- Mexico

- /

- Metals and Mining

- /

- BMV:GMEXICO B

Grupo México, S.A.B. de C.V. (BMV:GMEXICOB) Stock Rockets 25% As Investors Are Less Pessimistic Than Expected

The Grupo México, S.A.B. de C.V. (BMV:GMEXICOB) share price has done very well over the last month, posting an excellent gain of 25%. Looking further back, the 15% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

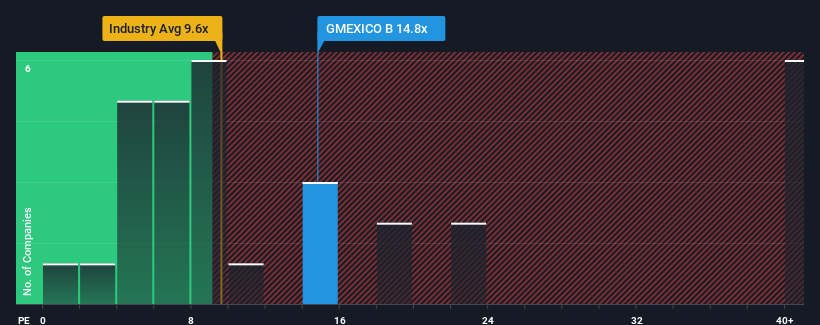

Although its price has surged higher, you could still be forgiven for feeling indifferent about Grupo México. de's P/E ratio of 14.8x, since the median price-to-earnings (or "P/E") ratio in Mexico is also close to 14x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Grupo México. de could be doing better as it's been growing earnings less than most other companies lately. It might be that many expect the uninspiring earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Grupo México. de

How Is Grupo México. de's Growth Trending?

In order to justify its P/E ratio, Grupo México. de would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a worthy increase of 8.8%. The latest three year period has also seen an excellent 49% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 2.3% per annum as estimated by the twelve analysts watching the company. With the market predicted to deliver 9.5% growth per year, the company is positioned for a weaker earnings result.

In light of this, it's curious that Grupo México. de's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Key Takeaway

Grupo México. de appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Grupo México. de currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Having said that, be aware Grupo México. de is showing 2 warning signs in our investment analysis, you should know about.

You might be able to find a better investment than Grupo México. de. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:GMEXICO B

Grupo México. de

Engages in copper production, cargo transportation, and infrastructure businesses worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives