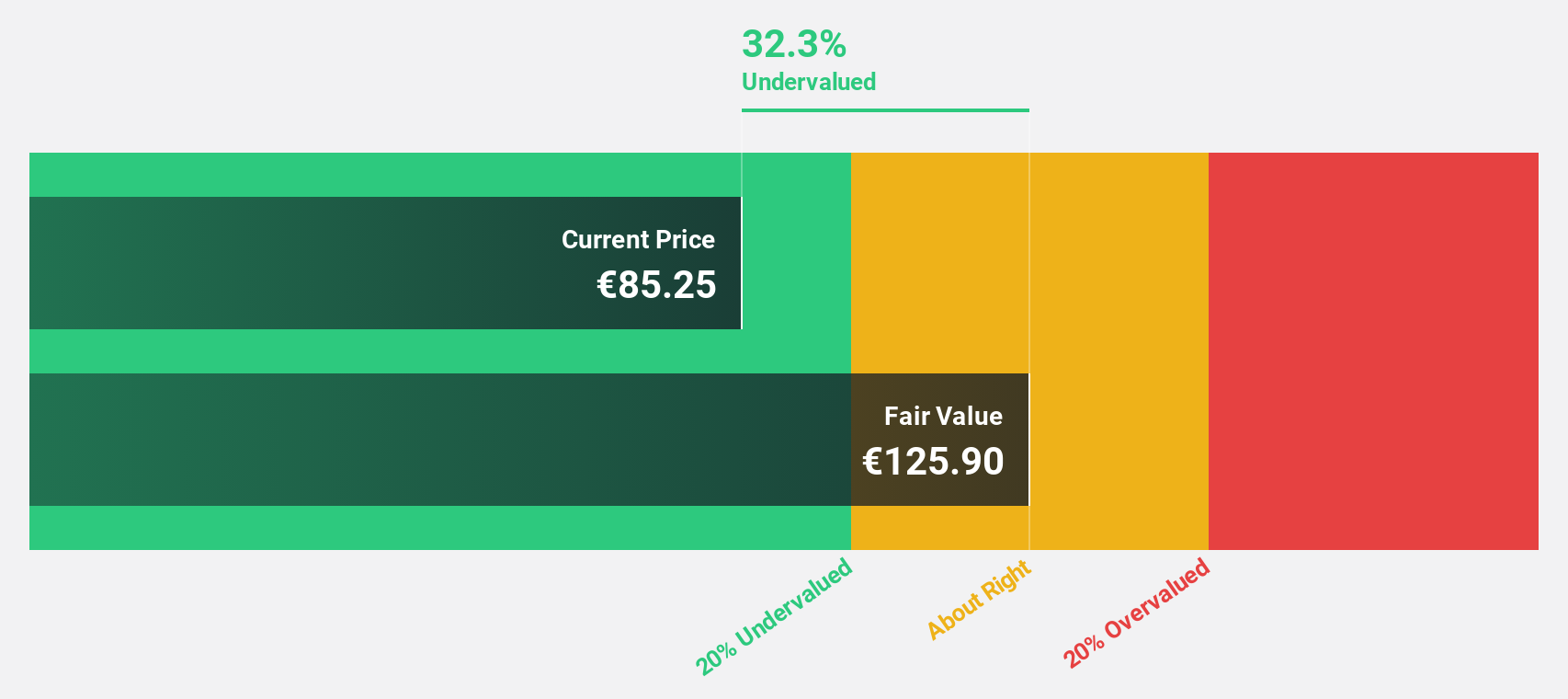

Estimated Discount To Fair Value: 50%

Hensoldt, trading at €40.78, is valued significantly below its estimated fair value of €81.5, highlighting potential undervaluation based on cash flows. Despite a decline in profit margins from last year and interest payments not being well covered by earnings, the company's earnings are forecasted to grow substantially faster than the German market over the next three years. Hensoldt's strategic focus on M&A aims to boost revenues by €600 million by 2030 through digitalization and international expansion initiatives.

- According our earnings growth report, there's an indication that Hensoldt might be ready to expand.

- Unlock comprehensive insights into our analysis of Hensoldt stock in this financial health report.

Next Steps

- Navigate through the entire inventory of 922 Undervalued Stocks Based On Cash Flows here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hensoldt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HAG

Hensoldt

HENSOLDT AG, together with its subsidiaries, provides defense and security electronic sensor solutions worldwide.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives