- Mexico

- /

- Paper and Forestry Products

- /

- BMV:TEAK CPO

Is Proteak Uno. de (BMV:TEAKCPO) Using Too Much Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Proteak Uno, S.A.B. de C.V. (BMV:TEAKCPO) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Proteak Uno. de

What Is Proteak Uno. de's Net Debt?

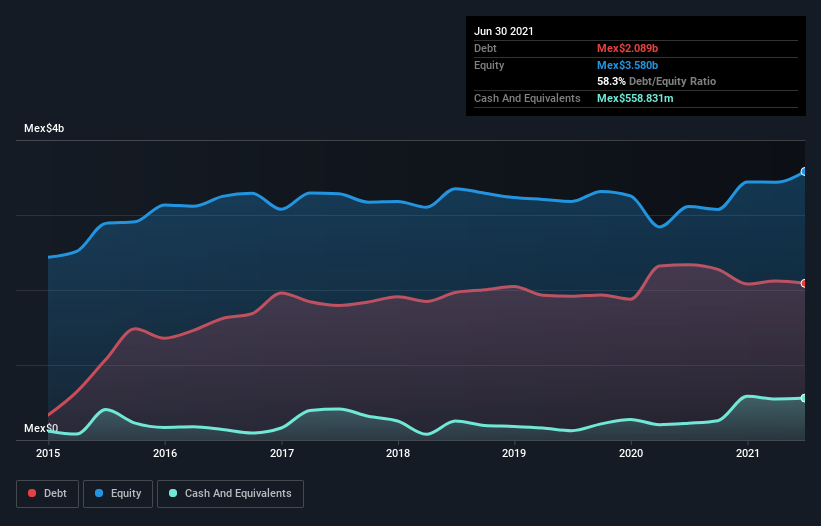

The image below, which you can click on for greater detail, shows that Proteak Uno. de had debt of Mex$2.09b at the end of June 2021, a reduction from Mex$2.34b over a year. On the flip side, it has Mex$558.8m in cash leading to net debt of about Mex$1.53b.

How Strong Is Proteak Uno. de's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Proteak Uno. de had liabilities of Mex$835.0m due within 12 months and liabilities of Mex$2.18b due beyond that. On the other hand, it had cash of Mex$558.8m and Mex$312.3m worth of receivables due within a year. So it has liabilities totalling Mex$2.15b more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of Mex$2.22b. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Proteak Uno. de's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Proteak Uno. de wasn't profitable at an EBIT level, but managed to grow its revenue by 30%, to Mex$1.6b. With any luck the company will be able to grow its way to profitability.

Caveat Emptor

While we can certainly appreciate Proteak Uno. de's revenue growth, its earnings before interest and tax (EBIT) loss is not ideal. To be specific the EBIT loss came in at Mex$66m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. Surprisingly, we note that it actually reported positive free cash flow of Mex$90m and a profit of Mex$348m. So one might argue that there's still a chance it can get things on the right track. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 3 warning signs for Proteak Uno. de (1 is a bit unpleasant!) that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BMV:TEAK CPO

Proteak Uno. de

Engages in sowing, harvesting, transformation, industrialization, and commercialization of commercial forest plantations in Mexico.

Mediocre balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026