- Mexico

- /

- Hospitality

- /

- BMV:RLH A

What Type Of Shareholders Make Up RLH Properties, S.A.B. de C.V.'s (BMV:RLHA) Share Registry?

The big shareholder groups in RLH Properties, S.A.B. de C.V. (BMV:RLHA) have power over the company. Large companies usually have institutions as shareholders, and we usually see insiders owning shares in smaller companies. Warren Buffett said that he likes "a business with enduring competitive advantages that is run by able and owner-oriented people." So it's nice to see some insider ownership, because it may suggest that management is owner-oriented.

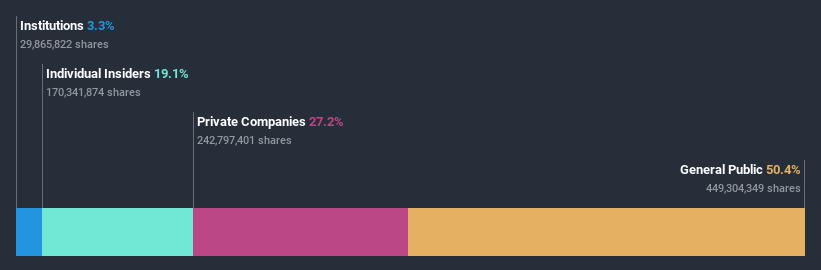

With a market capitalization of Mex$14b, RLH Properties. de is a small cap stock, so it might not be well known by many institutional investors. In the chart below, we can see that institutions are not really that prevalent on the share registry. Let's delve deeper into each type of owner, to discover more about RLH Properties. de.

Check out our latest analysis for RLH Properties. de

What Does The Institutional Ownership Tell Us About RLH Properties. de?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

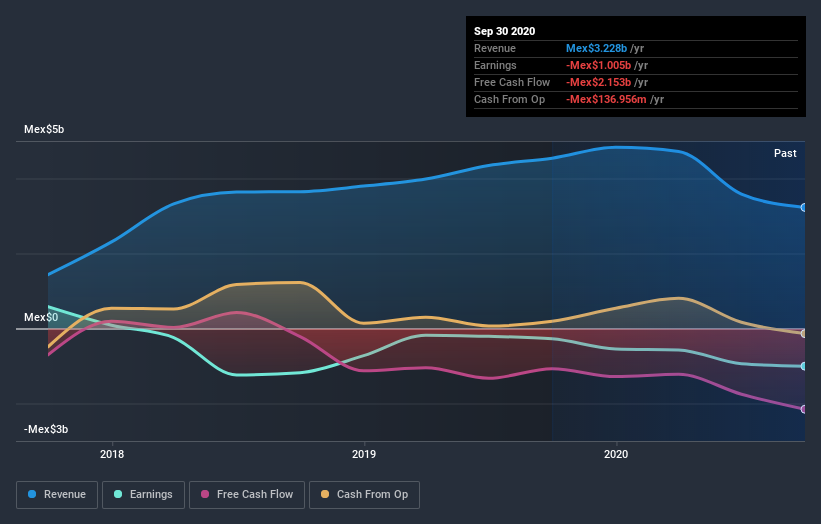

Institutions have a very small stake in RLH Properties. de. That indicates that the company is on the radar of some funds, but it isn't particularly popular with professional investors at the moment. So if the company itself can improve over time, we may well see more institutional buyers in the future. It is not uncommon to see a big share price rise if multiple institutional investors are trying to buy into a stock at the same time. So check out the historic earnings trajectory, below, but keep in mind it's the future that counts most.

We note that hedge funds don't have a meaningful investment in RLH Properties. de. Chpaf Holdings, S.A.P.I. De C.V. is currently the largest shareholder, with 27% of shares outstanding. The second and third largest shareholders are Andres Hernandez and Felipe Hernandez, with an equal amount of shares to their name at 9.1%. Felipe Hernandez, who is the third-largest shareholder, also happens to hold the title of Co-Chairman of the Board. Furthermore, CEO Francisco Borja Escalada Jiménez is the owner of 0.9% of the company's shares.

Our studies suggest that the top 7 shareholders collectively control less than half of the company's shares, meaning that the company's shares are widely disseminated and there is no dominant shareholder.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. As far I can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of RLH Properties. de

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

It seems insiders own a significant proportion of RLH Properties, S.A.B. de C.V.. Insiders have a Mex$2.7b stake in this Mex$14b business. I would say this shows alignment with shareholders, but it is worth noting that the company is still quite small; some insiders may have founded the business. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public, mostly retail investors, hold a substantial 50% stake in RLH Properties. de, suggesting it is a fairly popular stock. This size of ownership gives retail investors collective power. They can and probably do influence decisions on executive compensation, dividend policies and proposed business acquisitions.

Private Company Ownership

Our data indicates that Private Companies hold 27%, of the company's shares. Private companies may be related parties. Sometimes insiders have an interest in a public company through a holding in a private company, rather than in their own capacity as an individual. While it's hard to draw any broad stroke conclusions, it is worth noting as an area for further research.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Be aware that RLH Properties. de is showing 1 warning sign in our investment analysis , you should know about...

If you would prefer check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, backed by strong financial data.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you’re looking to trade RLH Properties. de, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BMV:RLH A

RLH Properties. de

Engages in the acquisition, development, and management of hotels and resorts.

Low risk with questionable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion