- Mexico

- /

- Food and Staples Retail

- /

- BMV:LACOMER UBC

Unpleasant Surprises Could Be In Store For La Comer, S.A.B. de C.V.'s (BMV:LACOMERUBC) Shares

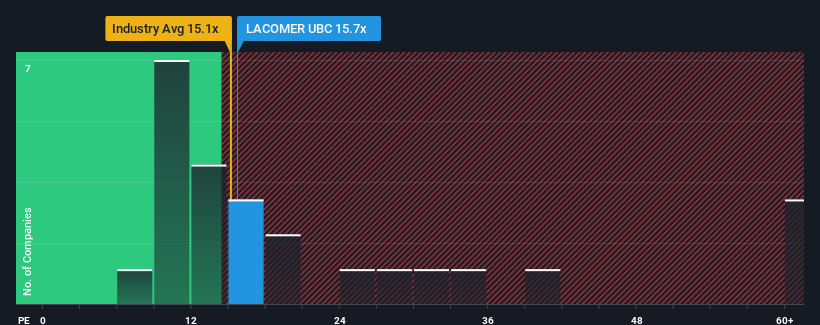

When close to half the companies in Mexico have price-to-earnings ratios (or "P/E's") below 11x, you may consider La Comer, S.A.B. de C.V. (BMV:LACOMERUBC) as a stock to potentially avoid with its 15.7x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's inferior to most other companies of late, La Comer. de has been relatively sluggish. It might be that many expect the uninspiring earnings performance to recover significantly, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for La Comer. de

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like La Comer. de's to be considered reasonable.

Retrospectively, the last year delivered a decent 4.1% gain to the company's bottom line. This was backed up an excellent period prior to see EPS up by 68% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 12% per year during the coming three years according to the five analysts following the company. That's shaping up to be similar to the 13% each year growth forecast for the broader market.

With this information, we find it interesting that La Comer. de is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of La Comer. de's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for La Comer. de with six simple checks.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:LACOMER UBC

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026