- Japan

- /

- Electronic Equipment and Components

- /

- TSE:8137

3 Dividend Stocks Offering Up To 5.4% Yield For Your Portfolio

Reviewed by Simply Wall St

As global markets continue to reach record highs, buoyed by positive sentiment despite geopolitical tensions and tariff concerns, investors are increasingly looking for stable income sources amidst the volatility. In such an environment, dividend stocks can offer a reliable stream of income and potential for growth, making them attractive options for those seeking to enhance their portfolios with steady yields.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.56% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.23% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.70% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.64% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.43% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.34% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.48% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.40% | ★★★★★★ |

Click here to see the full list of 1968 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Grupo México. de (BMV:GMEXICO B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Grupo México, S.A.B. de C.V. is involved in copper production, cargo transportation, and infrastructure businesses globally, with a market cap of MX$765.11 billion.

Operations: Grupo México's revenue segments include $0.24 billion from the Infrastructure Division and $3.24 billion from the Transportation Division.

Dividend Yield: 3.5%

Grupo México's dividend payments have been volatile over the past decade, with a recent cash dividend of MX$1.30 declared for November 2024. Despite this instability, dividends are well covered by earnings and cash flows, with payout ratios of 49.8% and 40.9%, respectively. The company's earnings have shown growth, supporting potential future payouts; however, its current yield of 3.5% is below top-tier levels in the Mexican market.

- Click here and access our complete dividend analysis report to understand the dynamics of Grupo México. de.

- The valuation report we've compiled suggests that Grupo México. de's current price could be quite moderate.

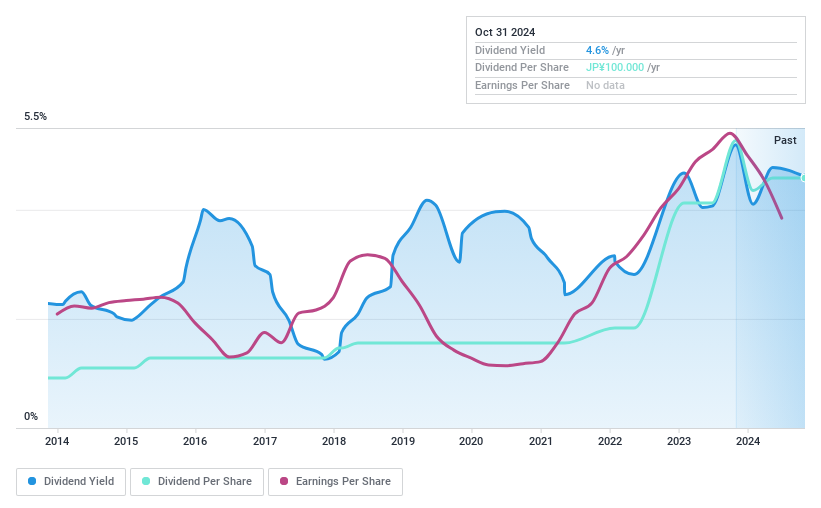

Komori (TSE:6349)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Komori Corporation is involved in the manufacture, sale, and repair of printing presses across Japan, North America, Europe, and Greater China with a market cap of ¥60.06 billion.

Operations: Komori Corporation's revenue segments are comprised of Japan at ¥80.50 billion, Europe at ¥22.47 billion, Greater China at ¥15.72 billion, and North America at ¥10.52 billion.

Dividend Yield: 4.4%

Komori Corporation's dividend yield is among the top 25% in Japan, with a recent increase to JPY 30.00 per share, up from JPY 15.00 last year. Despite past volatility in dividends, current payouts are well-covered by earnings and cash flow, with payout ratios of 41.2% and 55.3%, respectively. The company has raised its earnings guidance for the fiscal year ending March 2025, indicating potential stability in future dividend payments.

- Navigate through the intricacies of Komori with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Komori's current price could be inflated.

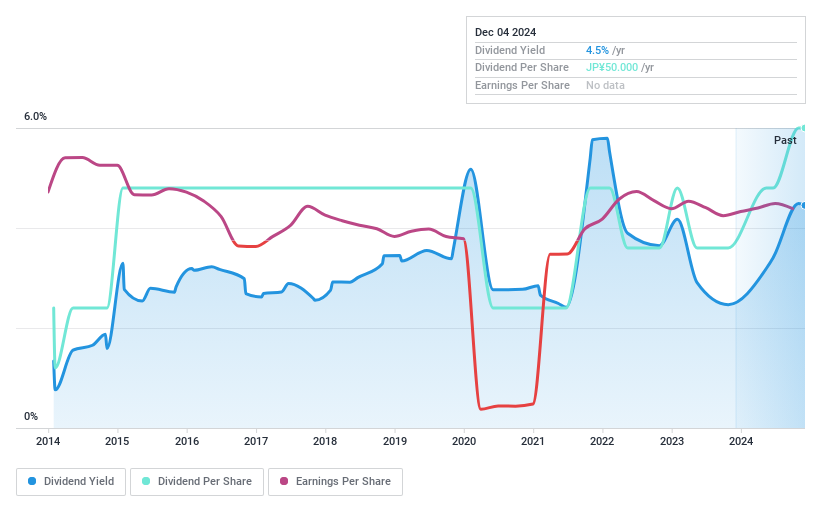

Sun-Wa Technos (TSE:8137)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Sun-Wa Technos Corporation is involved in the distribution of electrical machinery, electronics, and general machinery both in Japan and internationally, with a market cap of ¥33.35 billion.

Operations: Sun-Wa Technos Corporation generates revenue primarily from Japan with ¥104.05 billion, followed by Asia at ¥50.31 billion, and Europe & North America contributing ¥6.98 billion.

Dividend Yield: 5.5%

Sun-Wa Technos Corporation has announced a dividend increase to ¥50.00 per share for the second quarter, with expectations of ¥70.00 for the fiscal year ending March 31, 2025. The dividends are well-covered by earnings and cash flows, with payout ratios of 47.2% and 17.2%, respectively, indicating sustainability. Its dividend yield of 5.46% ranks in the top quartile in Japan's market, offering reliable growth over the past decade despite slightly declining profit margins.

- Delve into the full analysis dividend report here for a deeper understanding of Sun-Wa Technos.

- Our comprehensive valuation report raises the possibility that Sun-Wa Technos is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Reveal the 1968 hidden gems among our Top Dividend Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8137

Sun-Wa Technos

Engages in the distribution of electrical machinery, electronics, and general machinery in Japan and internationally.

6 star dividend payer with excellent balance sheet.

Market Insights

Community Narratives