Fomento Económico Mexicano. de (BMV:FEMSAUBD) Has A Pretty Healthy Balance Sheet

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Fomento Económico Mexicano, S.A.B. de C.V. (BMV:FEMSAUBD) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Fomento Económico Mexicano. de

What Is Fomento Económico Mexicano. de's Net Debt?

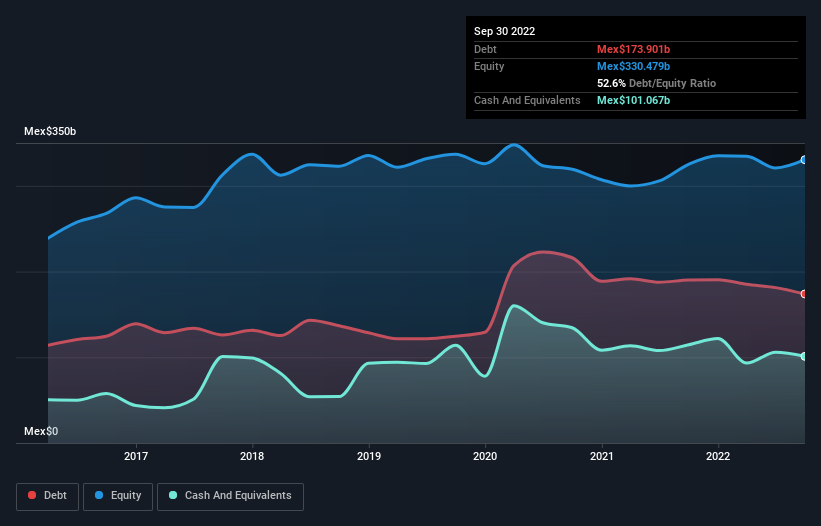

The image below, which you can click on for greater detail, shows that Fomento Económico Mexicano. de had debt of Mex$173.9b at the end of September 2022, a reduction from Mex$190.2b over a year. However, it does have Mex$101.1b in cash offsetting this, leading to net debt of about Mex$72.8b.

How Healthy Is Fomento Económico Mexicano. de's Balance Sheet?

We can see from the most recent balance sheet that Fomento Económico Mexicano. de had liabilities of Mex$167.6b falling due within a year, and liabilities of Mex$244.2b due beyond that. On the other hand, it had cash of Mex$101.1b and Mex$58.1b worth of receivables due within a year. So it has liabilities totalling Mex$252.7b more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since Fomento Económico Mexicano. de has a huge market capitalization of Mex$529.3b, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Looking at its net debt to EBITDA of 1.1 and interest cover of 5.9 times, it seems to us that Fomento Económico Mexicano. de is probably using debt in a pretty reasonable way. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. Unfortunately, Fomento Económico Mexicano. de saw its EBIT slide 7.0% in the last twelve months. If earnings continue on that decline then managing that debt will be difficult like delivering hot soup on a unicycle. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Fomento Económico Mexicano. de's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Fomento Económico Mexicano. de recorded free cash flow worth a fulsome 82% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Our View

When it comes to the balance sheet, the standout positive for Fomento Económico Mexicano. de was the fact that it seems able to convert EBIT to free cash flow confidently. However, our other observations weren't so heartening. For instance it seems like it has to struggle a bit to grow its EBIT. Considering this range of data points, we think Fomento Económico Mexicano. de is in a good position to manage its debt levels. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Fomento Económico Mexicano. de's earnings per share history for free.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:FEMSA UBD

Fomento Económico Mexicano. de

Through its subsidiaries, operates as a bottler of Coca-Cola trademark beverages.

Excellent balance sheet and fair value.