Amidst a backdrop of tariff uncertainties and mixed economic signals, global markets have shown resilience, with some indices managing to recover from early losses driven by geopolitical tensions. As investors navigate these challenging conditions, companies with strong insider ownership can offer a unique perspective on growth potential, reflecting confidence in their business models and long-term strategies.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 111.4% |

Let's uncover some gems from our specialized screener.

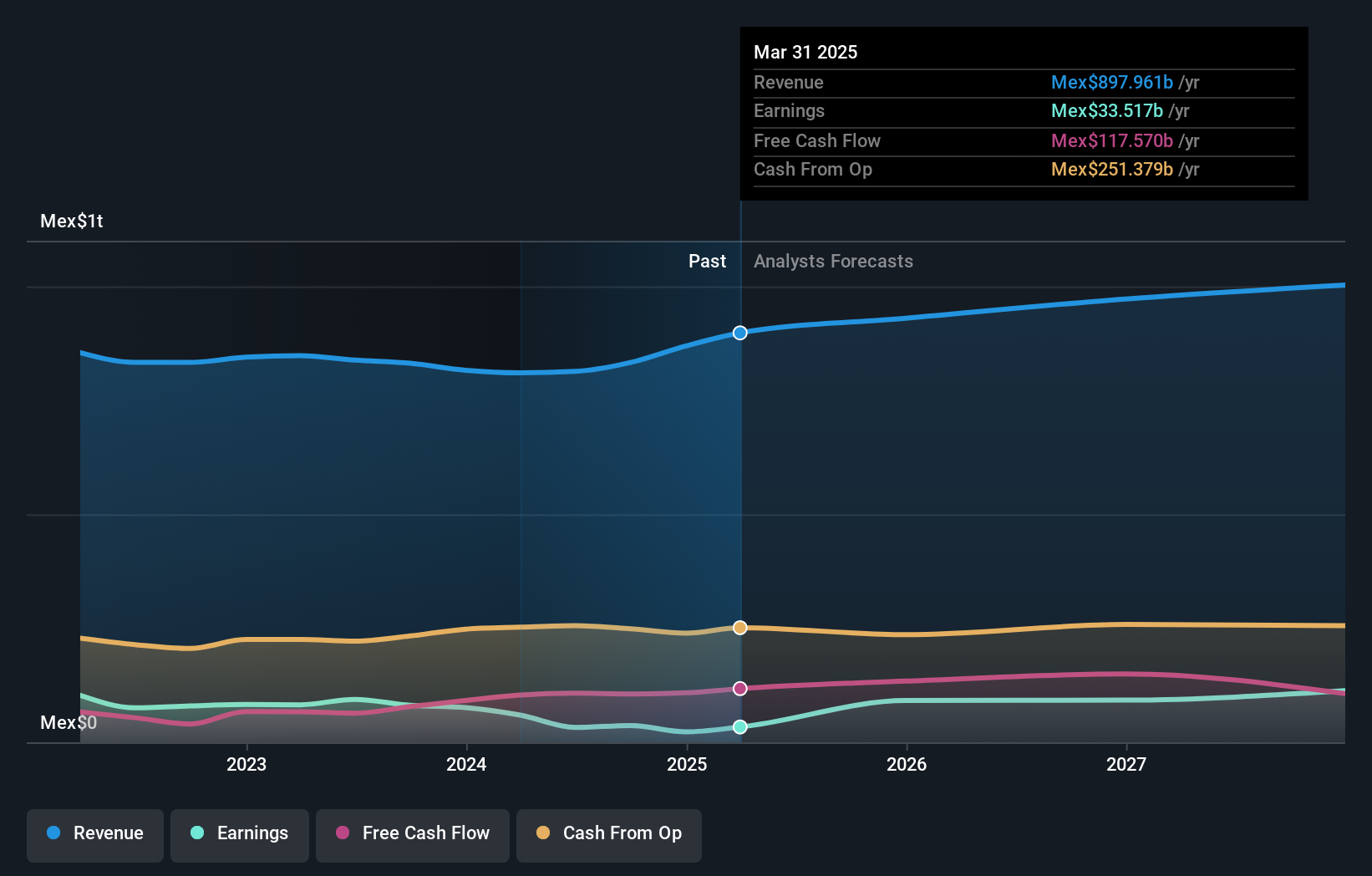

América Móvil. de (BMV:AMX B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: América Móvil, S.A.B. de C.V. is a telecommunications company offering services across Latin America and internationally, with a market cap of MX$923.96 billion.

Operations: The company generates revenue primarily from Cellular Services, amounting to MX$832.99 billion.

Insider Ownership: 22.6%

América Móvil's insider ownership aligns with its growth potential, despite revenue growth forecasts of 5.3% per year lagging behind the market. Earnings are expected to grow significantly at 30.67% annually, outpacing the market average of 11.9%. However, high debt levels and declining profit margins from 9.8% to 4.4% pose challenges. Analysts suggest a potential stock price increase of 22.8%, while recent earnings discussions highlight ongoing strategic focus amidst financial pressures.

