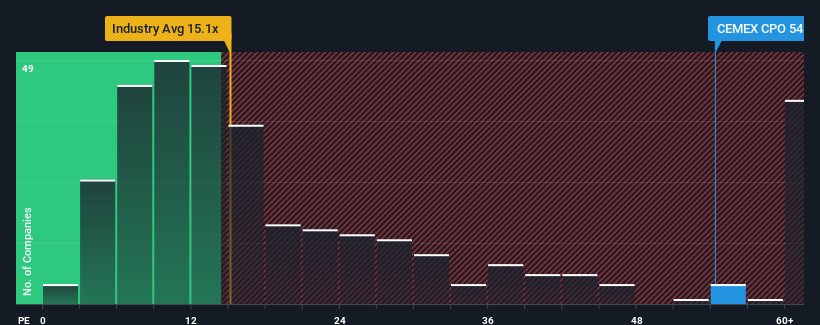

CEMEX, S.A.B. de C.V.'s (BMV:CEMEXCPO) price-to-earnings (or "P/E") ratio of 54.3x might make it look like a strong sell right now compared to the market in Mexico, where around half of the companies have P/E ratios below 14x and even P/E's below 8x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

CEMEX. de hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for CEMEX. de

Does Growth Match The High P/E?

In order to justify its P/E ratio, CEMEX. de would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 64% decrease to the company's bottom line. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings should grow by 94% each year over the next three years. That's shaping up to be materially higher than the 9.7% per year growth forecast for the broader market.

In light of this, it's understandable that CEMEX. de's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On CEMEX. de's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of CEMEX. de's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for CEMEX. de that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:CEMEX CPO

CEMEX. de

Engages in the production, marketing, distribution, and sale of cement, ready-mix concrete, aggregates, urbanization solutions, and other construction materials and services worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives