- Switzerland

- /

- Banks

- /

- SWX:SGKN

Top Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and mixed economic signals, investors are closely monitoring indices that have shown resilience amidst fluctuating conditions. With U.S. job growth falling short of estimates and manufacturing showing signs of recovery, dividend stocks continue to attract attention for their potential to provide steady income streams in uncertain times. In such an environment, a good dividend stock is often characterized by its ability to maintain consistent payouts and demonstrate financial stability despite broader market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.08% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.55% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.79% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.99% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.39% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.11% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.25% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.85% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.45% | ★★★★★☆ |

Click here to see the full list of 1959 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

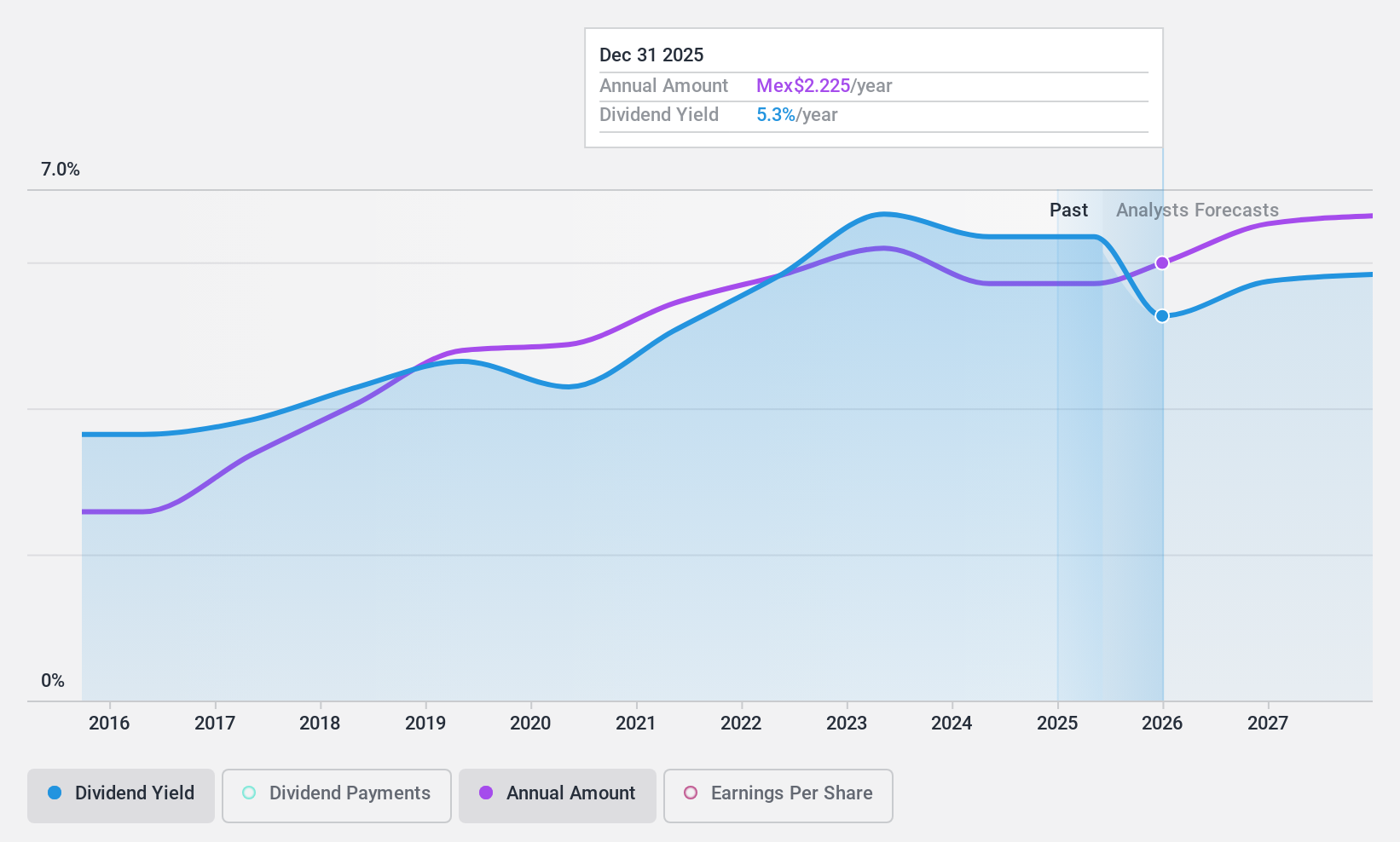

Bolsa Mexicana de Valores. de (BMV:BOLSA A)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Bolsa Mexicana de Valores, S.A.B. de C.V. (BMV:BOLSA A) operates as the primary stock exchange in Mexico, with a market cap of MX$18.14 billion.

Operations: Bolsa Mexicana de Valores, S.A.B. de C.V. generates revenue through various segments including trading services, listing fees, and market data sales in millions of MX$.

Dividend Yield: 6.3%

Bolsa Mexicana de Valores offers a compelling dividend profile with a 6.31% yield, placing it in the top quartile of MX market payers. Its dividends have been stable and growing over the past decade, supported by an 80.4% payout ratio from earnings and a 66.3% cash payout ratio, indicating coverage by both earnings and cash flows. Recent earnings growth of 6.7% further supports its dividend sustainability and attractiveness for income-focused investors.

- Click here and access our complete dividend analysis report to understand the dynamics of Bolsa Mexicana de Valores. de.

- The analysis detailed in our Bolsa Mexicana de Valores. de valuation report hints at an inflated share price compared to its estimated value.

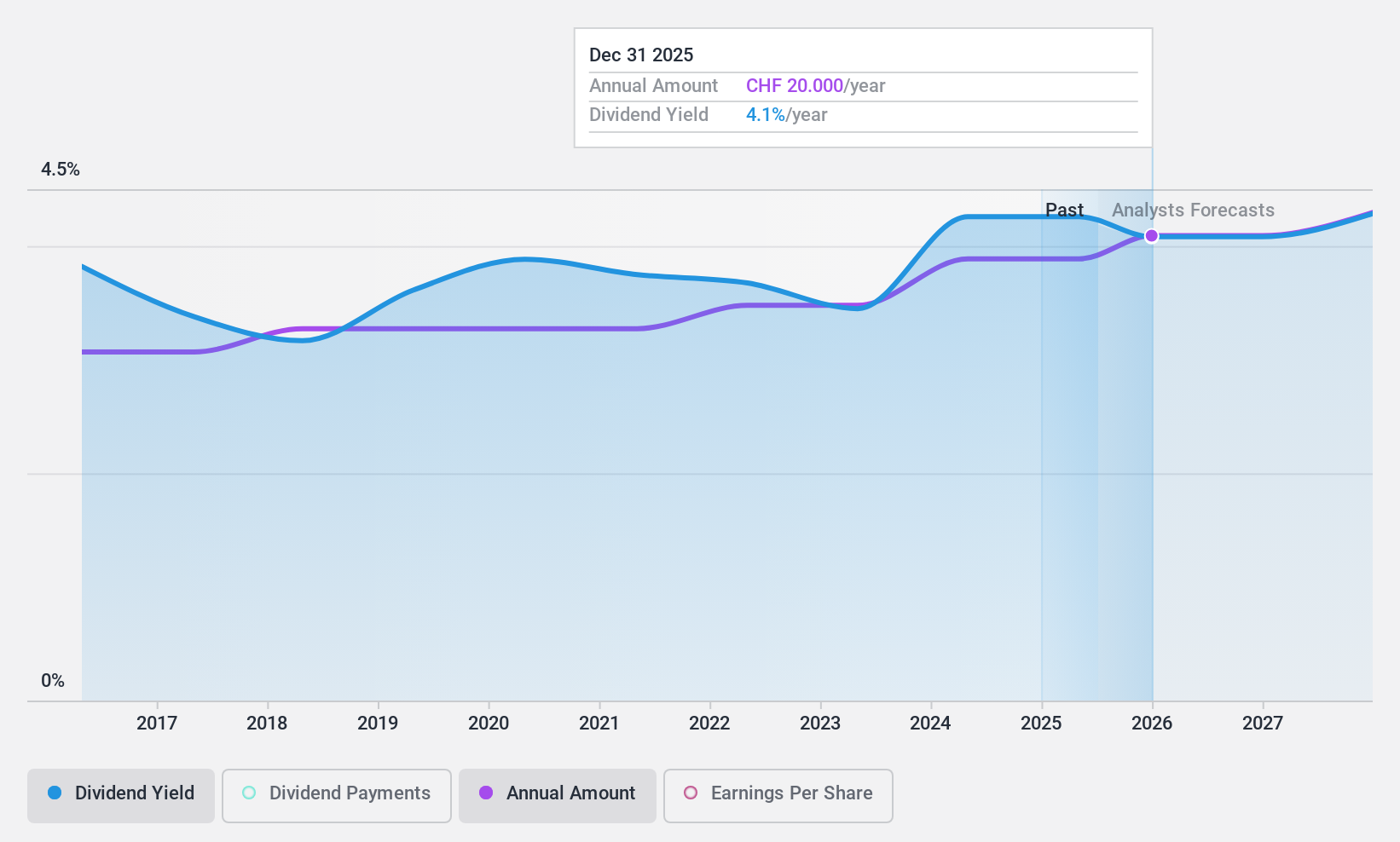

St. Galler Kantonalbank (SWX:SGKN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: St. Galler Kantonalbank AG is a cantonal bank offering banking products and services to local residents and small to medium-sized enterprises in the Cantons of St. Gallen, with a market cap of CHF2.77 billion.

Operations: St. Galler Kantonalbank AG generates its revenue primarily through providing banking products and services to individuals and small to medium-sized businesses in the Cantons of St. Gallen.

Dividend Yield: 4.1%

St. Galler Kantonalbank's dividend is appealing with a 4.1% yield, ranking it in the top 25% of Swiss market payers. The dividend has been stable and growing over the past decade, backed by a sustainable payout ratio of 57.1%, forecasted to remain covered at 52.1% in three years. Despite trading at a discount to its estimated fair value, SGKN maintains low bad loan allowances, underscoring its financial prudence and reliability for dividend investors.

- Dive into the specifics of St. Galler Kantonalbank here with our thorough dividend report.

- Upon reviewing our latest valuation report, St. Galler Kantonalbank's share price might be too pessimistic.

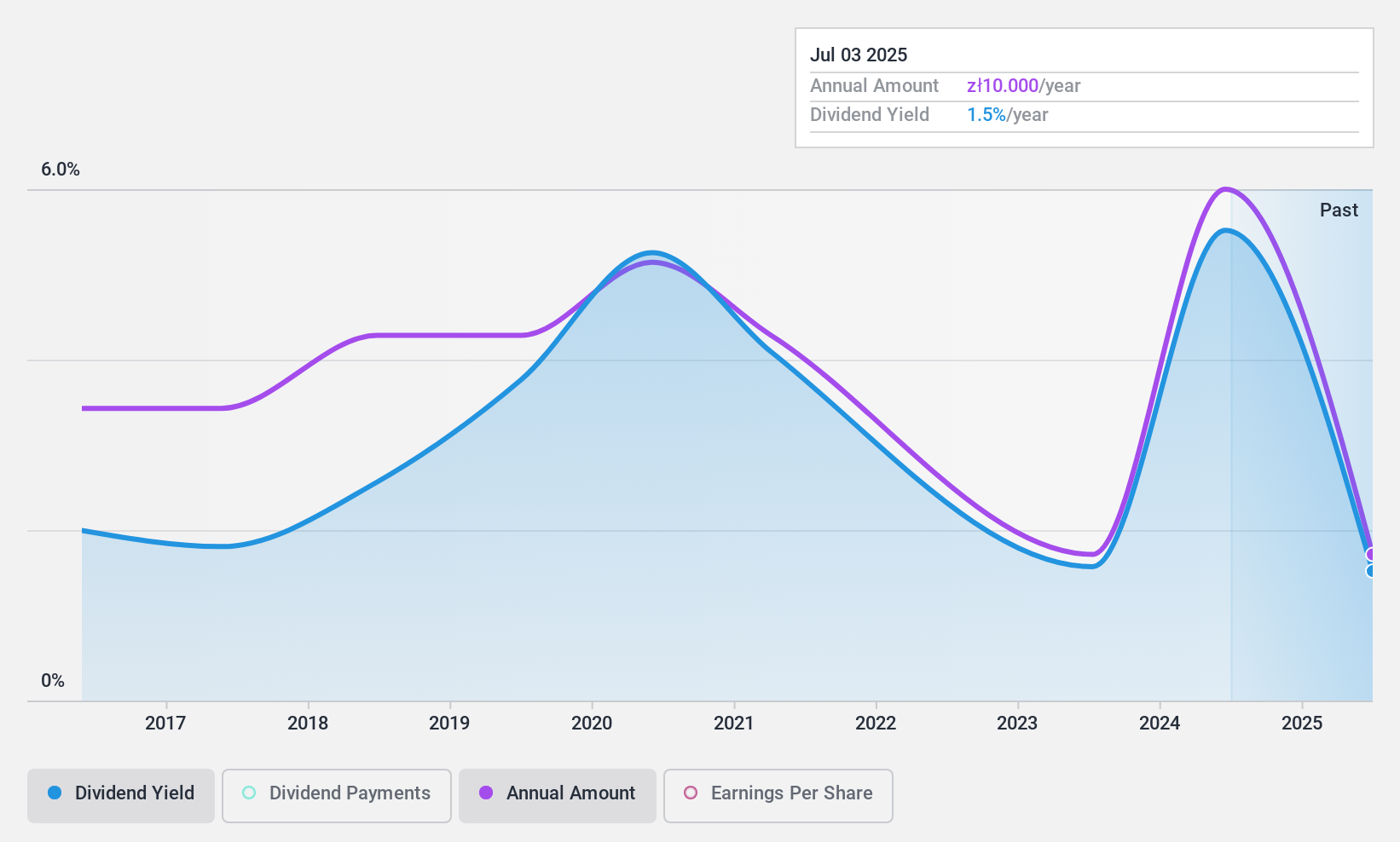

Wawel (WSE:WWL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wawel S.A. is a company that produces and sells cocoa, chocolate, and confectionery products in Poland with a market cap of PLN813.86 million.

Operations: Wawel S.A.'s revenue from the production and sale of confectionery products amounts to PLN672.94 million.

Dividend Yield: 5.6%

Wawel's dividend yield of 5.56% is lower than the top 25% in the Polish market. Despite a reasonable payout ratio of 63.9%, dividends have been unreliable and volatile over the past decade, with significant fluctuations exceeding 20%. Earnings have grown modestly by 4% annually over five years, supporting dividend coverage alongside a cash payout ratio of 58.4%. The stock trades at a substantial discount to its estimated fair value, presenting potential value for investors.

- Delve into the full analysis dividend report here for a deeper understanding of Wawel.

- Our expertly prepared valuation report Wawel implies its share price may be lower than expected.

Taking Advantage

- Click through to start exploring the rest of the 1956 Top Dividend Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SGKN

St. Galler Kantonalbank

A cantonal bank, provides banking products and services to the local population, and small and middle-sized companies in the Cantons of St.

6 star dividend payer with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives