Genomma Lab Internacional. de (BMV:LABB) Has A Pretty Healthy Balance Sheet

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Genomma Lab Internacional, S.A.B. de C.V. (BMV:LABB) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Genomma Lab Internacional. de

What Is Genomma Lab Internacional. de's Debt?

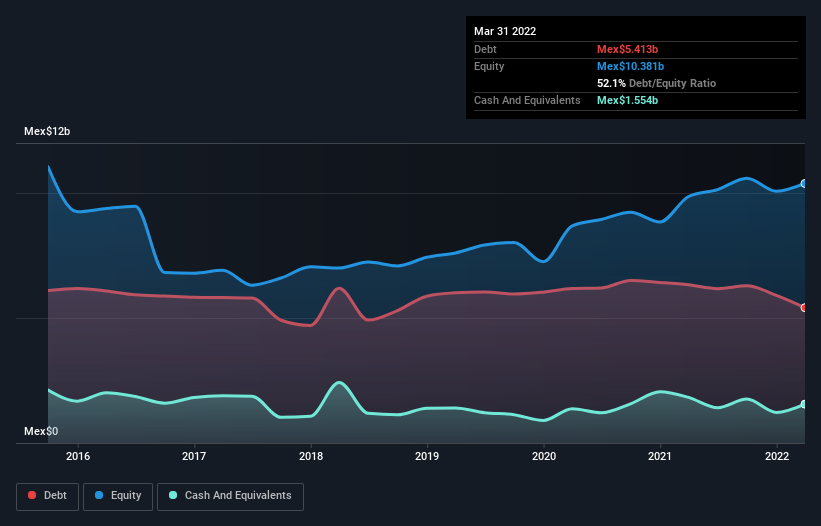

The image below, which you can click on for greater detail, shows that Genomma Lab Internacional. de had debt of Mex$5.41b at the end of March 2022, a reduction from Mex$6.33b over a year. However, it does have Mex$1.55b in cash offsetting this, leading to net debt of about Mex$3.86b.

How Strong Is Genomma Lab Internacional. de's Balance Sheet?

We can see from the most recent balance sheet that Genomma Lab Internacional. de had liabilities of Mex$6.97b falling due within a year, and liabilities of Mex$4.81b due beyond that. Offsetting this, it had Mex$1.55b in cash and Mex$7.45b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by Mex$2.78b.

Given Genomma Lab Internacional. de has a market capitalization of Mex$19.6b, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Genomma Lab Internacional. de has net debt of just 1.2 times EBITDA, indicating that it is certainly not a reckless borrower. And it boasts interest cover of 8.0 times, which is more than adequate. And we also note warmly that Genomma Lab Internacional. de grew its EBIT by 12% last year, making its debt load easier to handle. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Genomma Lab Internacional. de's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. In the last three years, Genomma Lab Internacional. de's free cash flow amounted to 34% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

On this analysis, Genomma Lab Internacional. de's interest cover was a real positive, just like an unsolicited gift of cupcakes from a work colleague. But we're not so comfortable with its conversion of EBIT to free cash flow. Looking at all the aforementioned factors together, it strikes us that Genomma Lab Internacional. de can handle its debt fairly comfortably. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Genomma Lab Internacional. de's earnings per share history for free.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:LAB B

Genomma Lab Internacional. de

Provides pharmaceutical and personal care products primarily in Mexico and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026