- Navigate through the intricacies of América Móvil. de with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that América Móvil. de's share price might be on the expensive side.

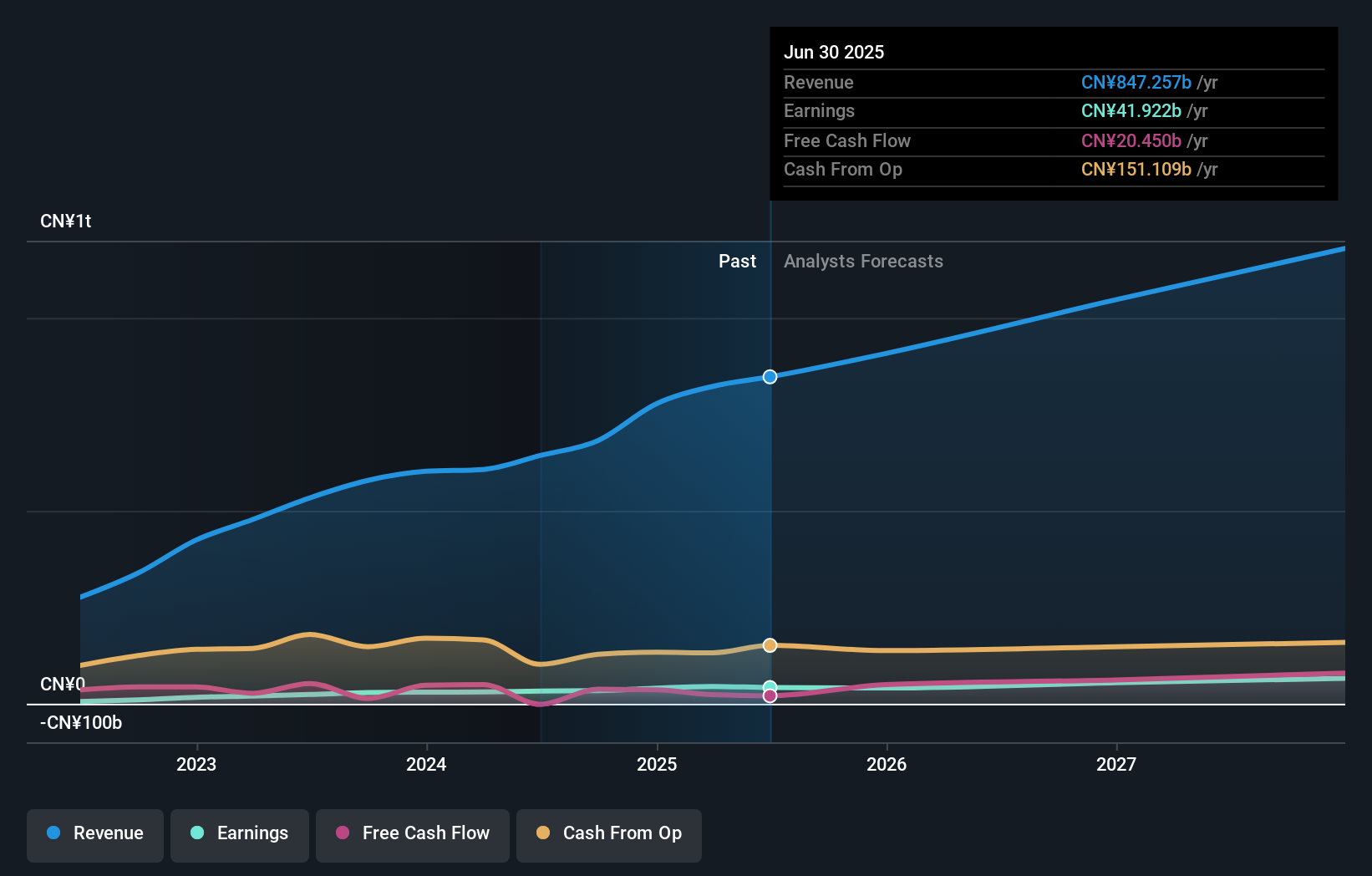

BYD (SEHK:1211)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited, along with its subsidiaries, operates in the automobiles and batteries sectors across China, Hong Kong, Macau, Taiwan, and internationally with a market cap of HK$1.05 trillion.

Operations: BYD generates revenue primarily from its automobiles and batteries businesses, serving markets in China, Hong Kong, Macau, Taiwan, and internationally.

Insider Ownership: 30.1%

BYD's insider ownership supports its growth trajectory, with earnings forecasted to grow at 16.9% annually, surpassing the Hong Kong market average. Recent expansions in the UK and a strategic partnership with Energy Toolbase highlight BYD's focus on innovation and sustainable mobility. January sales rose significantly from last year, reflecting strong operational performance. However, revenue growth expectations of 14.1% per year are modest compared to more aggressive targets seen in some high-growth sectors.

- Delve into the full analysis future growth report here for a deeper understanding of BYD.

- Our valuation report unveils the possibility BYD's shares may be trading at a premium.

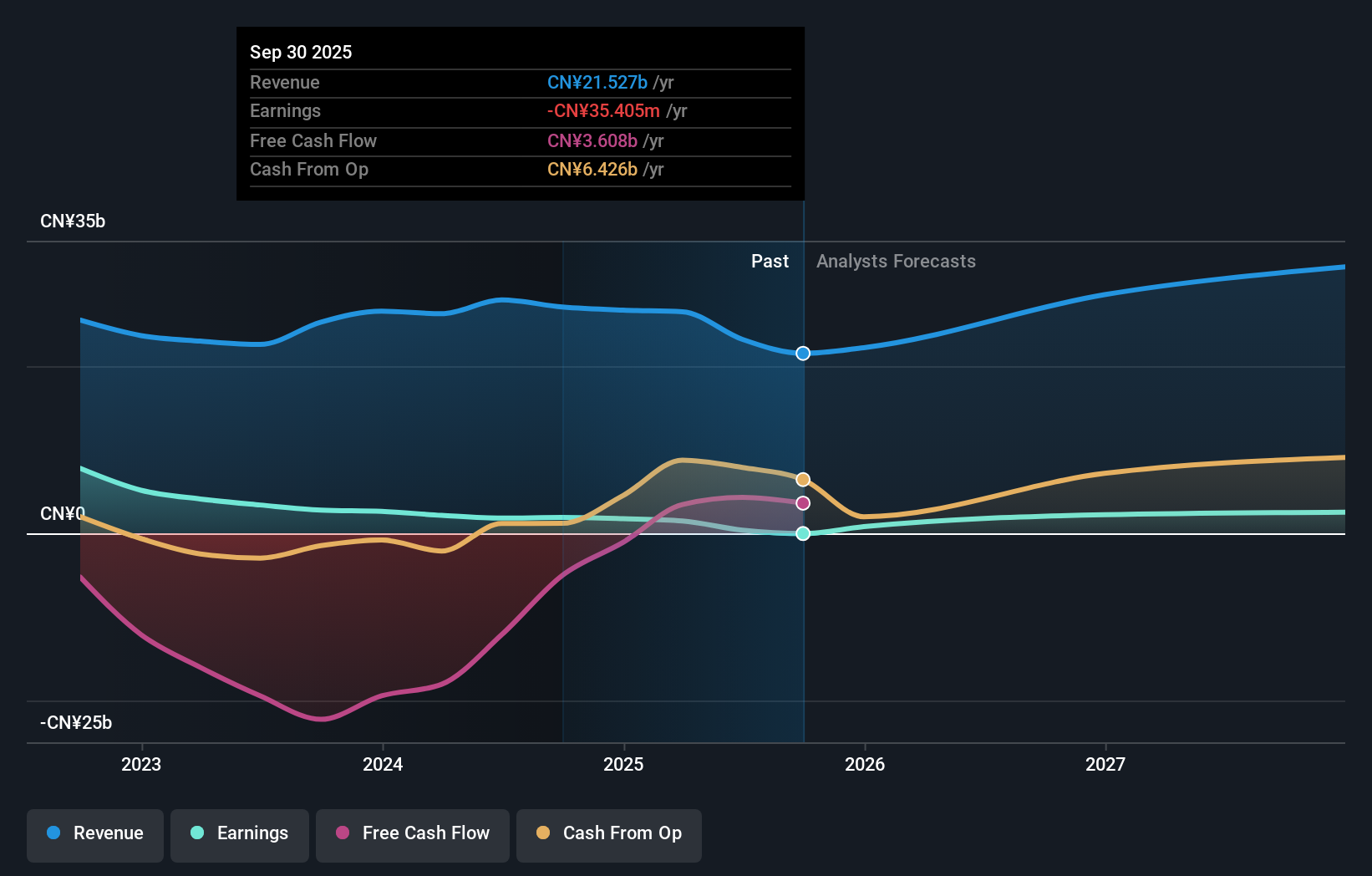

Hoshine Silicon Industry (SHSE:603260)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hoshine Silicon Industry Co., Ltd. is involved in the production and sale of silicon-based materials both in China and internationally, with a market cap of CN¥66.72 billion.

Operations: Hoshine Silicon Industry Co., Ltd. generates its revenue through the production and sale of silicon-based materials, serving both domestic and international markets.

Insider Ownership: 32.6%

Hoshine Silicon Industry's growth outlook is bolstered by high insider ownership, with earnings forecasted to grow significantly at 32.8% annually, outpacing the CN market average. Despite a lower profit margin this year, its revenue growth of 16.9% per year remains above the market rate. The company recently completed a share buyback program worth CNY 500.09 million and was added to key indices like SSE 180, enhancing its market visibility and investor appeal.

- Unlock comprehensive insights into our analysis of Hoshine Silicon Industry stock in this growth report.

- In light of our recent valuation report, it seems possible that Hoshine Silicon Industry is trading beyond its estimated value.

Turning Ideas Into Actions

- Embark on your investment journey to our 1453 Fast Growing Companies With High Insider Ownership selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if BYD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1211

BYD

Engages in automobiles and batteries business in the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives