In November 2024, global markets have been buoyed by strong labor market data and broad-based gains in major U.S. stock indexes, with smaller-cap stocks outperforming their larger counterparts. As investors navigate the current landscape marked by geopolitical tensions and economic policy shifts, identifying promising small-cap stocks can be a strategic move to capture potential growth opportunities that may not yet be fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Watt's | 73.27% | 7.85% | -1.33% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.44% | 27.31% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

INVEX Controladora. de (BMV:INVEX A)

Simply Wall St Value Rating: ★★★★☆☆

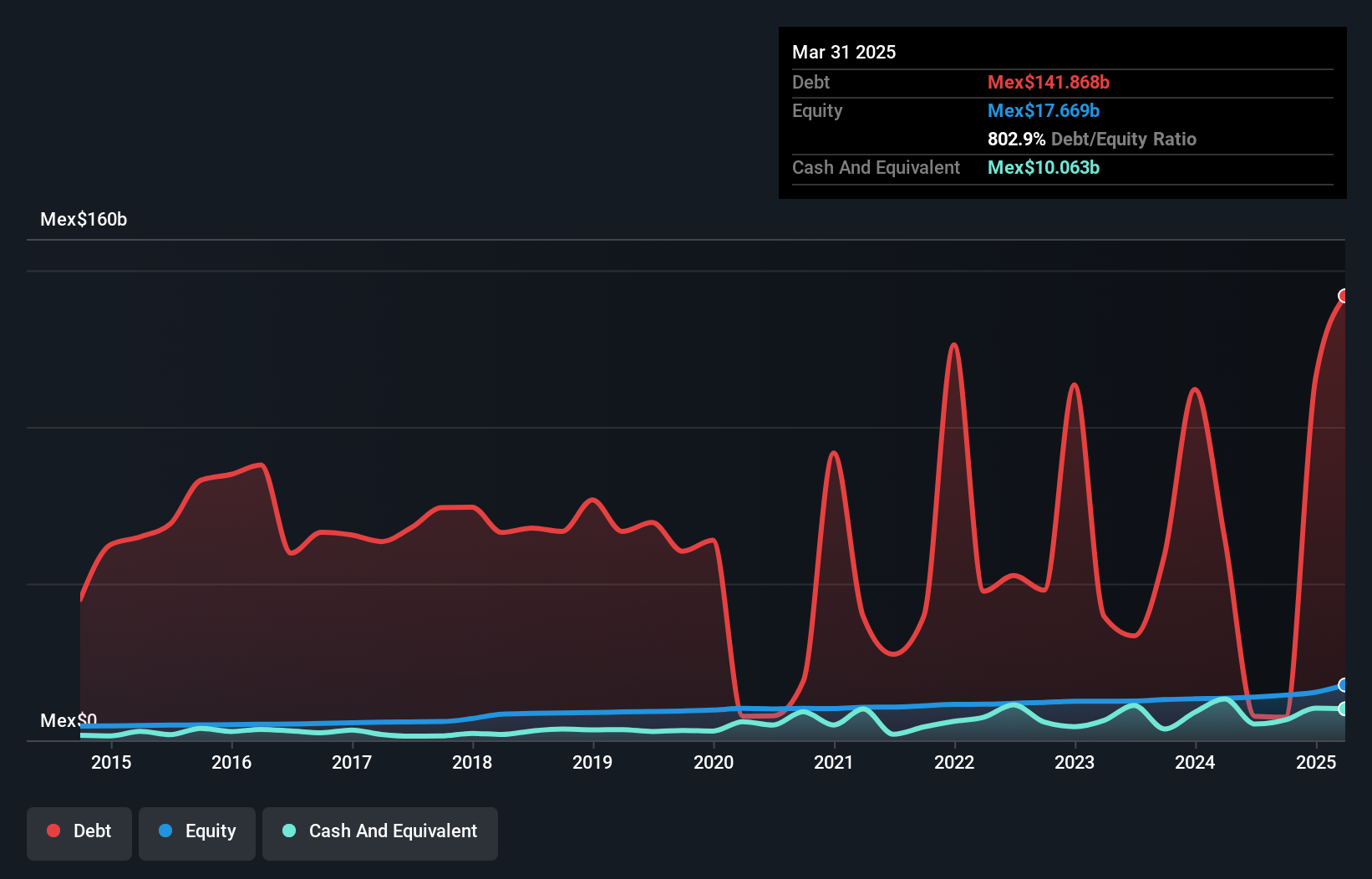

Overview: INVEX Controladora, S.A.B. de C.V. offers a range of financial products and services to both individual and business customers in Mexico and internationally, with a market capitalization of MX$13.05 billion.

Operations: INVEX generates revenue primarily through its financial products and services offered to individual and business clients. The company's net profit margin has shown variability, reflecting changes in operational efficiency and cost management.

INVEX Controladora, a financial player with a knack for growth, showcases a compelling narrative. With earnings up 29% last year and revenue expected to climb 25% annually, it outpaces its industry peers. Its price-to-earnings ratio sits attractively at 8.9x against the MX market's 11.6x, suggesting potential undervaluation. The net debt to equity ratio has impressively shrunk from over 644% to just above 51% in five years, indicating improved financial health. Recent earnings of MXN1.18 billion for nine months ending September highlight robust performance compared to last year's MXN739 million, underscoring its promising trajectory in the diversified financial space.

- Delve into the full analysis health report here for a deeper understanding of INVEX Controladora. de.

Explore historical data to track INVEX Controladora. de's performance over time in our Past section.

Xiamen Hexing Packaging Printing (SZSE:002228)

Simply Wall St Value Rating: ★★★★★★

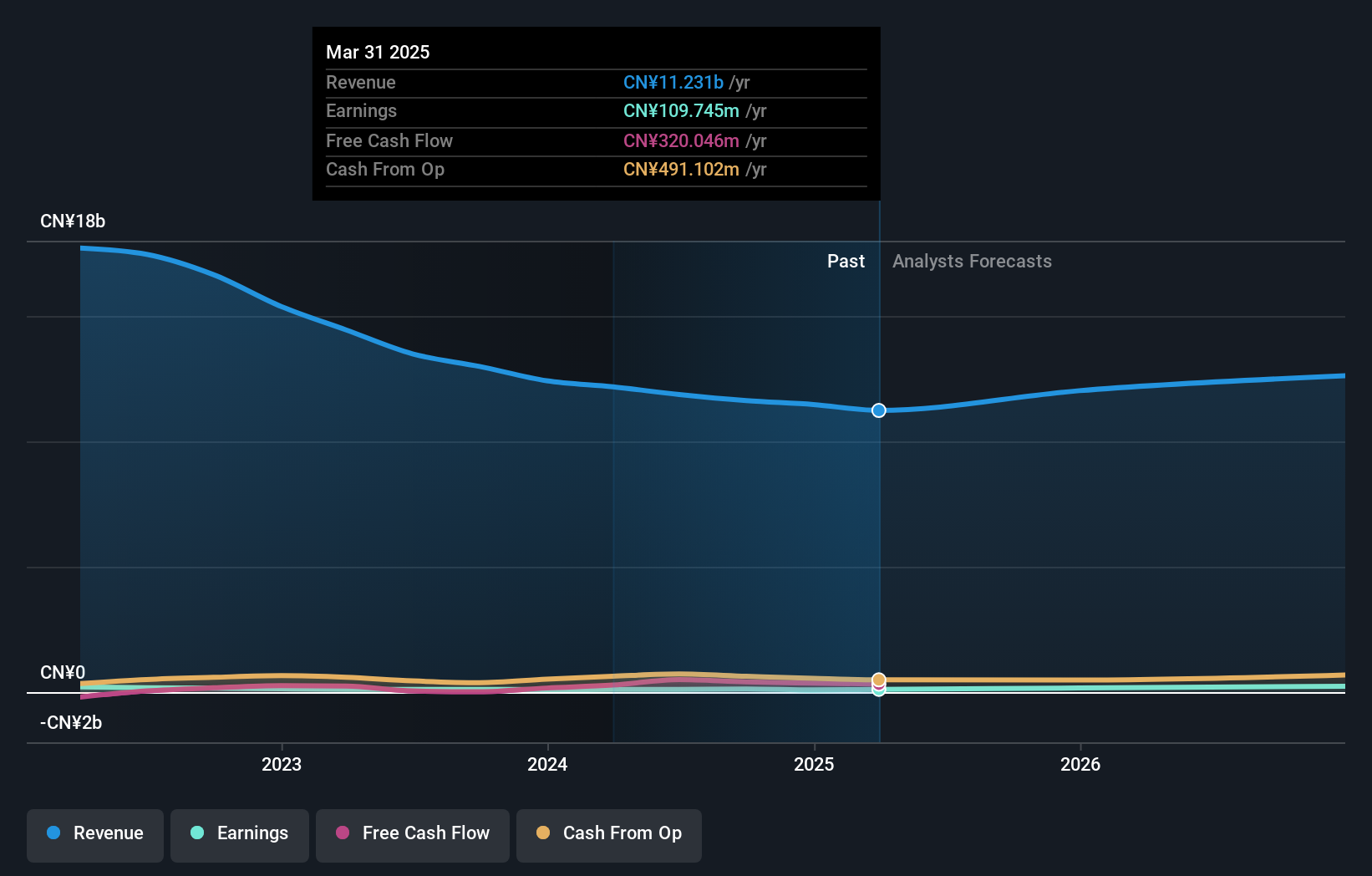

Overview: Xiamen Hexing Packaging Printing Co., Ltd. specializes in the production and distribution of packaging materials, with a market capitalization of CN¥3.56 billion.

Operations: Hexing Packaging generates revenue primarily from its packaging manufacturing segment, amounting to CN¥11.63 billion.

Hexing Packaging Printing, a smaller player in the packaging industry, has shown resilience with earnings growth of 20% over the past year, surpassing the industry's 18.4%. Despite a dip in revenue to CNY 8.59 billion from CNY 9.38 billion year-on-year for nine months ending September 2024, net income rose to CNY 144.42 million from CNY 119.83 million. The company repurchased over ten million shares recently for CNY 24.99 million, reflecting confidence in its valuation at nearly 79% below fair value estimates. With debt-to-equity down to a manageable level of around 42%, Hexing appears well-positioned financially.

OHB (XTRA:OHB)

Simply Wall St Value Rating: ★★★★☆☆

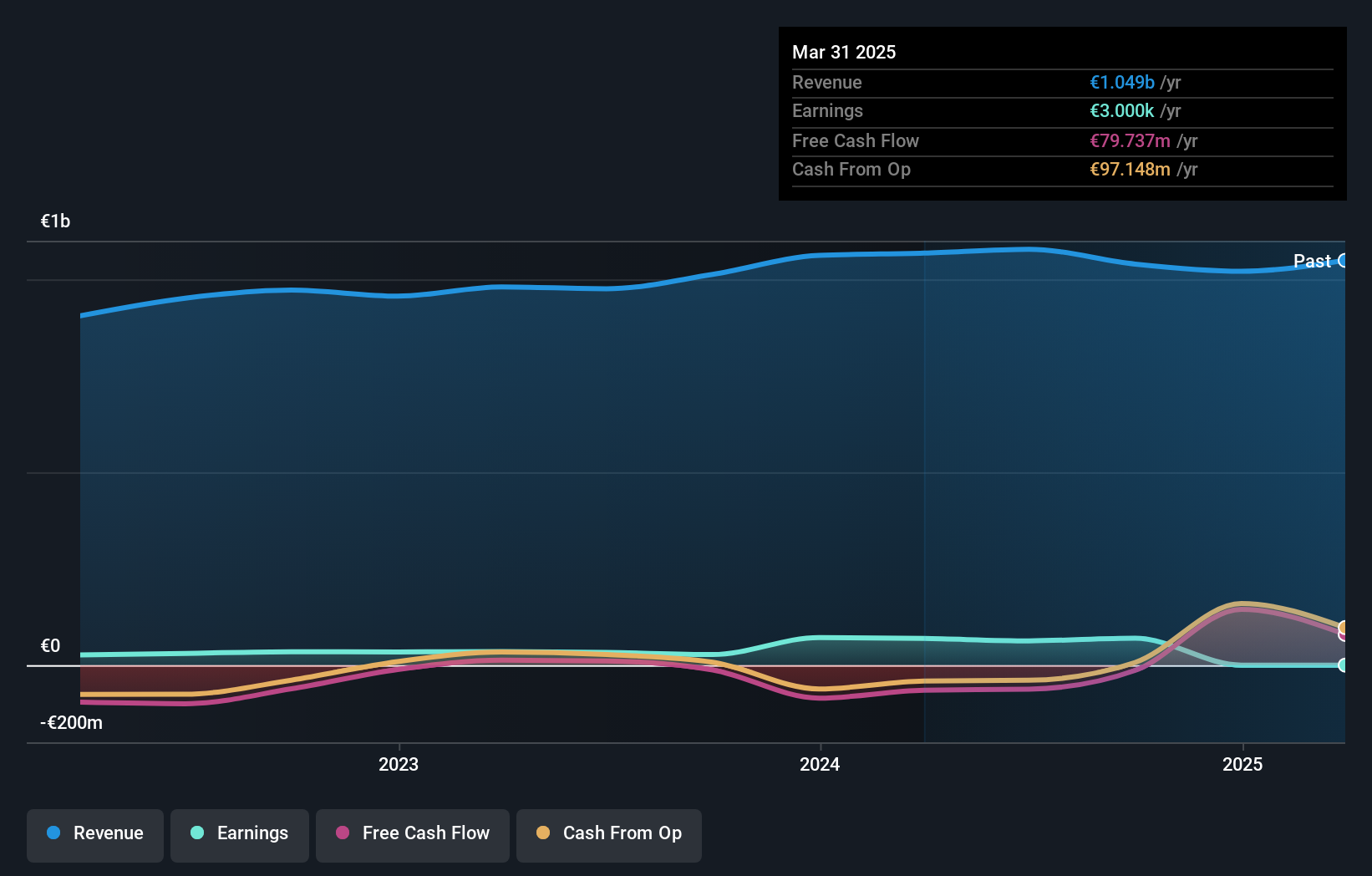

Overview: OHB SE is a space and technology company operating in Germany, the rest of Europe, and internationally, with a market capitalization of approximately €892.50 million.

Operations: OHB SE generates revenue primarily from its Space Systems segment, contributing €818.74 million, and its Aerospace segment, which adds €129.26 million. The Digital segment also contributes €117.41 million to the overall revenue.

OHB, a player in the Aerospace & Defense sector, has made strides with its debt to equity ratio dropping from 102.6% to 57.9% over five years, indicating improved financial leverage. Despite a significant one-off loss of €37.8M affecting recent results, OHB's earnings surged by 155%, outpacing industry growth of 23.8%. However, shareholder dilution and a high net debt to equity ratio at 52.6% present challenges. The company reported Q3 sales of €241M and net income of €12M compared to last year's figures but maintains a favorable price-to-earnings ratio at 12.8x against the German market's average of 15.7x.

Turning Ideas Into Actions

- Click here to access our complete index of 4621 Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002228

Xiamen Hexing Packaging Printing

Xiamen Hexing Packaging Printing Co., Ltd.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives