- Mexico

- /

- Consumer Finance

- /

- BMV:CREAL *

Reflecting on Crédito Real. de Sociedad Financiera de Objeto Múltiple Entidad No Regulada's (BMV:CREAL) Share Price Returns Over The Last Five Years

Generally speaking long term investing is the way to go. But along the way some stocks are going to perform badly. For example the Crédito Real, S.A.B. de C.V., Sociedad Financiera de Objeto Múltiple, Entidad No Regulada (BMV:CREAL) share price dropped 69% over five years. That's not a lot of fun for true believers. We also note that the stock has performed poorly over the last year, with the share price down 48%. It's up 5.1% in the last seven days.

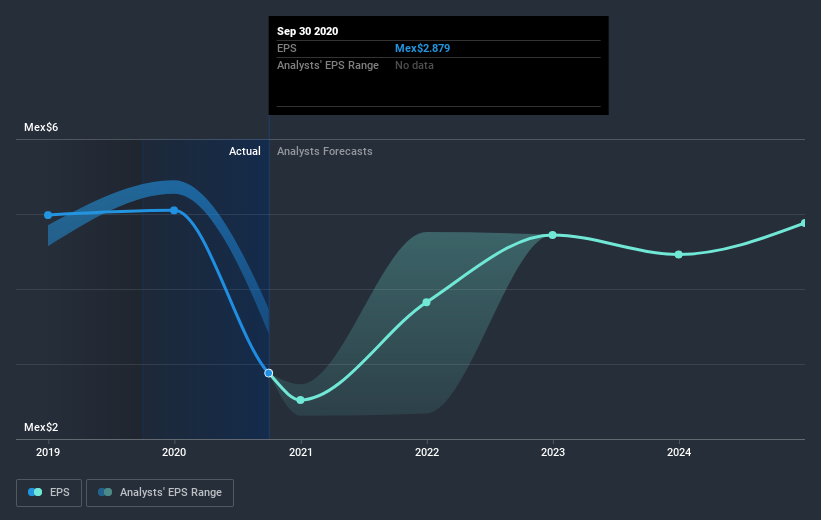

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

A Different Perspective

Investors in Crédito Real. de Sociedad Financiera de Objeto Múltiple Entidad No Regulada had a tough year, with a total loss of 48% (including dividends), against a market gain of about 2.7%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for Crédito Real. de Sociedad Financiera de Objeto Múltiple Entidad No Regulada you should be aware of, and 1 of them is a bit concerning.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MX exchanges.

When trading Crédito Real. de Sociedad Financiera de Objeto Múltiple Entidad No Regulada or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BMV:CREAL *

Crédito Real. de Sociedad Financiera de Objeto Múltiple Entidad No Regulada

Crédito Real, S.A.B. de C.V., Sociedad Financiera de Objeto Múltiple, Entidad No Regulada, a non- banking institution, provides financial solutions and services in Mexico.

Good value with imperfect balance sheet.

Market Insights

Community Narratives