- Mexico

- /

- Metals and Mining

- /

- BMV:MFRISCO A-1

While shareholders of Minera Frisco. de (BMV:MFRISCOA-1) are in the black over 1 year, those who bought a week ago aren't so fortunate

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Minera Frisco, S.A.B. de C.V. (BMV:MFRISCOA-1) share price is 59% higher than it was a year ago, much better than the market return of around 2.6% (not including dividends) in the same period. That's a solid performance by our standards! Zooming out, the stock is actually down 3.0% in the last three years.

In light of the stock dropping 8.5% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive one-year return.

View our latest analysis for Minera Frisco. de

Given that Minera Frisco. de didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Minera Frisco. de saw its revenue grow by 2.2%. That's not great considering the company is losing money. In keeping with the revenue growth, the share price gained 59% in that time. While not a huge gain tht seems pretty reasonable. It could be worth keeping an eye on this one, especially if growth accelerates.

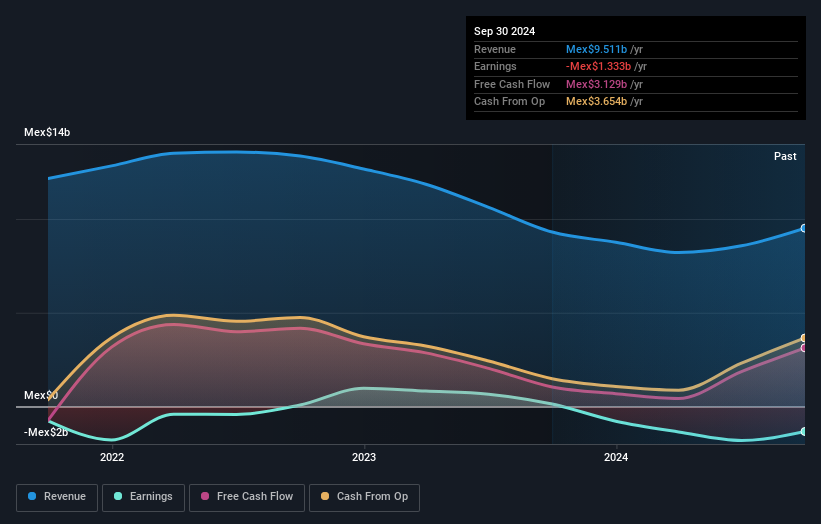

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Minera Frisco. de's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Minera Frisco. de shareholders have received a total shareholder return of 59% over the last year. Notably the five-year annualised TSR loss of 1.4% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Minera Frisco. de better, we need to consider many other factors. Take risks, for example - Minera Frisco. de has 1 warning sign we think you should be aware of.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Mexican exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:MFRISCO A-1

Minera Frisco. de

Engages in the exploration and exploitation of mining lots for the production and sale of gold and silver doré in Mexico.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives