Even after rising 8.7% this past week, Grupo Televisa (BMV:TLEVISACPO) shareholders are still down 82% over the past three years

As every investor would know, not every swing hits the sweet spot. But you want to avoid the really big losses like the plague. So take a moment to sympathize with the long term shareholders of Grupo Televisa, S.A.B. (BMV:TLEVISACPO), who have seen the share price tank a massive 84% over a three year period. That would be a disturbing experience. And the ride hasn't got any smoother in recent times over the last year, with the price 30% lower in that time. Unfortunately the share price momentum is still quite negative, with prices down 8.8% in thirty days. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

The recent uptick of 8.7% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Grupo Televisa isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last three years Grupo Televisa saw its revenue shrink by 3.4% per year. That is not a good result. Having said that the 23% annualized share price decline highlights the risk of investing in unprofitable companies. This business clearly needs to grow revenues if it is to perform as investors hope. Don't let a share price decline ruin your calm. You make better decisions when you're calm.

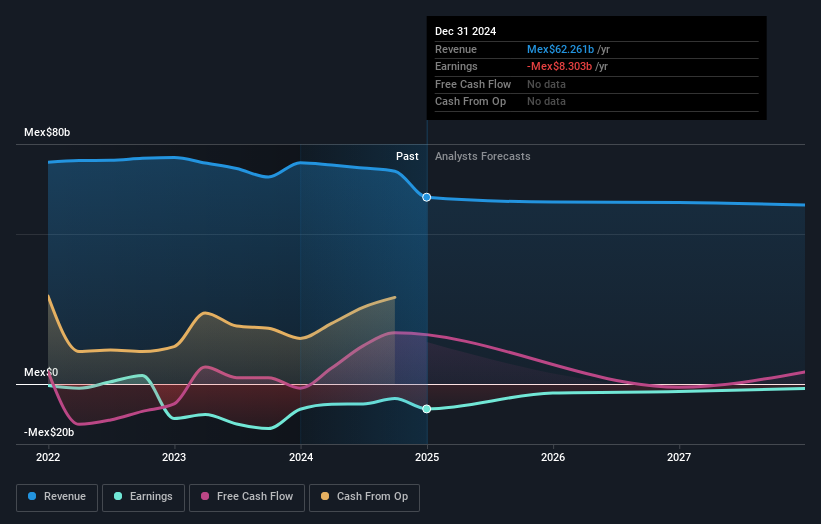

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Grupo Televisa is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think Grupo Televisa will earn in the future (free analyst consensus estimates)

A Different Perspective

While the broader market lost about 6.9% in the twelve months, Grupo Televisa shareholders did even worse, losing 28% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Grupo Televisa has 3 warning signs we think you should be aware of.

But note: Grupo Televisa may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Mexican exchanges.

If you're looking to trade Grupo Televisa, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:TLEVISA CPO

Grupo Televisa

Owns and operates cable companies and provides direct-to-home satellite pay television system in Mexico and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives